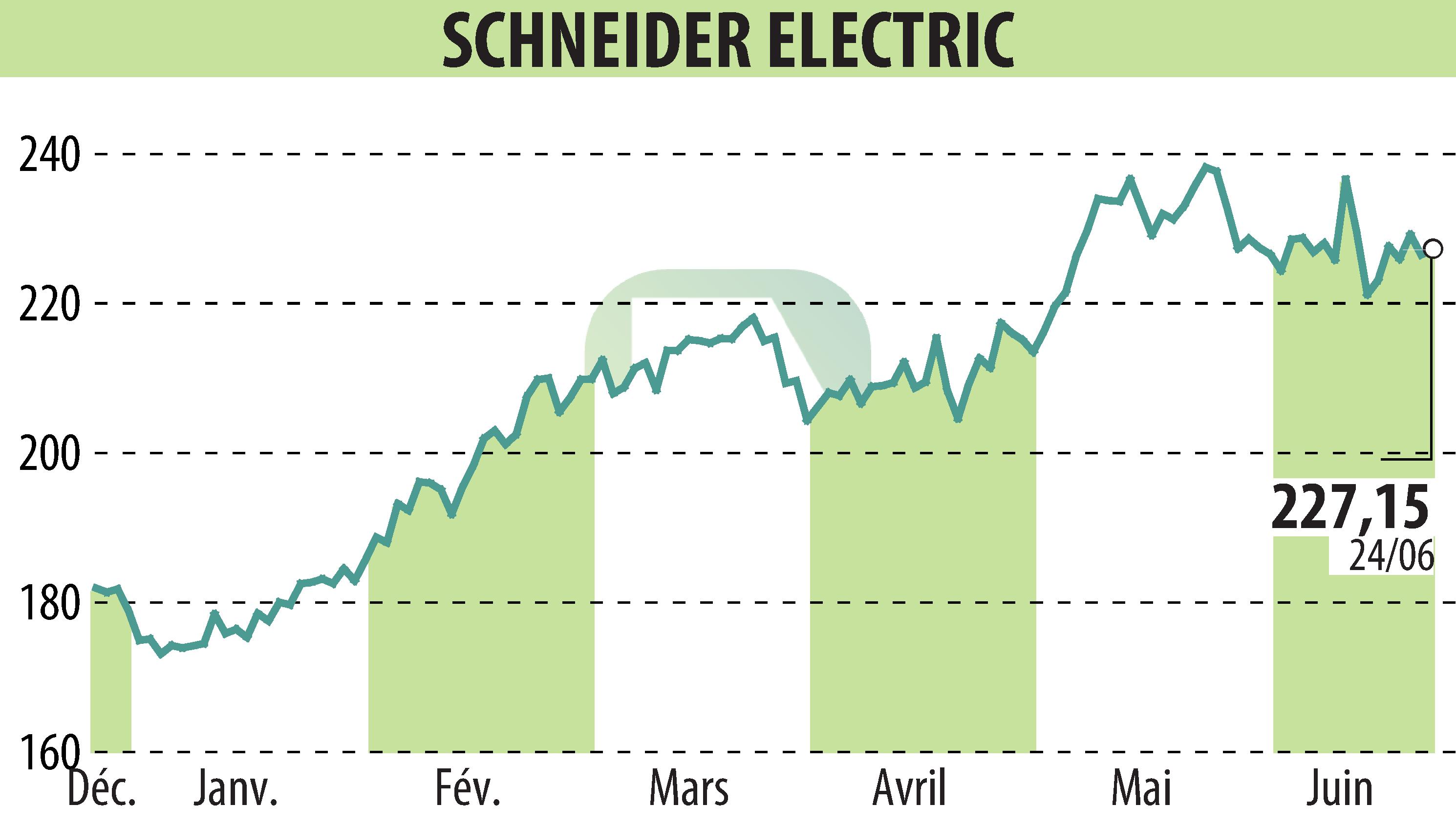

on SCHNEIDER ELECTRIC (EPA:SU)

Schneider Electric Announces €750 Million Convertible Bond Offering and Repurchase Initiative

Schneider Electric unveiled a €750 million bond offering to qualified investors. The bonds, due 2031, can be converted into new shares or exchanged for existing ones. Concurrently, the company will repurchase its outstanding bonds due 2026 via a reverse bookbuilding process.

The net proceeds will primarily fund the repurchase of its 2026 bonds, with any remaining funds used for corporate purposes. With this move, Schneider Electric aims to mitigate potential dilution risks and optimize its financing strategy.

The bonds, with a €100,000 denomination each, are expected to offer a fixed coupon rate between 1.375% and 1.875% per annum. The final terms will be determined after the bookbuilding process, with settlement set for 28 June 2024.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SCHNEIDER ELECTRIC news