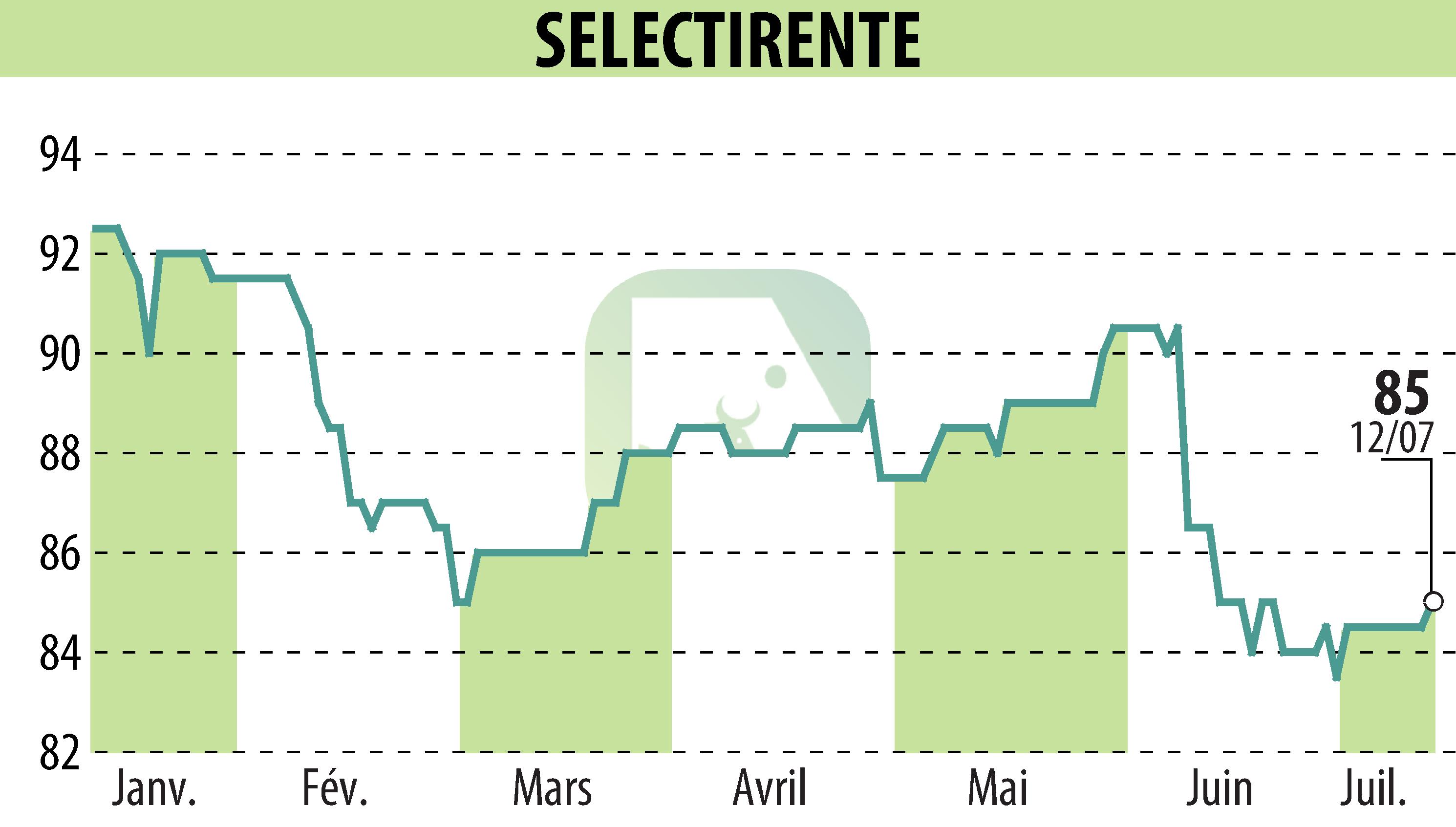

on SELECTIRENTE (EPA:SELER)

SELECTIRENTE successfully concludes an 80 MEUR refinancing

SELECTIRENTE, a company specializing in local retail real estate, announces that it has signed a refinancing of 80 million euros with its historic banking partners. This amount represents more than 35% of its current debt and postpones any significant debt maturity until 2027.

The company finalized this agreement by nine months ahead of its current deadline. The transaction includes two lines of credit: €50 million in mortgage credit over five years, with two extension options, and a new RCF of €30 million over three years, also extendable.

The refinancing allows SELECTIRENTE to extend the maturity of its debt to almost five years and to strengthen its financial structure. Available liquidity is now at €25 million, with a competitive average cost of debt.

Société Générale, Banque Européenne du Crédit Mutuel and HSBC Continental Europe orchestrated the operation. SELECTIRENTE is positioning itself to seize new market opportunities.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SELECTIRENTE news