on MLP AG (ETR:MLP)

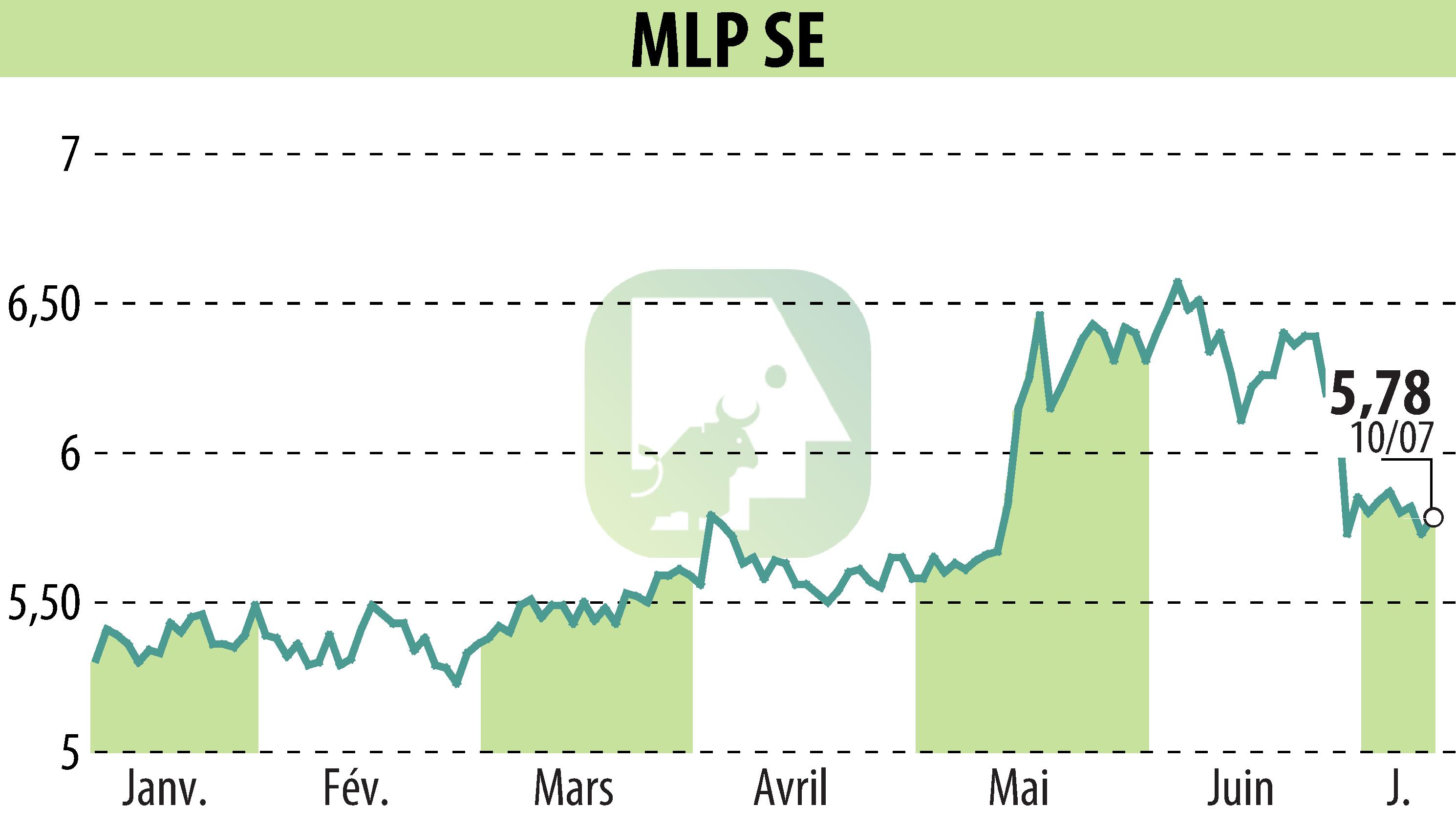

MLP SE Expected to Collect €4.2m in Performance Fees in Q2

NuWays AG has updated its recommendation for MLP SE, reaffirming a "Buy" rating and setting a target price of EUR 11.50 from July 11, 2024. Analyst Henry Wendisch forecasts significant performance fees for MLP SE due to successful outcomes in two of its major public funds.

FERI, MLP's asset manager, surpassed benchmarks in its two main public funds by the end of Q2. The Optoflex fund, which records performance fees quarterly, is anticipated to contribute €3.9m. The Euro Equity Flex fund, recording fees annually, is expected to add €0.3m.

FERI's assets under management (AuM) make up 81% of MLP's €59.3bn total AuM. Public funds account for €3.6bn, with alternative assets like hedge funds and private equity comprising €17.5bn, and other undisclosed assets adding up to €28bn.

Due to these figures, NuWays AG has revised its EBIT estimate for MLP to €90m, above the company's guidance of €75-85m. A guidance upgrade with Q2 results is likely, supporting the reaffirmed "Buy" recommendation.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news