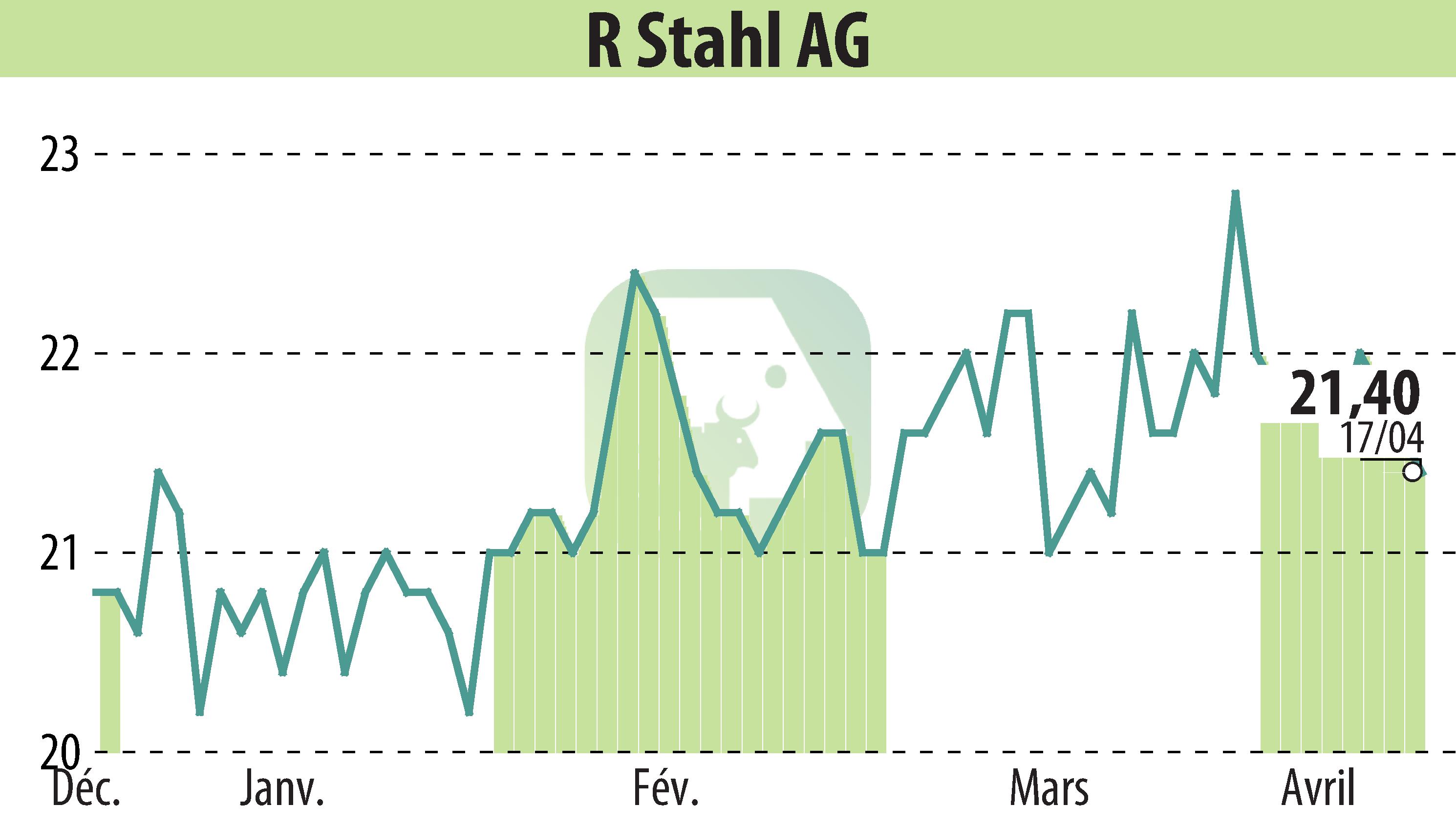

on R. Stahl AG (isin : DE000A1PHBB5)

R. Stahl AG Reports Strong Financial Outcomes and Steady Performance

R. Stahl AG has exhibited robust financial results for FY23, achieving a record-high revenue of €331m, a 21% year-over-year increase. This growth surpassed the expected guidance range of €305-320m. The company, noted for its electrical explosion protection solutions, benefited from stable demand in the LNG and gas sector, enhanced supply chains, and strategic price hikes.

Adjusted EBITDA for the period rose by 73% to €38.6m, aligning with the forecasted €35-40m range and demonstrating an improved margin of 11.7%. The significant adjustments include effective capacity utilization and targeted cost management strategies. Notably, despite a notable write-off related to its Russian venture, R. Stahl maintained a healthy financial position, improving its free cash flow to €0.3m from a previous -€4.4m.

Looking ahead, R. Stahl provided a conservative forecast for FY24, with anticipated sales between €335-350m and an adjusted EBITDA of €35-45m, driven by continuous strong demand from the LNG sector. The preliminary order backlog stood at €123m at the end of Q1, supporting the company’s optimistic outlook for the upcoming fiscal year. R. Stahl's management remains committed to efficiency enhancements and strategic growth initiatives.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all R. Stahl AG news