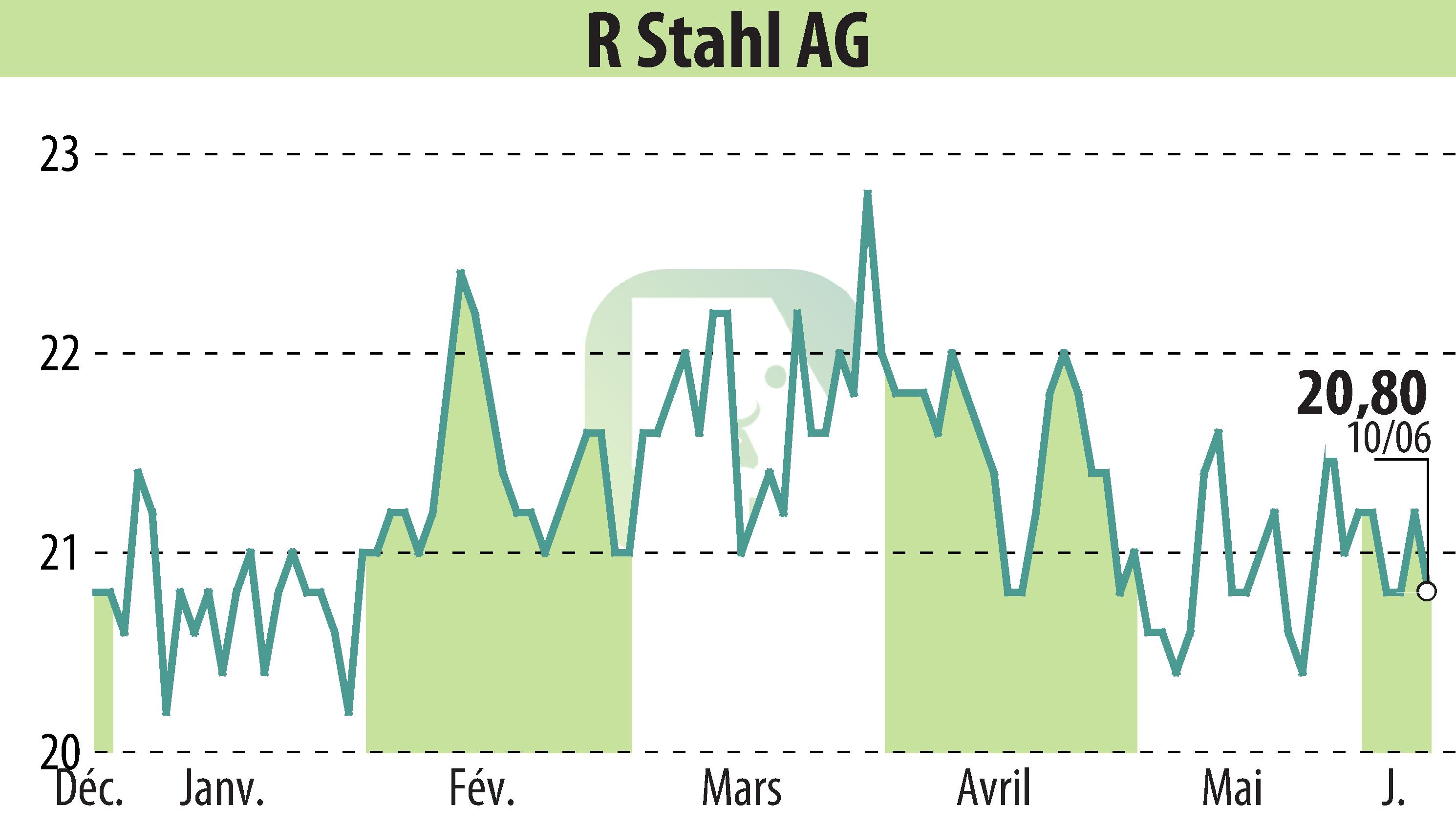

on R. Stahl AG (isin : DE000A1PHBB5)

R. STAHL AG Shows Promising Growth Amid Structural Trends

NuWays AG has updated its research on R. STAHL AG, recommending a "Kaufen" (buy) rating with a target price of EUR 29.00 over the next 12 months. The company's position in explosion protection for LNG tankers and terminals stands to benefit from Europe's increasing LNG demand, driven by the need for energy independence from Russia. Five of nine planned LNG terminals in Germany are operational, and another will commence in H2 2024.

The German chemical industry, showing a 5.4% year-on-year growth in Q1 2024, may enhance investments in explosion protection products, impacting R. Stahl positively. The company currently derives roughly one-third of its revenue from this sector.

Additionally, R. Stahl's involvement in supplying lighting technology for the Hinkley Point C nuclear power plant and potential future projects in France indicates a significant revenue opportunity, estimated at €330 million over the next two decades.

With a strong order intake of €92.3 million in Q1 FY24, reflecting a 24% quarter-on-quarter increase, R. STAHL AG is expected to achieve mid-single-digit sales growth and low double-digit EBITDA margins for FY24.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all R. Stahl AG news