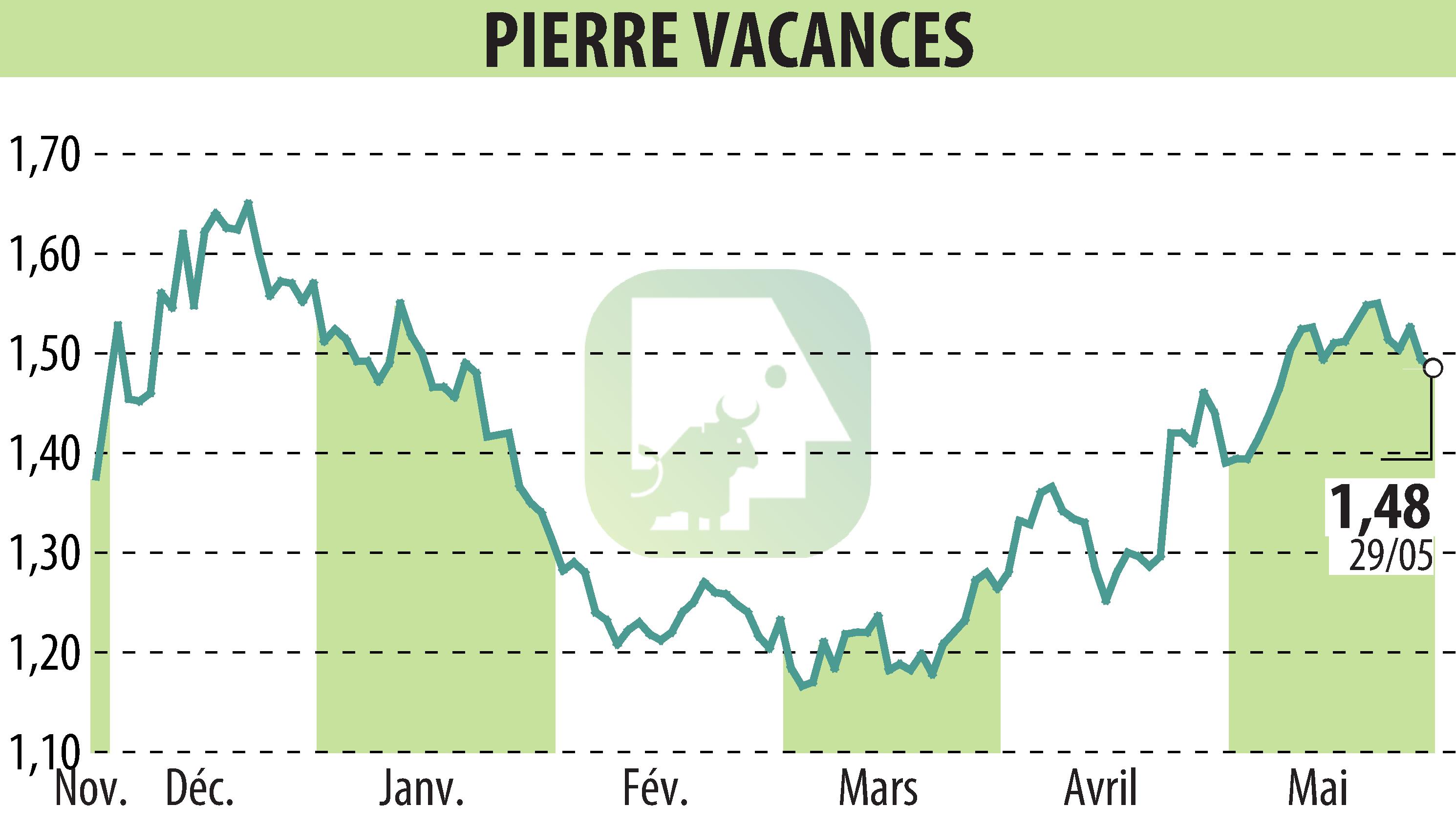

on GROUPE PIERRE ET VACANCES (EPA:VAC)

Pierre & Vacances-Center Parcs Group Reports 37% Increase in Adjusted EBITDA for H1 2024

The Pierre & Vacances-Center Parcs Group recorded a 31% increase in adjusted EBITDA for the first half of 2024, or 54% on an unadjusted basis. The Group now expects adjusted EBITDA to reach at least €160 million for the full year.

This performance enables the Group to confirm its strategic directions under the ReInvention plan. The Group has also secured lender approval to refinance its corporate debt, involving an early redemption of €328 million and the implementation of a €205 million revolving credit facility.

Franck Gervais, CEO, emphasized the Group's expectations of achieving record profitability by 2026 and cited the implementation of a new financing structure as a testament to banking partner confidence.

The Group's revenue for the first half reached €822.2 million, driven by increased rates and higher occupancy across all brands. Adjusted EBITDA for this period stood at -€21.4 million, a significant improvement from the previous year's -€46.8 million.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GROUPE PIERRE ET VACANCES news