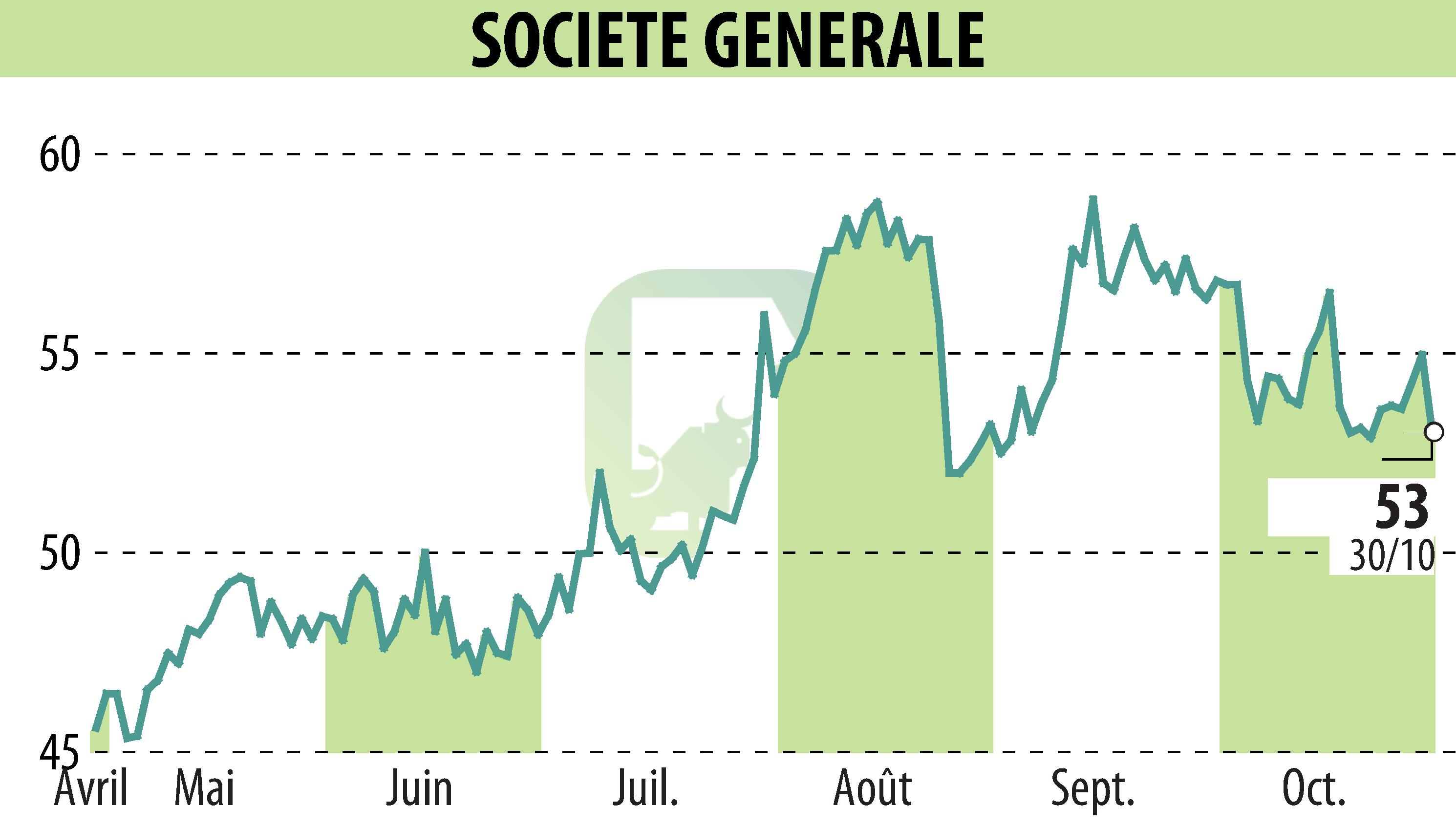

on SOCIETE GENERALE (EPA:GLE)

Prudential capital requirements for Société Générale in 2026

The European Central Bank has informed the Société Générale Group of its Pillar 2 capital requirements, applicable from January 1, 2026. The capital requirement is set at 2.36%, with a minimum of 1.38% in the form of CET1 core capital. An additional requirement of 0.11% applies to non-performing loans granted before April 26, 2019.

Including the various regulatory buffers, the minimum requirements for the group will be 10.26% for the CET1 ratio, 12.19% for the Tier 1 ratio, and 14.74% for Total Capital. The minimum leverage ratio required is 3.6%, higher than Société Générale's current 4.35%.

With a CET1 ratio of 13.7% as of September 30, 2025, the bank has a margin of 340 basis points above the requirement, indicating a solid financial position.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SOCIETE GENERALE news