on Peugeot Invest (EPA:PEUG)

Peugeot Invest Reports H1 2024 Results: Enhanced Investment Capacity

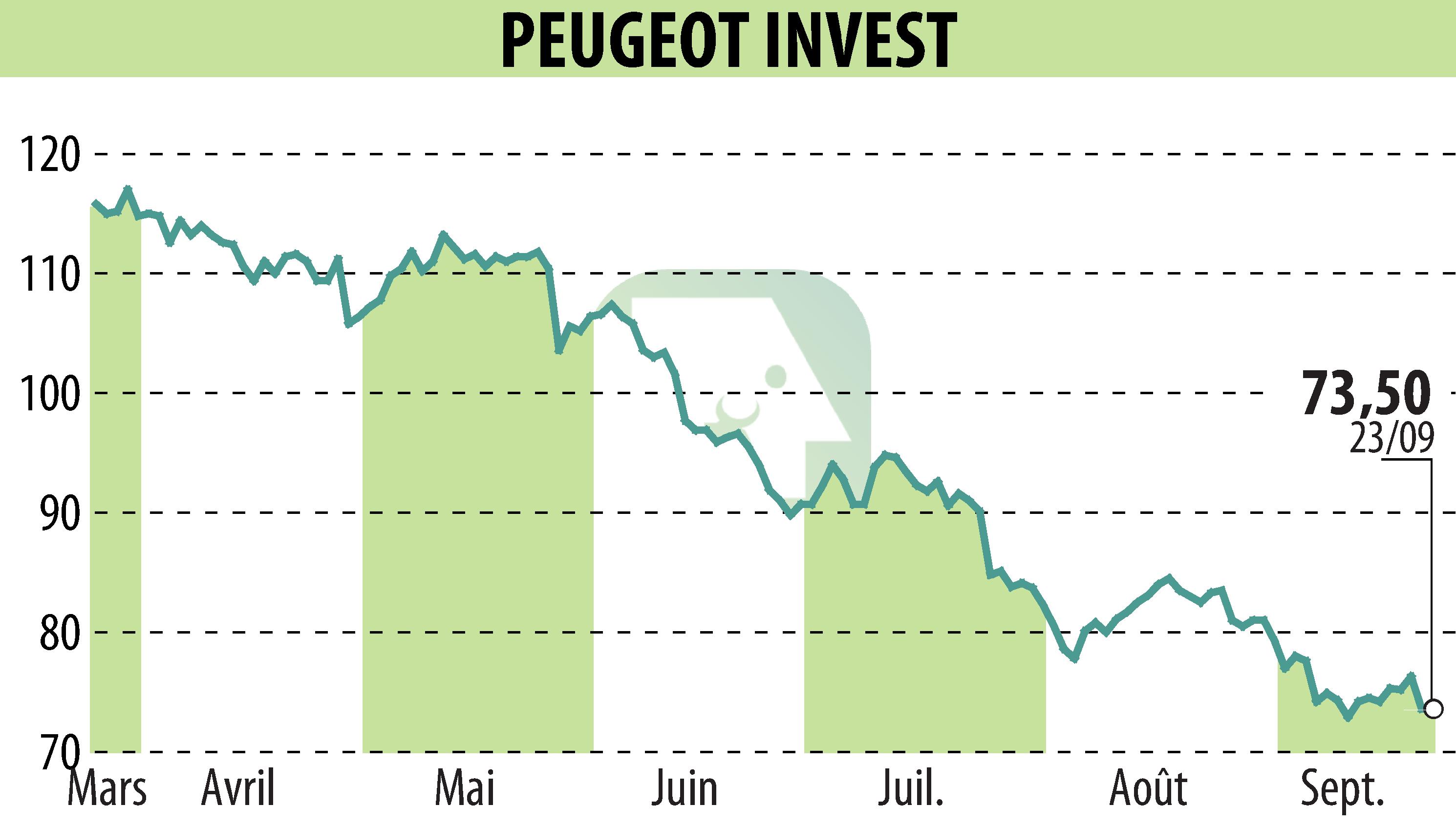

Peugeot Invest has reported significant activity for the first half of 2024, marked by €437 million in disposals. These transactions have bolstered the company's investment capacity despite a challenging market environment. The net asset value (NAV) per share decreased by 3.7% to €226.7, reflecting the decline in Stellantis' share price.

Net profit attributable to the Group reached €228 million. Meanwhile, the appointment of Jean-Charles Douin as CEO was confirmed. Disposals included stakes in Groupe SEB for €236 million and Tikehau Capital for €58.3 million.

Investment strategies focused on sectors like energy transition and digital transformation. Highlights include the sale of AmaWaterways for $48 million and new commitments totalling €77 million to investment funds.

Net debt was reduced to €374 million, providing significant liquidity. Governance updates included the appointment of new directors and internal rule adjustments to further formalize operational practices.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Peugeot Invest news