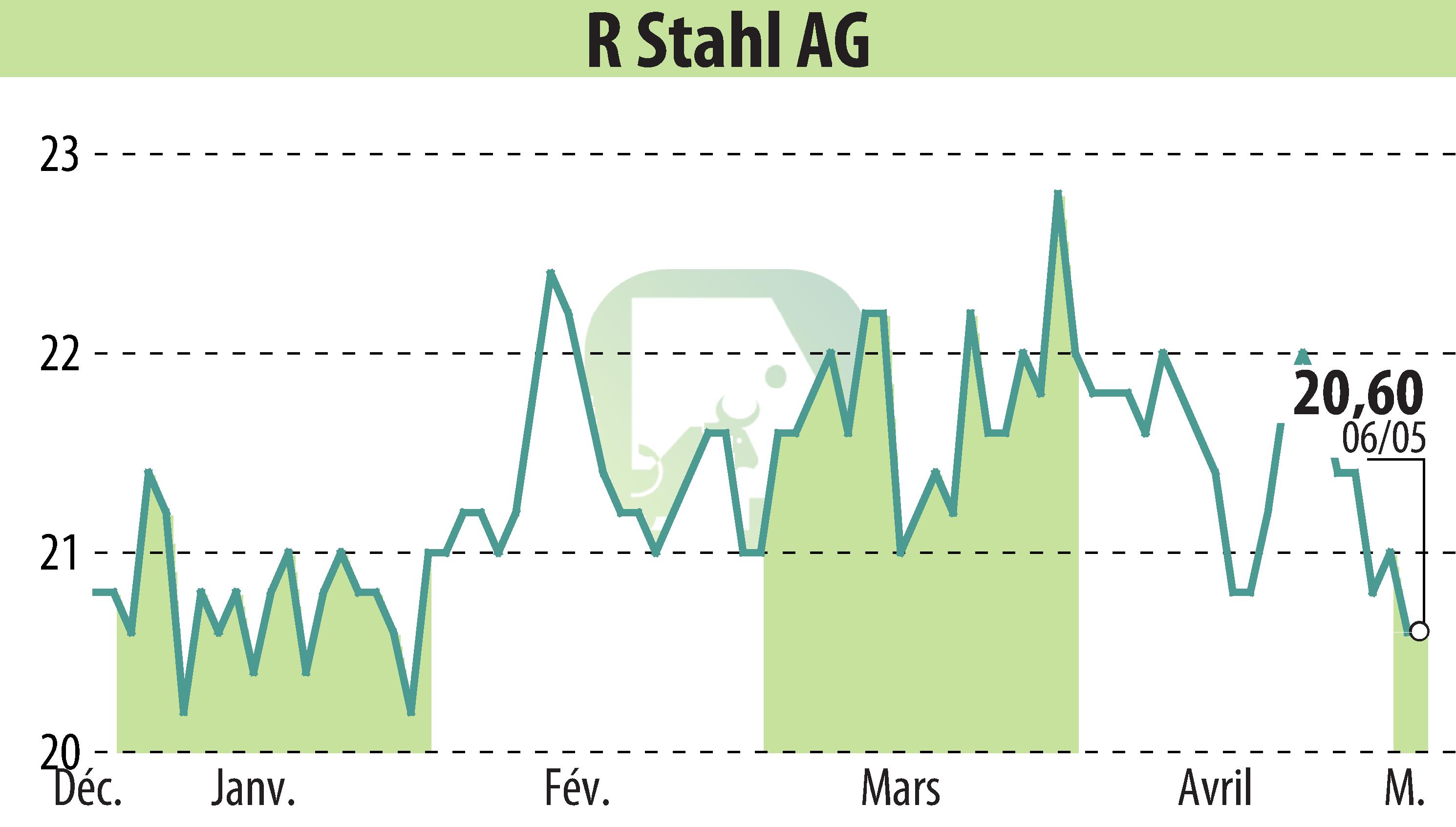

on R. Stahl AG (isin : DE000A1PHBB5)

R. Stahl AG Reports Strong Q1 2024 Performance, Maintains Optimistic FY24 Guidance

R. Stahl AG, a key player in electrical explosion protection solutions, has presented a robust performance for Q1 2024, propelled by rising demand in its market segment. The company posted a Q1 revenue growth of 8.5% year-over-year, totaling €84.7 million. This growth is attributed to a significant order backlog from the end of FY23 which stood at €115 million.

Despite facing inflationary pressures affecting personnel and material costs that led to a decline in Q1 adjusted EBITDA by 19% to €8.4 million, the company’s operational efficiency remained commendable with a solid margin of 9.9%. Excluding one-off expenses linked to its EXcelerate strategy program, the adjusted EBITDA margin would have been 12.3%.

R. Stahl also reported a strong Q1 order intake of €92.3 million, nearly reaching the previous year's Q1 level, signaling resilience in various sectors like LNG, petrochemical, and nuclear despite a slower chemical industry. The backlog has improved by 6% to €122 million. Encouraged by these results and positive market trends, management has reaffirmed its FY24 guidance, projecting sales between €335 million and €350 million with adjusted EBITDA expected to range from €35 million to €45 million.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all R. Stahl AG news