on Audacia SAS (EPA:ALAUD)

Robust Performance for Audacia SAS in 2023 with Growth in AUM and NAV per Share

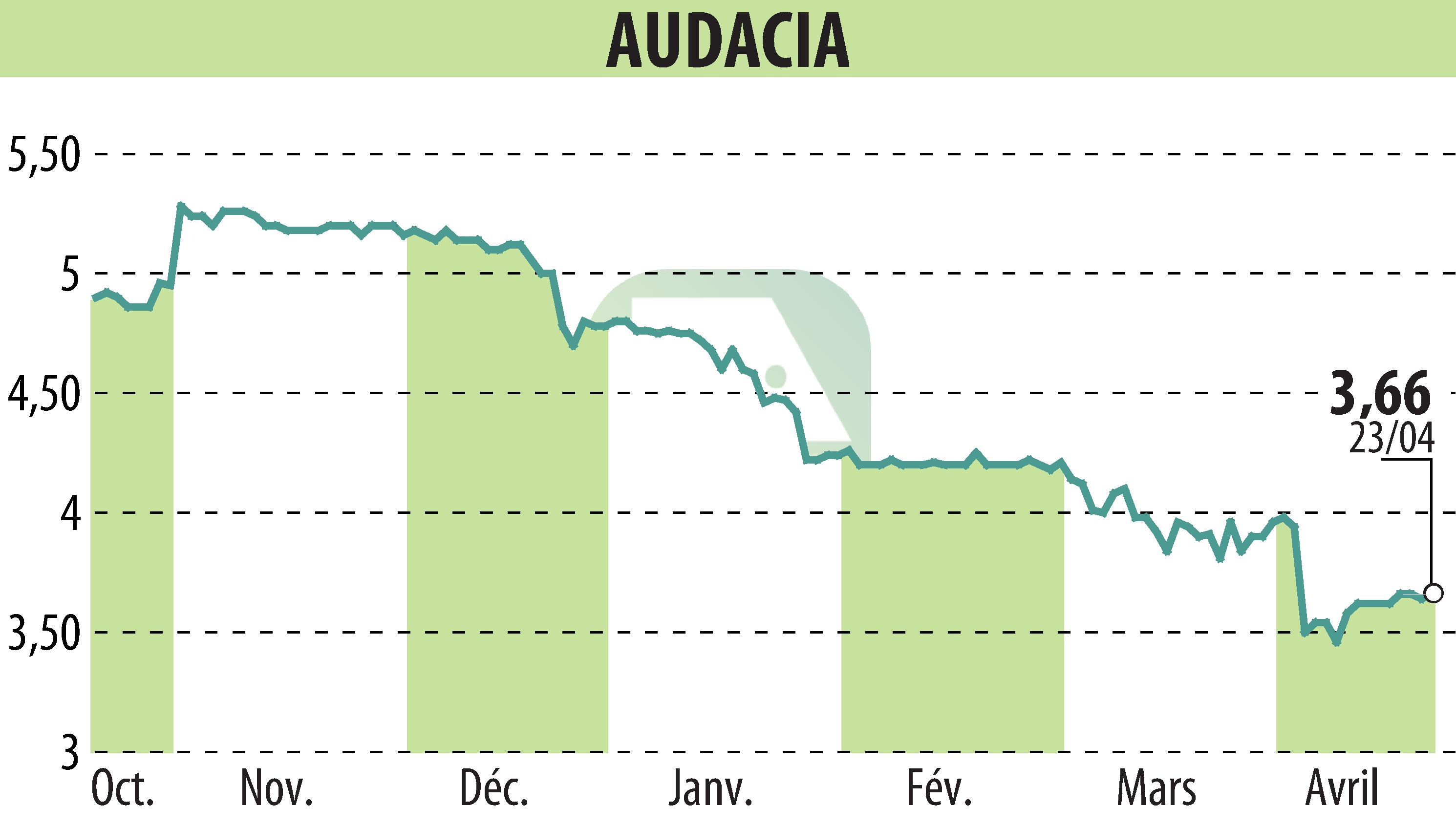

Audacia SAS has published its annual results for 2023, revealing a notable increase in its assets under management (AUM) which now reach 510 million euros, an increase of 26% compared to the previous year. This growth is mainly attributable to the new funds launched by the company. Furthermore, the Net Asset Value (NAV) per share increased to 4.58 euros.

The company recorded an 11% increase in its consolidated turnover, amounting to 10.8 million euros. Operating profit also increased by an impressive 42%, reflecting efficient management and a successful investment strategy. These results underline the strategic repositioning of Audacia, with an increased focus on innovative sectors such as Quantum, New Space and health.

The Managing Director, Olivier de Panafieu, highlighted the acceleration of the group's transformation and the successful diversification of their investment portfolio. For 2024, Audacia is preparing for a dynamic year with the launch of several new funds targeting key sectors of innovation and technology.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Audacia SAS news