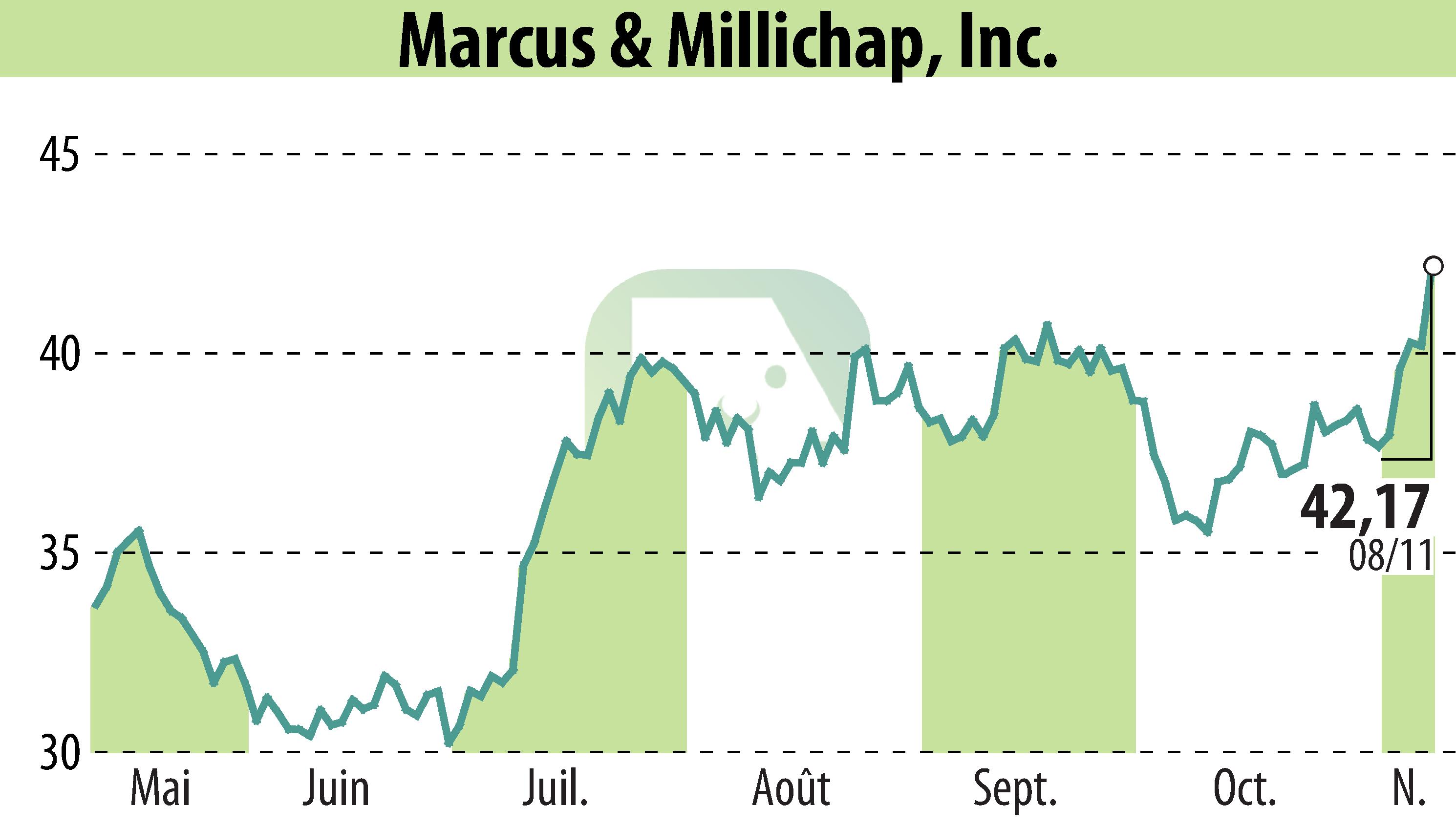

on Equity Multiple Inc (NASDAQ:MMI)

Opportunities in Multifamily Real Estate Amid Economic Changes

EquityMultiple, a leading investment platform, highlights the potential within the multifamily real estate sector despite economic shifts. With rising interest rates and recalibrated property values, multifamily investments remain strategically appealing. As economic uncertainty diminishes, fundamentals within the sector are stabilizing, presenting normalized rent growth opportunities driven by strong household formation and labor markets.

Marious Sjulsen, EquityMultiple's Chief Investment Officer, notes that constrained markets with pent-up demand and limited housing options could outperform. The company leverages its market reach to identify high-potential areas offering well-vetted investment opportunities.

Post-election policy changes in the U.S. could impact multifamily investments through housing initiatives and fiscal reforms. EquityMultiple stays adaptable, prepared for potential policy-driven changes that might affect investor strategies and market liquidity.

The firm's strategic partnerships and data-driven approach ensure continued access to diverse multifamily opportunities, supporting a focus on risk-adjusted returns and diversification. Current offerings include a mixed-use portfolio in New York City and a private credit investment vehicle targeting multifamily assets.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Equity Multiple Inc news