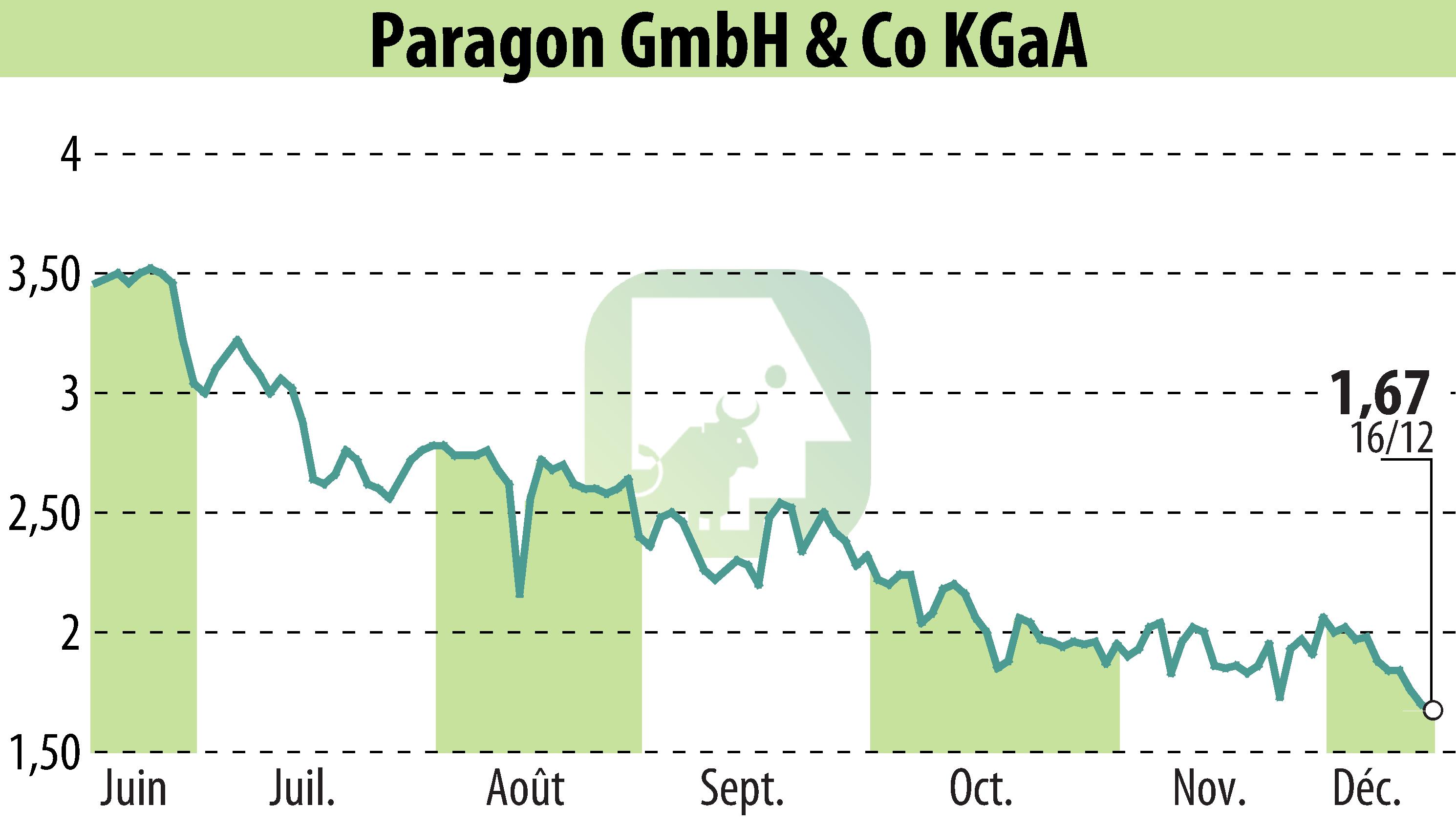

on Paragon AG (isin : DE0005558696)

Paragon AG Anticipates Revenue and Profit Growth in 2025

Paragon GmbH & Co. KGaA projects moderate revenue growth and increased profitability in 2025. The company estimates revenues will reach between EUR 140 million and EUR 145 million, with EBITDA projected at EUR 20 million to EUR 22 million. Paragon credits these improvements to year-round optimization measures and strategic expansion in China.

A significant achievement for Paragon Kunshan, the company's China branch, was securing the largest order in its history from a German-Chinese joint venture, involving kinematics products such as folding tables for vehicles. This move aligns with Paragon's "Local-for-Local" strategy, enhancing its capacity to meet Chinese market demands.

The licensing of the "TELEFUNKEN" brand also contributes to expected profitability increases, with sales growth anticipated through various new audio products. Moving forward, Paragon aims to double its sales, leveraging these strategic initiatives.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Paragon AG news