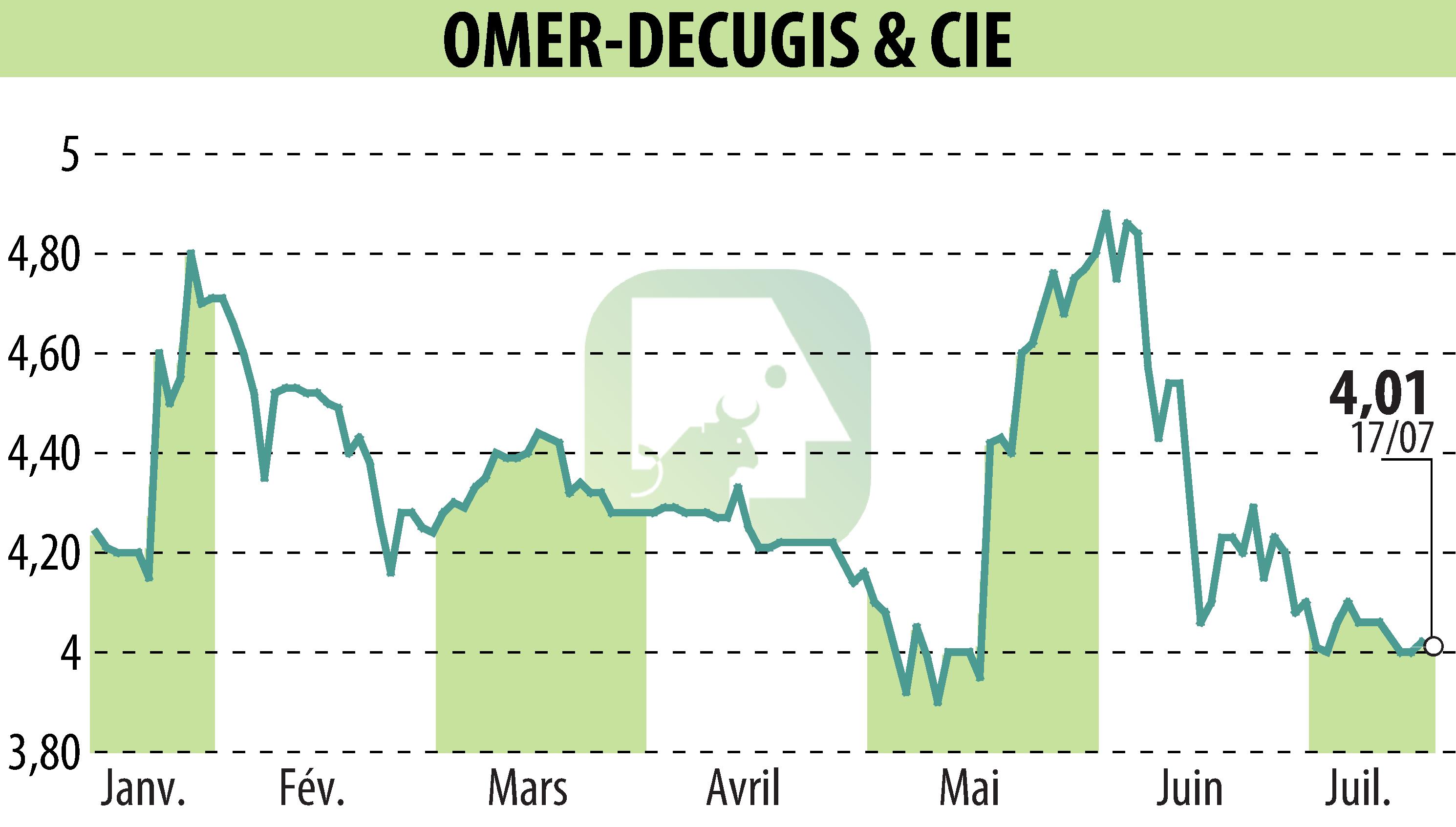

on OMER-DECUGIS & CIE (EPA:ALODC)

Omer-Decugis & Cie Reports Robust H1 2023/24 Growth

Omer-Decugis & Cie, a company focusing on fresh and exotic fruits and vegetables, announced an 18.3% increase in first-half revenue for the 2023/24 financial year, with significant organic growth of 13.2%. EBITDA margin improved notably to 3.5%, marking a strong operational performance.

The outlook remains positive, supported by a 15.3% revenue growth recorded in Q3 2023/24. The company is on track to meet its 2025 targets, showcasing the effectiveness of its strategic investments and business model. Both divisions contributed to this growth, with the SIIM division seeing a 16.6% uptick and the wholesale division growing by 23.7%.

Operating improvements included a gross margin rise to 15.1%, highlighting operational efficiency measures. Despite a 19.1% increase in personnel expenses, significant gains were made in EBITDA, which reached €4.4 million.

Cash flow from operations stood strong at €4.1 million, while net cash flow from investing activities decreased to €1.5 million. With sound financial health, the group looks forward to sustaining growth and achieving its 2025 revenue target of €230 million and an EBITDA margin over 5%.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OMER-DECUGIS & CIE news