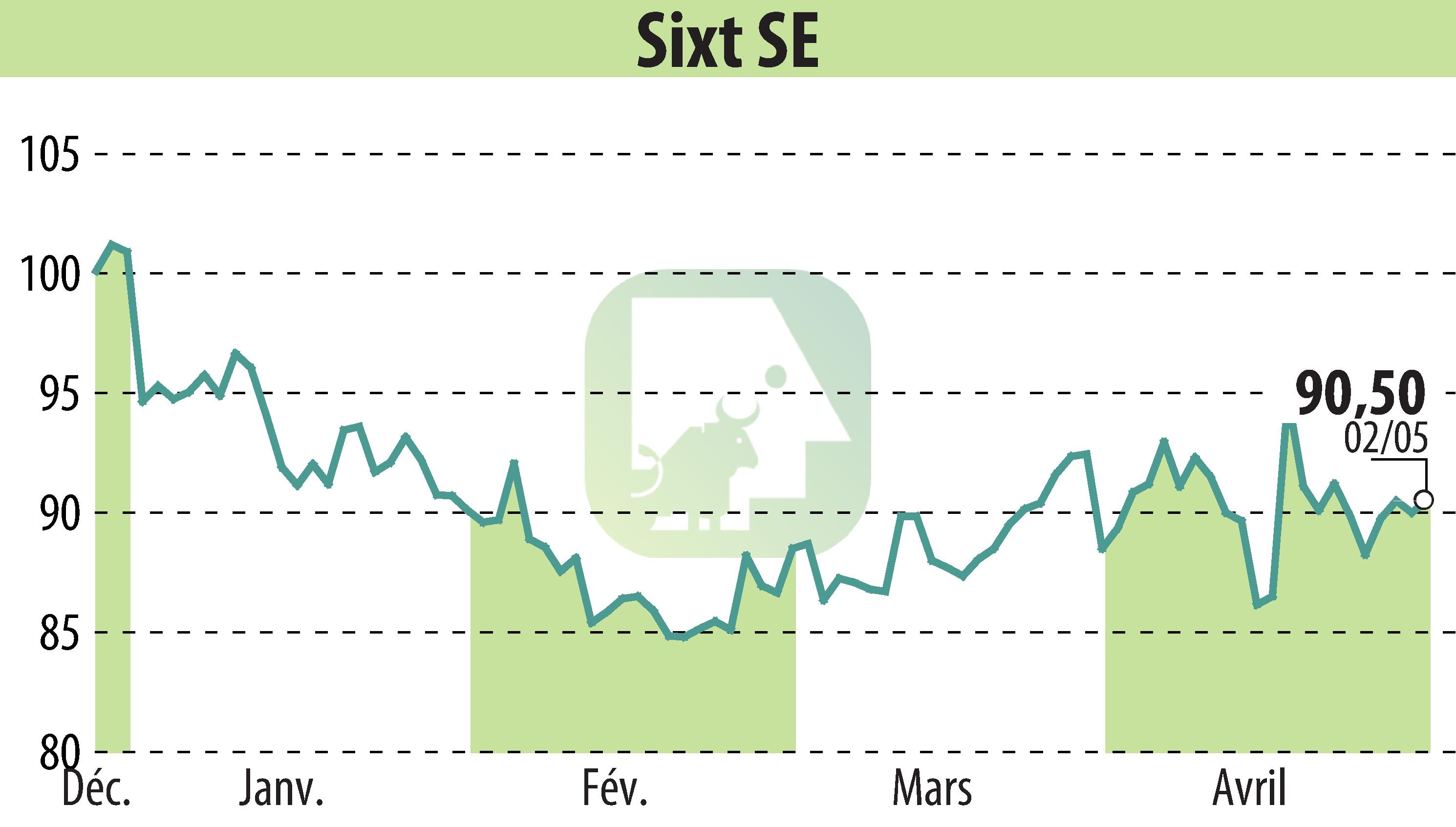

on Sixt Aktiengesellschaft (isin : DE0007231326)

SIXT Reports Record Revenue in Q1 Despite Challenges, Optimistic About Full Year

Sixt SE announced a significant revenue increase for Q1 2024, marking the twelfth consecutive quarter of double-digit growth. The company generated EUR 780.2 million, up by 12.3% year-on-year, with notable contributions from North America, Germany, and other European markets. Despite this, Q1 earnings before taxes (EBT) showed a deficit of EUR 27.5 million, primarily due to adverse market conditions affecting residual vehicle values.

The record revenue achievement was supported by strong demand across its 162,000 rental vehicle fleet. EBITDA for the period reached an all-time high of EUR 217.8 million. However, economic challenges, including falling used car prices and high vehicle costs, particularly impacted earnings. In response, Sixt has implemented measures such as optimizing fleet utilization and reducing costs through strategic vehicle acquisitions and efficiency improvements.

Looking forward, Sixt has adjusted its full-year earnings forecast due to the current economic outlook but remains positive about its profitability for the remainder of the year. The company expects EBT for 2024 to range between EUR 350 and EUR 450 million, with a promising return to profit expected in Q2, projected between EUR 60 and EUR 90 million.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Sixt Aktiengesellschaft news