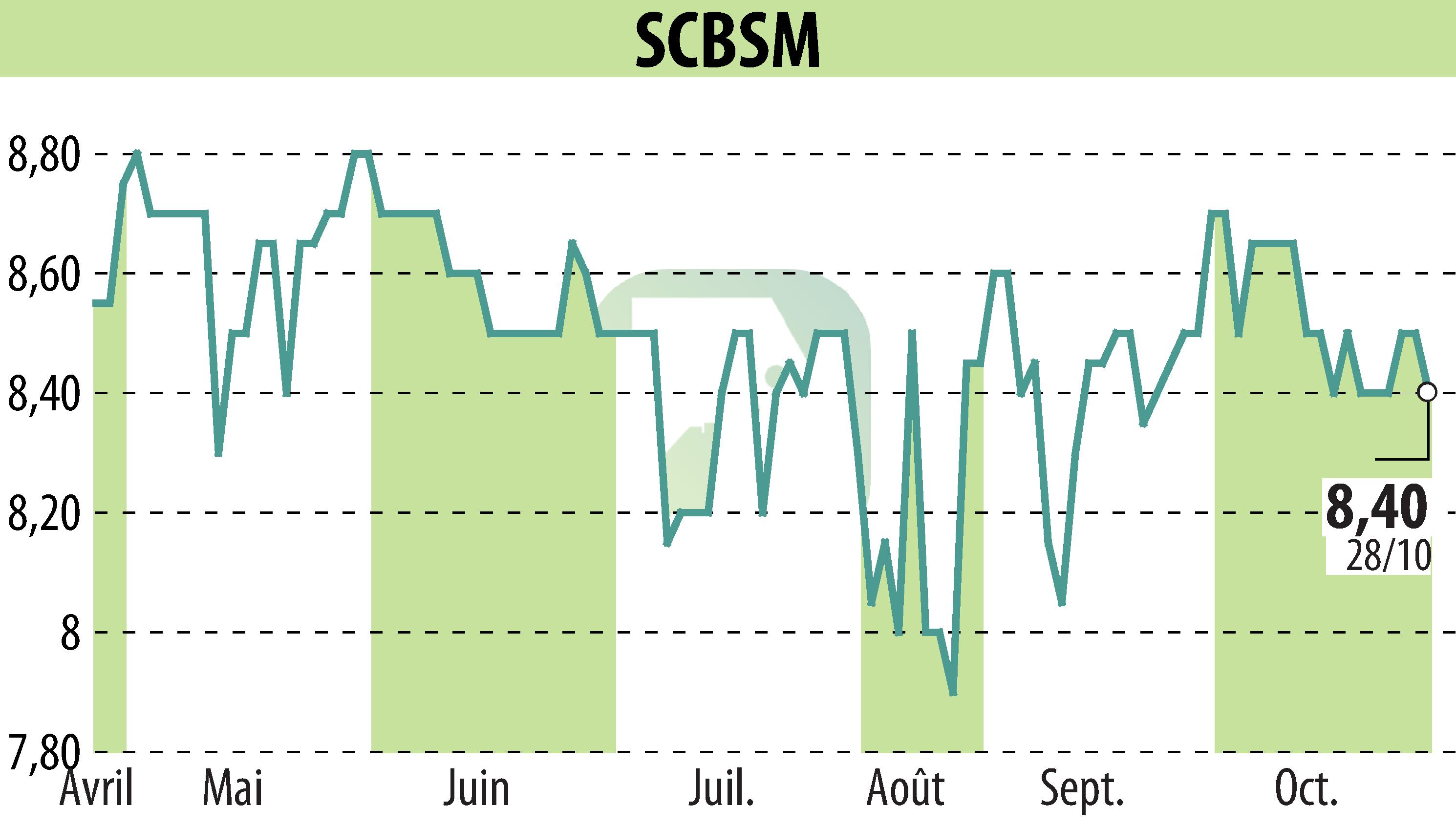

on SCBSM (EPA:CBSM)

SCBSM posts 20% increase in recurring profit in 2023-2024

SCBSM, the real estate company listed on Euronext Paris, closed the 2023-2024 financial year with a notable 20% increase in its recurring profit, reaching €10.8 million. This performance is part of a context of continued improvement in the profitability of its real estate assets and the stabilization of interest rates.

Composed of 90% Parisian assets, SCBSM's assets have benefited from significant restructuring projects, such as that of the Ponthieu building in Paris. Thanks to optimized management, SCBSM was able to lower its debt ratio to 37.3%.

The group plans to offer a coupon of €0.17 per share at its next General Meeting. In terms of sustainable commitment, its ESG rating reached 52/100, signaling efforts to formalize responsible practices.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SCBSM news