on SFC Energy AG (ETR:F3C)

SFC Energy AG Faces Challenges, Yet Retains Market Potential

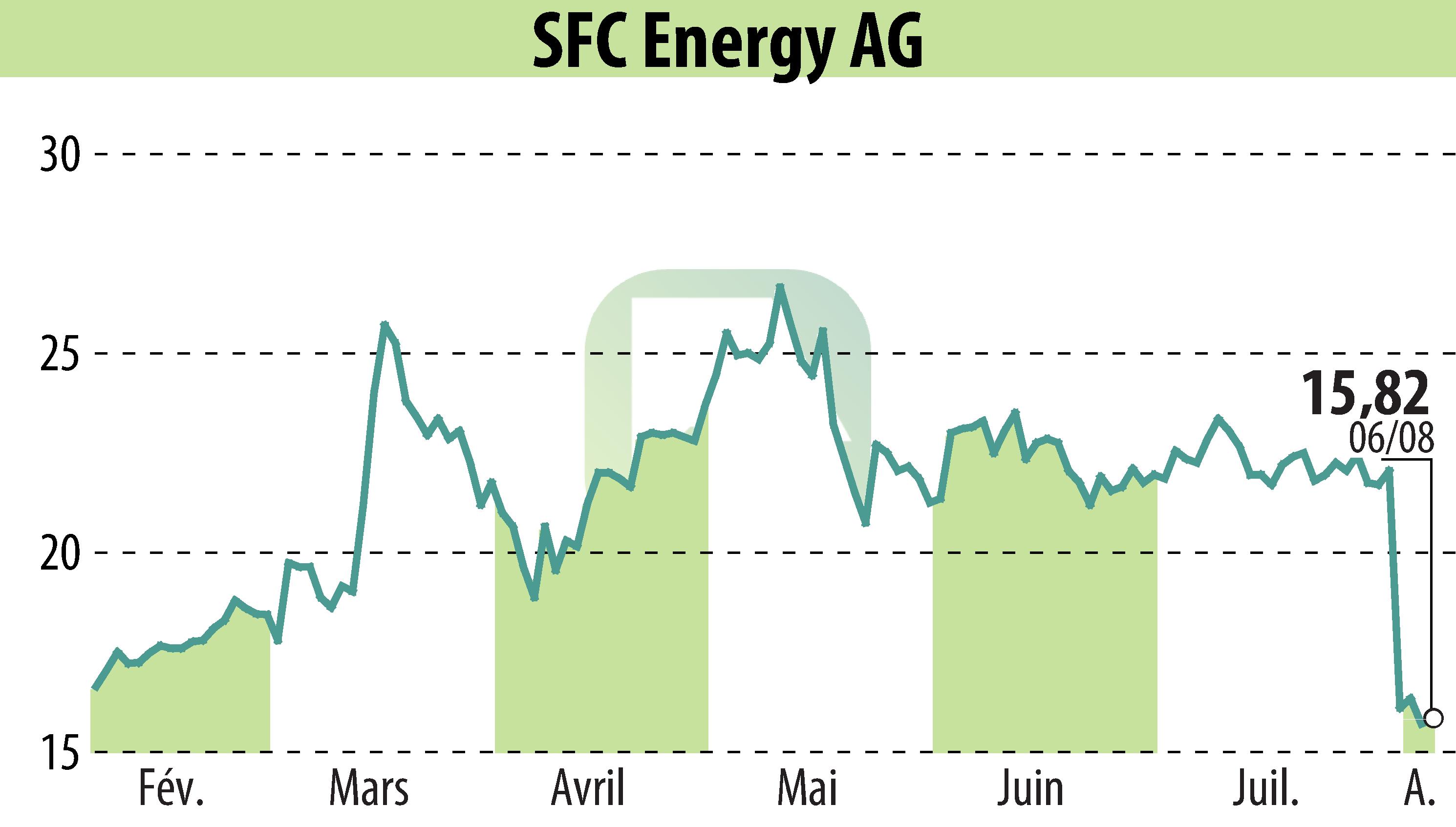

SFC Energy AG's recent research update from First Berlin Equity Research GmbH reveals a cautious outlook for 2025 due to disappointing second-quarter results and ongoing challenges. Analyst Dr. Karsten von Blumenthal maintained a "Buy" recommendation but lowered the price target from €31 to €26. The company's revised revenue guidance is set between €146.5 million and €161 million, a reduction of 10% to 12% from previous forecasts.

Key factors for these adjustments include macroeconomic uncertainties, tariffs, and delays in defense sector projects. The hydrogen business's weaker performance and the underachievement of new business ventures in the United States have also contributed to this outlook. Despite a 20% share price drop following a profit warning, the company remains optimistic about its growth potential, citing strong structural growth drivers and its leading market position in fuel cell technology.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SFC Energy AG news