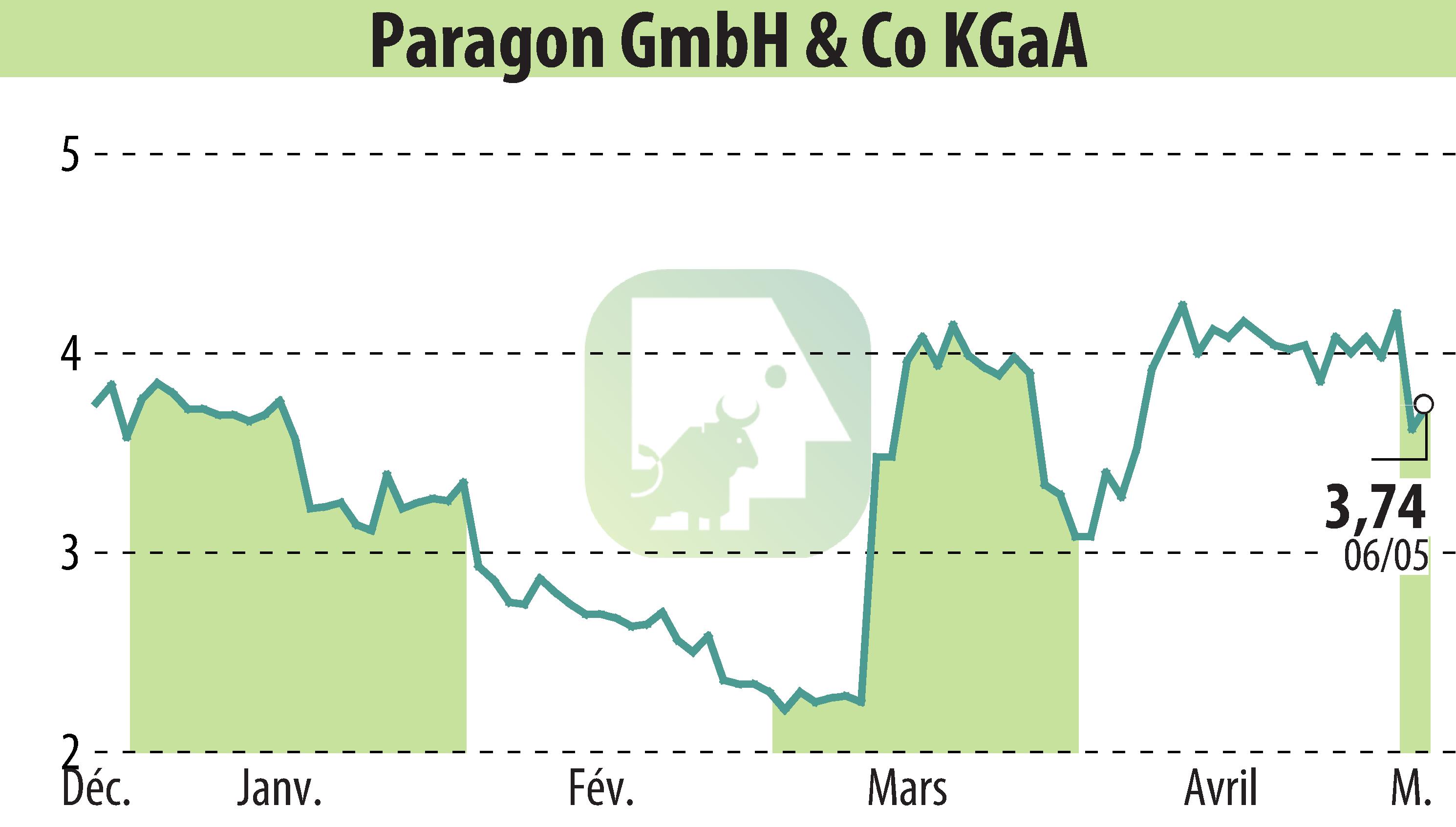

on Paragon AG (isin : DE0005558696)

Paragon GmbH Reports Strong Start to 2024 Despite Challenges

Paragon GmbH & Co. KGaA announced a promising start to 2024 with its Q1 results confirming the company's optimistic outlook for the year. The automotive and electronics manufacturer reported an EBITDA of EUR 4.1 million, up from EUR 3.8 million in the same quarter of the previous year. This growth occurred despite a reduction in call-off levels from customers and the discontinuation of a sensor product in the prior summer.

Total revenue for Q1 stood at EUR 40.9 million, down from EUR 44.7 million year-over-year, primarily due to the product discontinuation. However, the management remains positive about recovering call-off rates later in the year. The company highlighted significant profitability improvements, with a current EBITDA margin of 10.1% compared to 8.6% in the previous year's quarter.

Furthermore, Paragon has made strides in operational expansion, moving its China plant to a larger facility and initiating new ventures in the USA and India. The company affirmed its full-year forecast, expecting revenues between EUR 160 million and EUR 165 million, with EBITDA estimated to be between EUR 18 million and EUR 20 million.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Paragon AG news