on RUBIS (EPA:RUI)

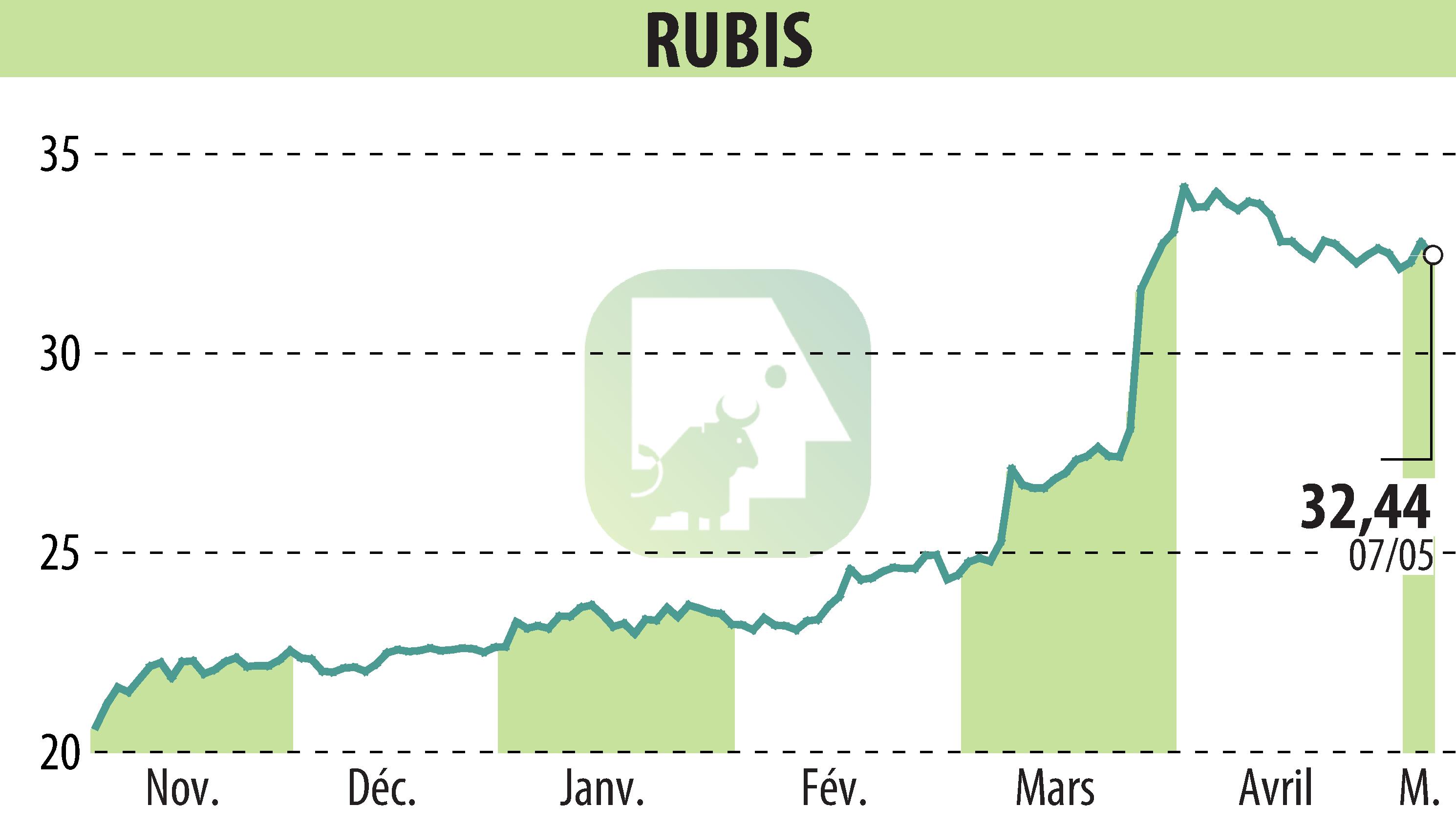

RUBIS: Solid Q1 Performance with Strategic Moves in 2024

RUBIS, a prominent player in energy distribution and renewable electricity production, reported a stable operational performance in Q1 2024, despite a slight revenue decline compared to Q1 2023. The company noted a 4% increase in volume in its energy distribution sector, with a significant adjustment in gross margins due to external factors in regions like Nigeria.

Furthermore, RUBIS has made strategic advancements, including the divestiture of Rubis Terminal, slated to close mid-year, which is expected to result in a €0.75 per share dividend. The renewable electricity sector reached 936 MWp, marking a 5% increase from December 2023. RUBIS also secured significant corporate PPAs contributing to its growth trajectory in this segment.

The financial outlook for 2024 remains optimistic, with RUBIS reiterating its guidance for an EBITDA of €725m to €775m. The company's performance aligns with expectations from the solid foundation laid in the previous year. RUBIS confirms that its strategic focus and corporate maneuvers position it well for sustained growth and operational stability.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all RUBIS news