on MLP AG (ETR:MLP)

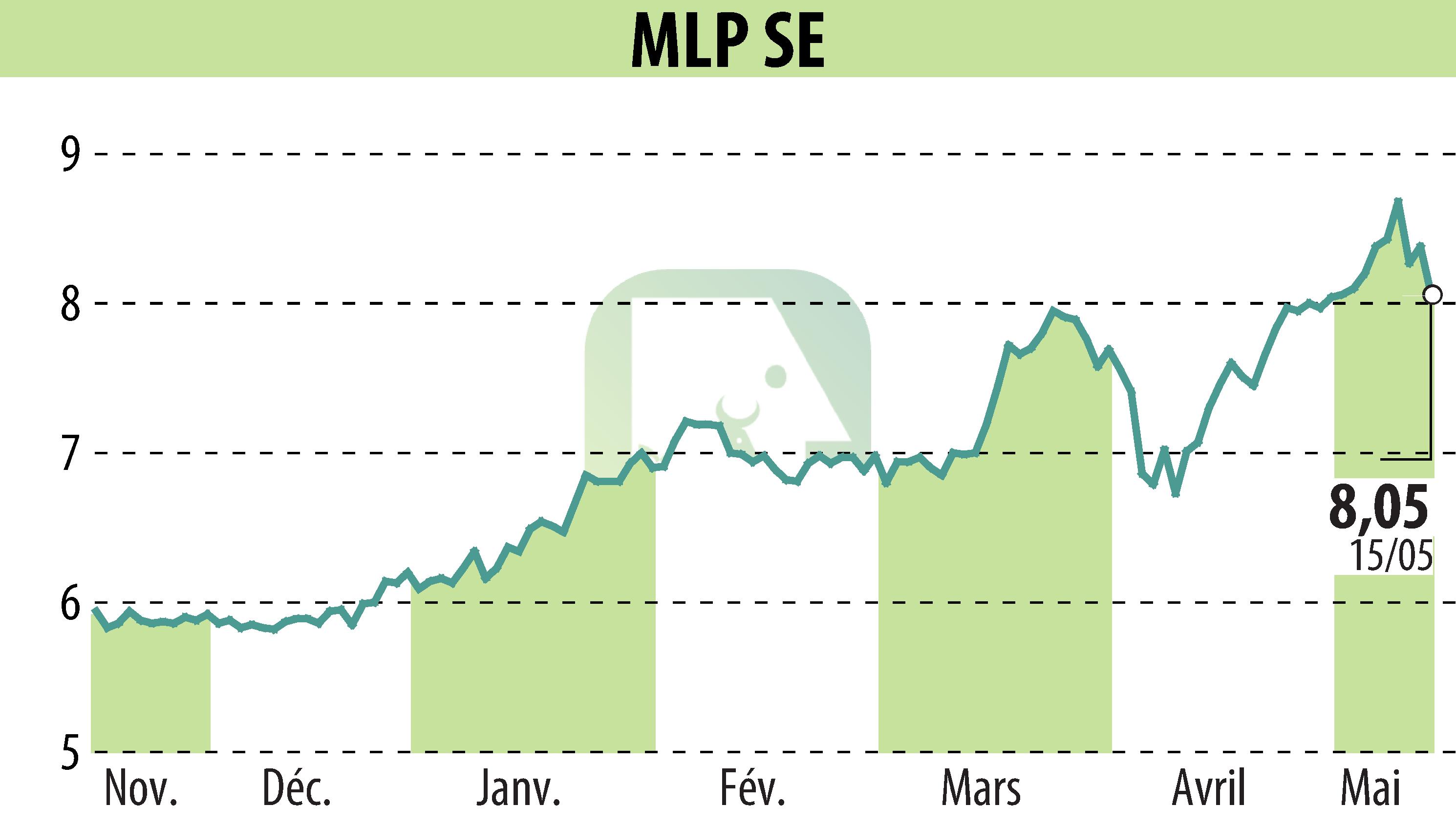

MLP SE Maintains Solid Outlook Amid Q1 Challenges

MLP SE's Q1 results showcased resilience despite slightly missing sales and EBIT expectations. Sales rose by 6% year-on-year to €301 million, with significant growth in Wealth and Life & Health segments. However, commissioned expenses, particularly in banking and real estate brokerage, impacted EBIT, which fell to €37.8 million.

Despite these challenges, underlying profitability improved with a 0.2pp increase in EBIT margin, excluding performance fees. The Financial Consulting and real estate segments provided support against declines in banking and asset management, helped by robust real estate brokerage recovery.

Assets under management remained stable at €62.8 billion, thanks to strong net inflows, offsetting broader market downturns. With rising brokerage margins and continued project developments, MLP SE's guidance for FY’25 remains within reach, sustaining a 'BUY' recommendation with a target price of €13.00.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news