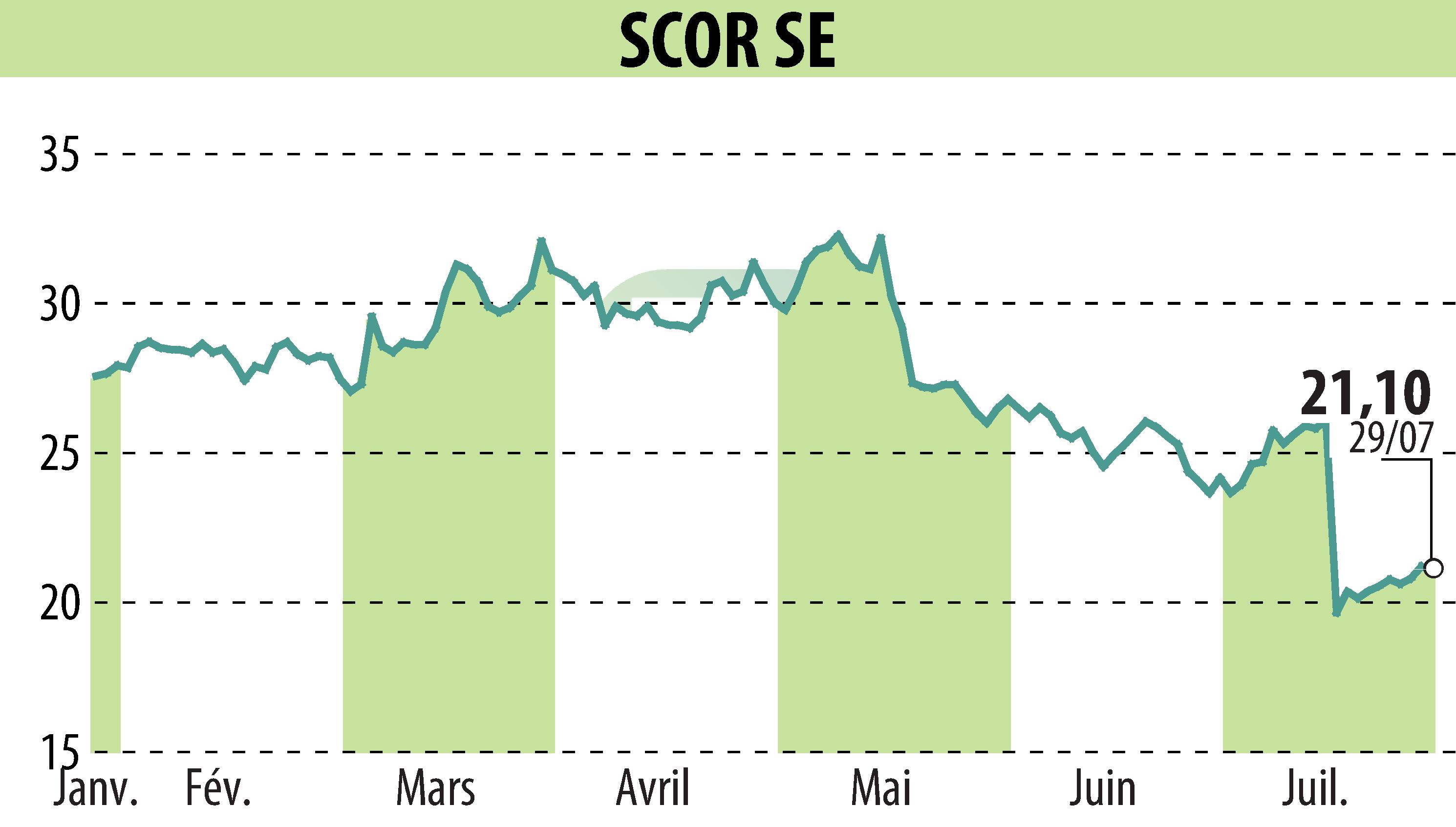

on SCOR (EPA:SCR)

SCOR Reports EUR -308 Million Net Loss in Q2 2024 Amid L&H Review

SCOR announced a net loss of EUR -308 million for Q2 2024 despite strong performances in Property & Casualty (P&C) and Investments. The net loss for the first half of 2024 stands at EUR -112 million. This downturn is primarily attributed to the ongoing 2024 Life & Health (L&H) assumption review, which has heavily impacted the results.

P&C results were notably robust, achieving a combined ratio of 86.9%, an improvement from 88.5% in Q2 2023. Furthermore, SCOR’s Investments showed a high regular income yield of 3.6%, up by 0.5 points from the same period last year.

The L&H insurance service result fell to EUR -329 million in Q2 2024, largely due to a EUR -509 million impact from the L&H assumption review. SCOR's solvency ratio is estimated at 201% as of June 30, 2024, within its optimal range despite a 20-point decrease due to the assumption review.

SCOR is implementing a three-step plan to restore L&H profitability, focusing on reserves, in-force management, and new business. Updates on this strategy will be presented on December 12, 2024.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SCOR news