on OPMobility (EPA:OPM)

OPmobility Reports Robust Q1 2024 Financial Performance

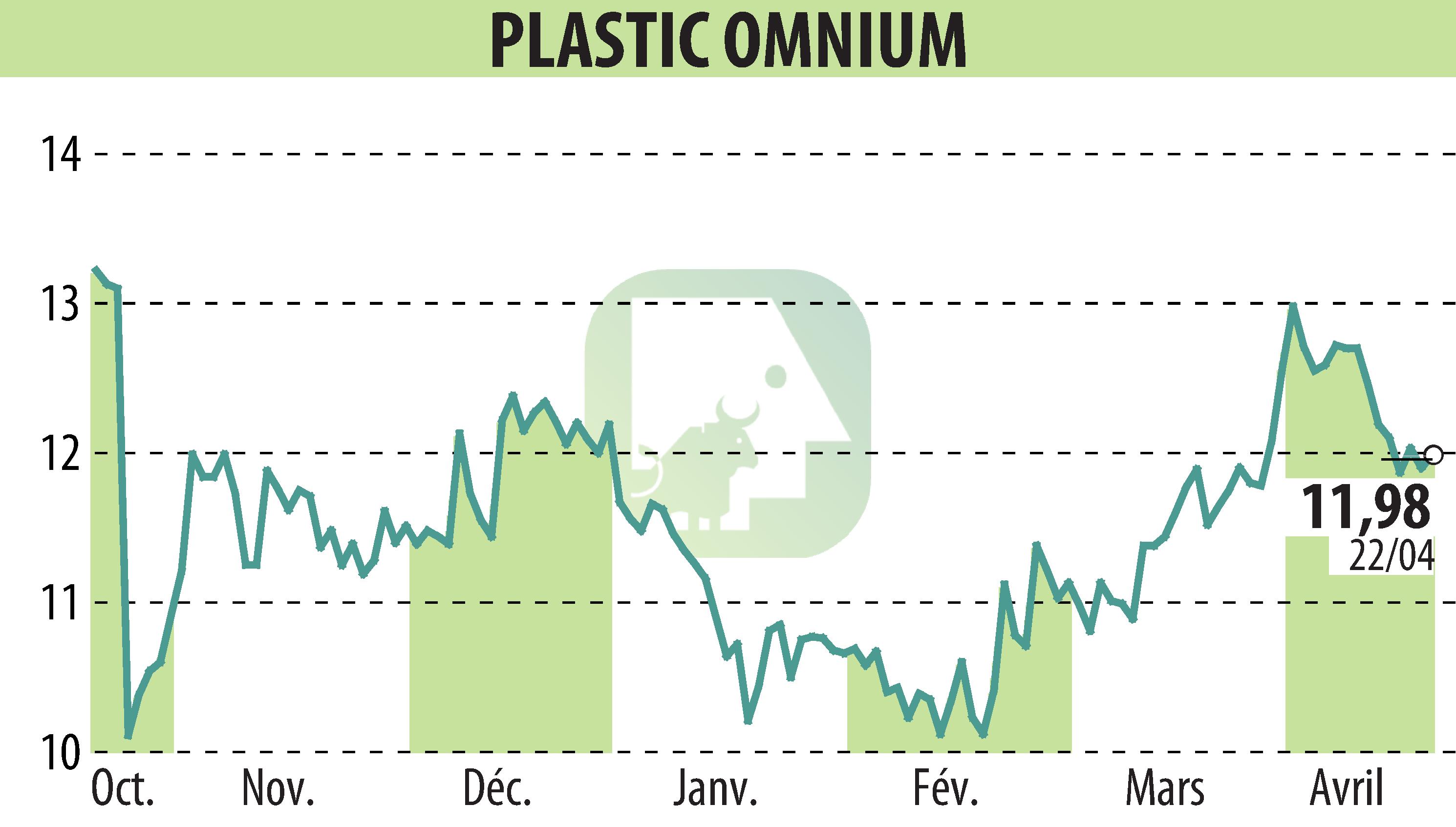

OPmobility (formerly Plastic Omnium) disclosed a first-quarter revenue of €2,867 million for 2024, marking a 1.6% increase and outperforming global automotive production by 4.5 points. Significant contributions to this growth came from the United States which remains the largest regional contributor to the group's revenue. Highlighting a strategic shift, the entity was recently rebranded to OPmobility, reflecting its renewed focus on sustainable and connected mobility.

In its detailed financial performance, the economic revenue witnessed a 3.6% like-for-like increase across its diverse segments with the Exterior Systems leading at a 5.5% growth. The new module assembly plant inaugurated in Austin, Texas, is set to enhance North American operations. Furthermore, OPmobility has also successfully placed a €500 million bond issue to extend debt maturities, backed by a recent BB+ credit rating from S&P Global Ratings.

Despite a global downturn in automotive production, which saw a 0.9% drop, OPmobility managed to secure a competitive edge with strategic expansions and an enhanced business portfolio. The diversity in its operational base spans significant markets including an ambitious push in the emerging electric mobility market in the U.S., and strengthening positions in sustainable practices globally.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OPMobility news