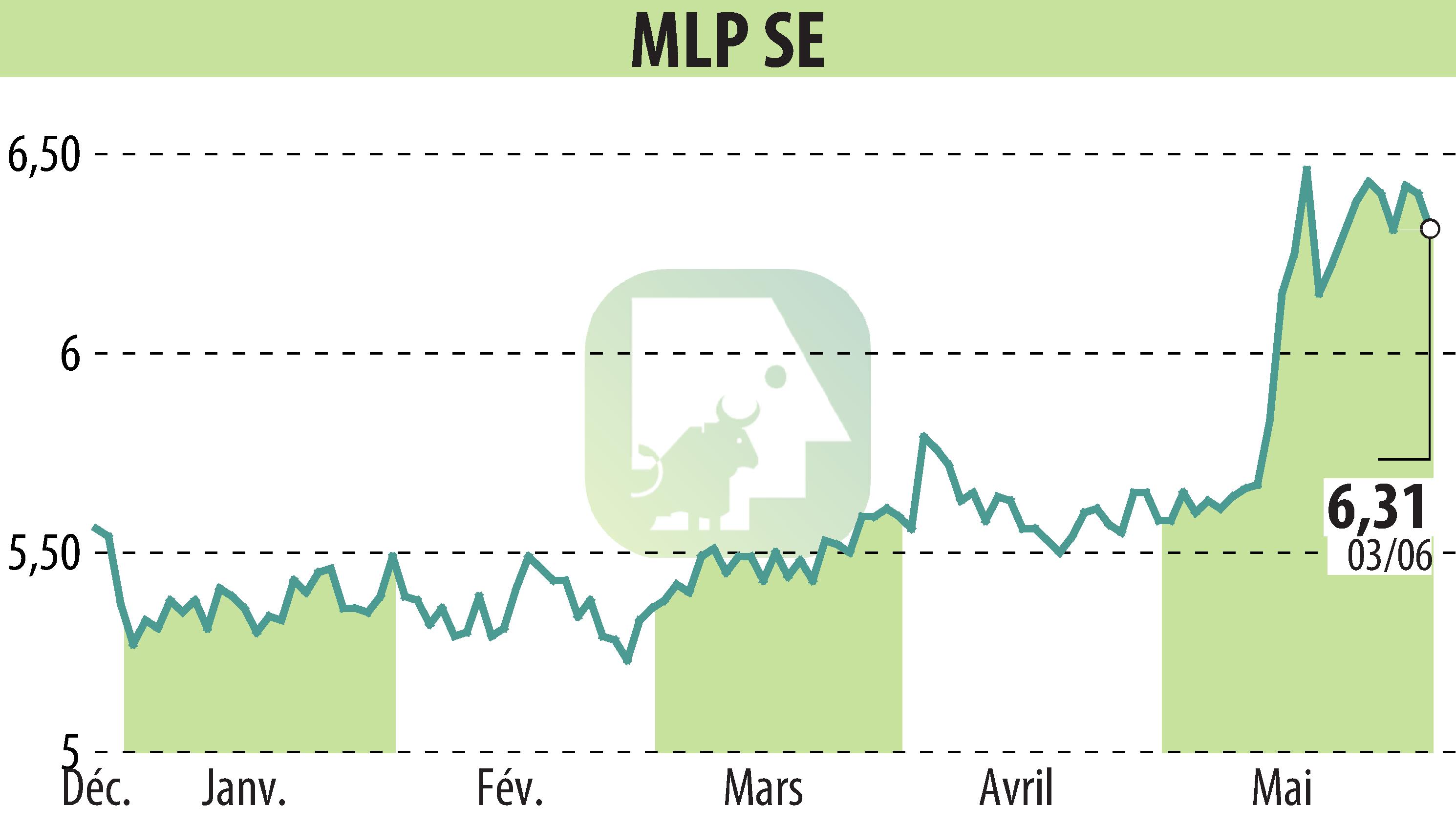

on MLP AG (isin : DE0006569908)

MLP SE: NuWays AG Recommends Buy with Target Price of €11.50

MLP SE has been analyzed by NuWays AG, resulting in a buy recommendation with a target price of €11.50 over the next 12 months. The research, conducted by analyst Henry Wendisch, updates market participants on MLP's prospects amid possible ECB rate changes.

The potential reduction of the ECB's main refinancing rate by 25 basis points is expected to have a limited impact on MLP's banking sector. Interest income, already strong in Q1'24 at €22.3 million, is estimated to slightly decrease to €20 million in Q2. For Q3 and Q4, the projected interest incomes are €19 million and €18 million, respectively. The full-year 2024 interest income is expected to be €80 million, 22% above 2023 levels.

Decreasing rates could boost MLP's wealth management sector, with strong performance from FERI's funds potentially yielding additional fees. Although, performance is subject to U.S. Federal Reserve rate decisions due to the funds' focus on U.S. markets.

In real estate, new tax incentives for construction and anticipated reductions in financing rates could spur market recovery. The diverse business model of MLP is seen as a buffer against potential rate cuts, with negatively correlated business segments providing stability.

NuWays AG maintains a buy recommendation for MLP SE, citing a stable outlook across different business areas and reiterates the €11.50 price target.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news