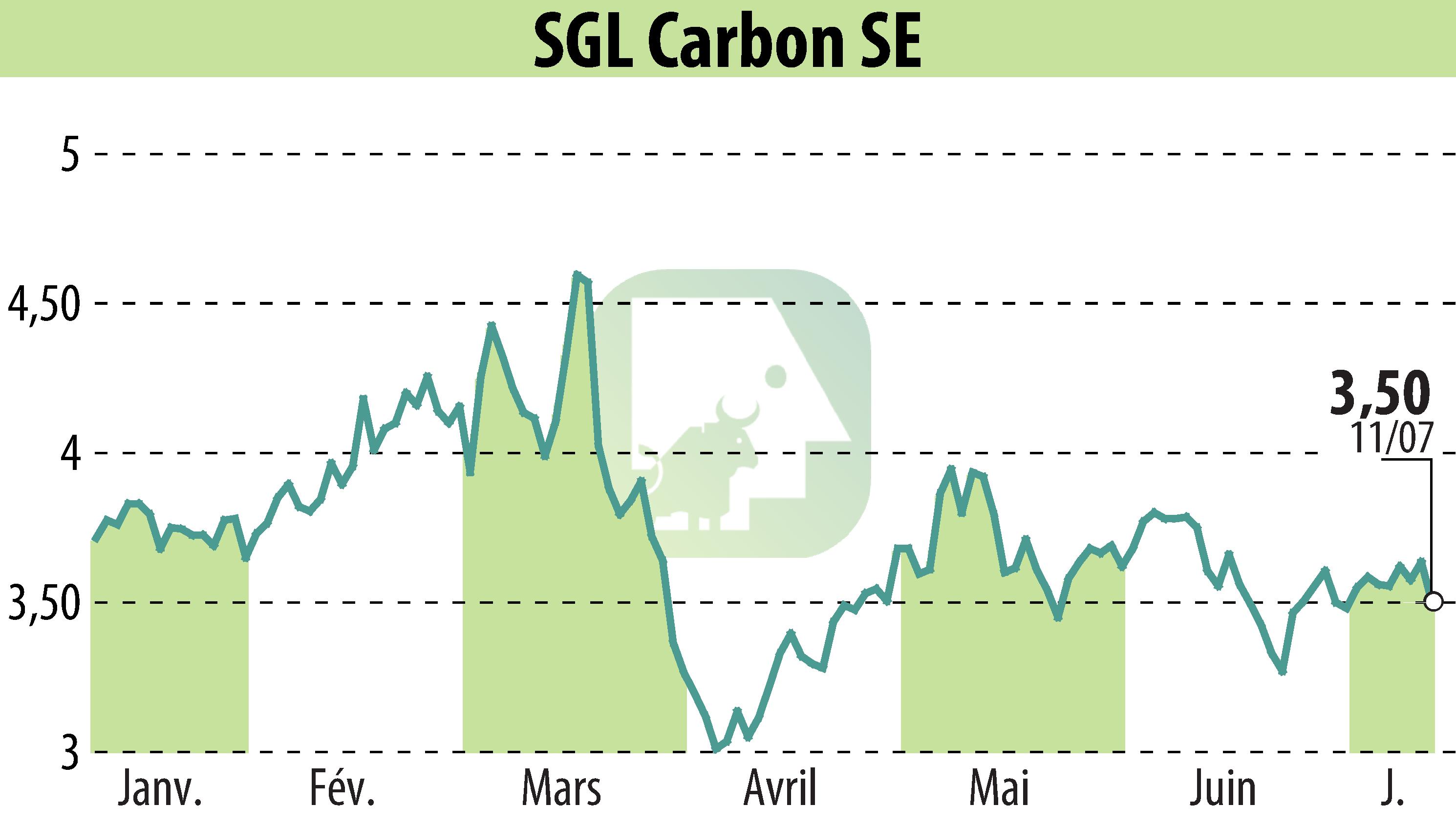

on SGL Carbon AG (ETR:SGL)

SGL Carbon Adjusts 2025 Sales Forecast Amid Declining Semiconductor Demand

SGL Carbon SE has released preliminary figures for the first half of 2025, indicating a 15.8% decrease in consolidated sales, totaling €453.2 million compared to €538.0 million in the first half of 2024. The decline is largely due to reduced demand from semiconductor customers for graphite components and a restructuring effort in its Carbon Fibers business unit, which involved the discontinuation of unprofitable operations.

Despite cost savings from the restructuring, preliminary adjusted EBITDA also fell by 16.2% year-on-year to €72.5 million. This drop is attributed to the inability to counterbalance the reduced revenues from high-margin semiconductor sales. Nevertheless, the EBITDA margin remained stable at 16.0%.

As a result, SGL Carbon has revised its sales forecast for 2025, now predicting a 10% to 15% decline compared to the previous year. However, expectations for the adjusted EBITDA remain steady, forecasted within a range of €130 million to €150 million. The final half-year report will be available on August 7, 2025.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SGL Carbon AG news