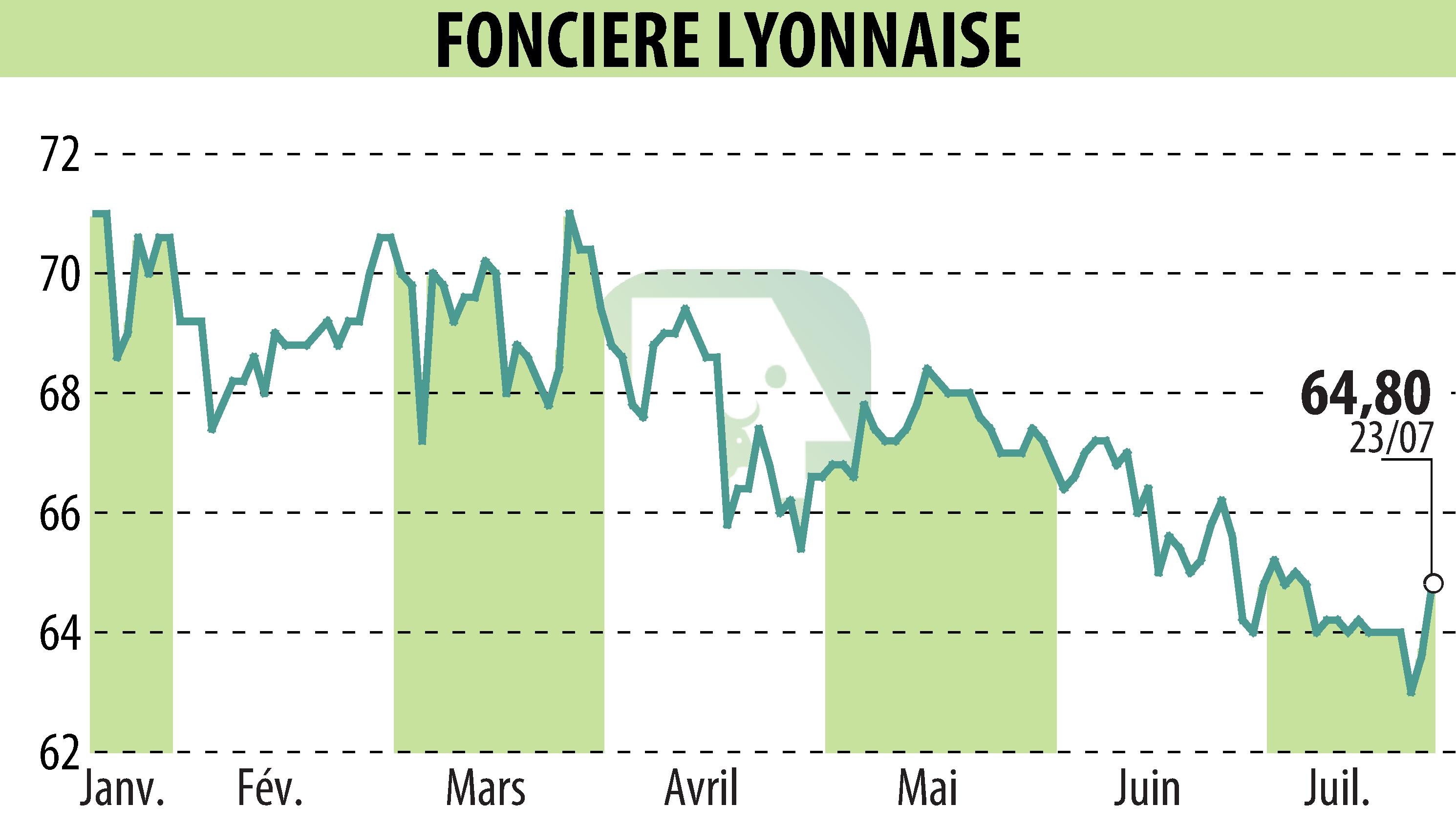

on SOCIETE FONCIERE LYONNAISE (EPA:FLY)

Société Foncière Lyonnaise: Results as of June 30, 2024

Société Foncière Lyonnaise (SFL) published its results as of June 30, 2024, marked by a notable increase in recurring net income per share, reaching €1.40, an increase of 12.9%. The company's assets are valued at €7,406 million, up 1% over six months on a like-for-like basis, with an exceptional occupancy rate of 99.8%.

Restated operating profit amounts to €109.8 million, up 12.9% compared to the first half of 2023. Rental income reached €121.6 million, an increase of 9.2%. These figures reflect the rigor of SFL's investment policy and the attractiveness of its premier Parisian offices.

The consolidated net profit amounts to €76.7 million compared to a loss of €177.5 million in 2023. The Board of Directors, under the chairmanship of Pere Viňolas Serra, highlights the stabilization of appraisal values and the progression rental income despite an uncertain context.

Net financial charges increased to €28.3 million, impacted by the increase in rates and the financing volume. However, SFL's strategic positioning makes it possible to maintain a record occupancy rate and increase rents.

The asset portfolio remains concentrated in the Paris Central Business District, with ongoing renovations and developments such as the Scope project. SFL stands out for its rigorous management and its commitment to sustainable real estate, thus strengthening its position in the market.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SOCIETE FONCIERE LYONNAISE news