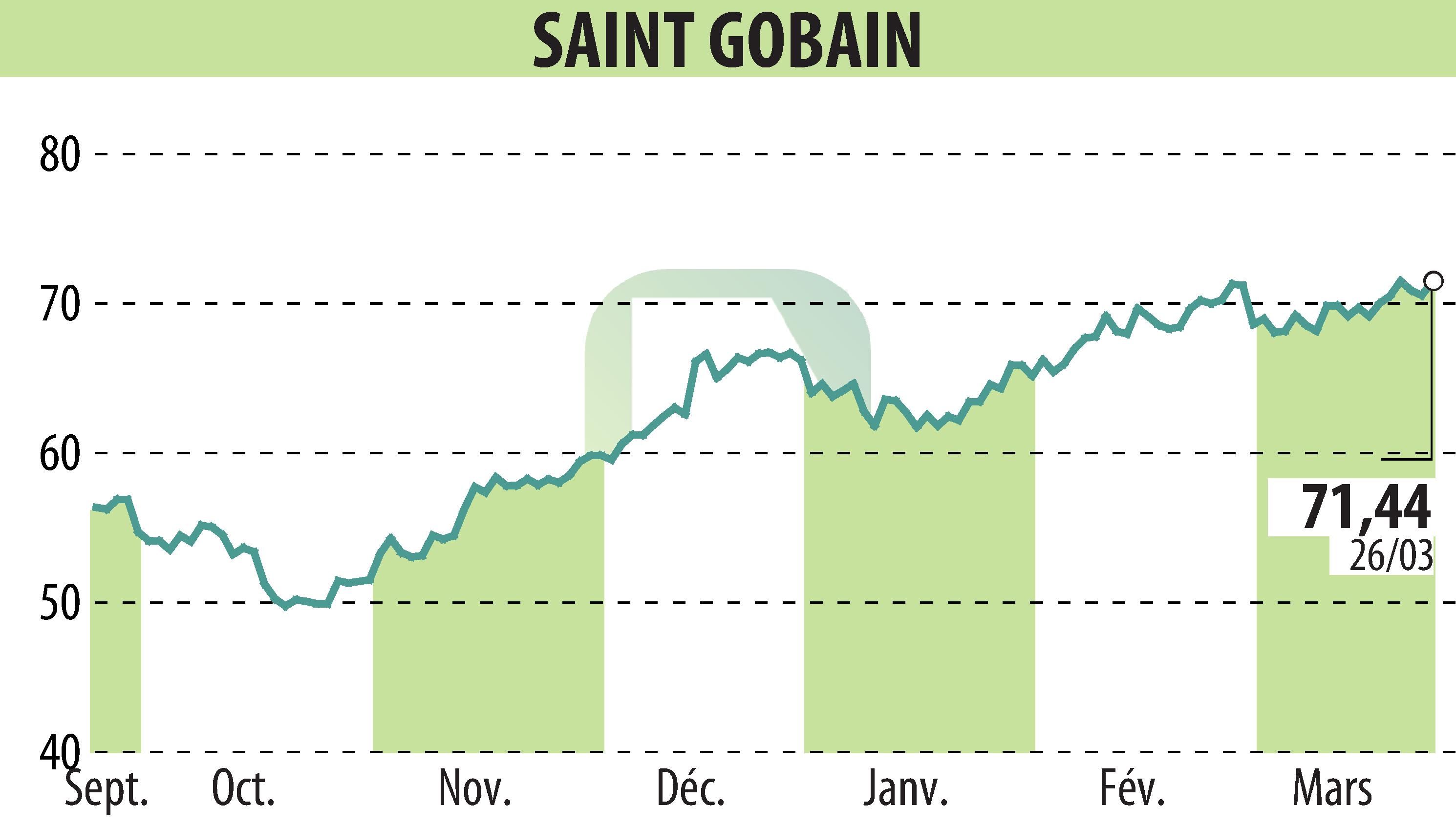

on SAINT-GOBAIN (EPA:SGO)

Saint-Gobain Launches First Green Bond to Fuel Sustainable Construction

Saint-Gobain has announced the pricing of its first Green Bond, marking a significant step in its sustainable finance journey. The double tranche bond includes EUR 1 billion with a 6-year maturity at a 3.375% coupon, and another EUR 1 billion with a 10-year maturity at a 3.625% coupon. This move underscores the company's commitment to sustainable growth and adheres to the European taxonomy for financing sustainable projects.

Following a Sustainability Linked Bond in 2022 and a Sustainability Linked Loan in 2023, this issuance enables Saint-Gobain to leverage favorable market conditions to extend its debt's average maturity while optimizing financing costs. The bond issuance was met with high demand, being oversubscribed by approximately 3 times, reflecting investor confidence in Saint-Gobain's credit quality. Standard & Poor’s and Moody's rate the company's senior long-term debt at BBB+ and Baa1, respectively, both with a stable outlook.

Sreedhar N., CFO of Saint-Gobain, highlighted the issuance as aligning with the company's strategy for sustainable growth, reducing carbon footprint, and leading in the decarbonizing of the construction sector. Global financial institutions including BNP Paribas, HSBC, along with others, played key roles as coordinators and bookrunners for this significant green initiative.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SAINT-GOBAIN news