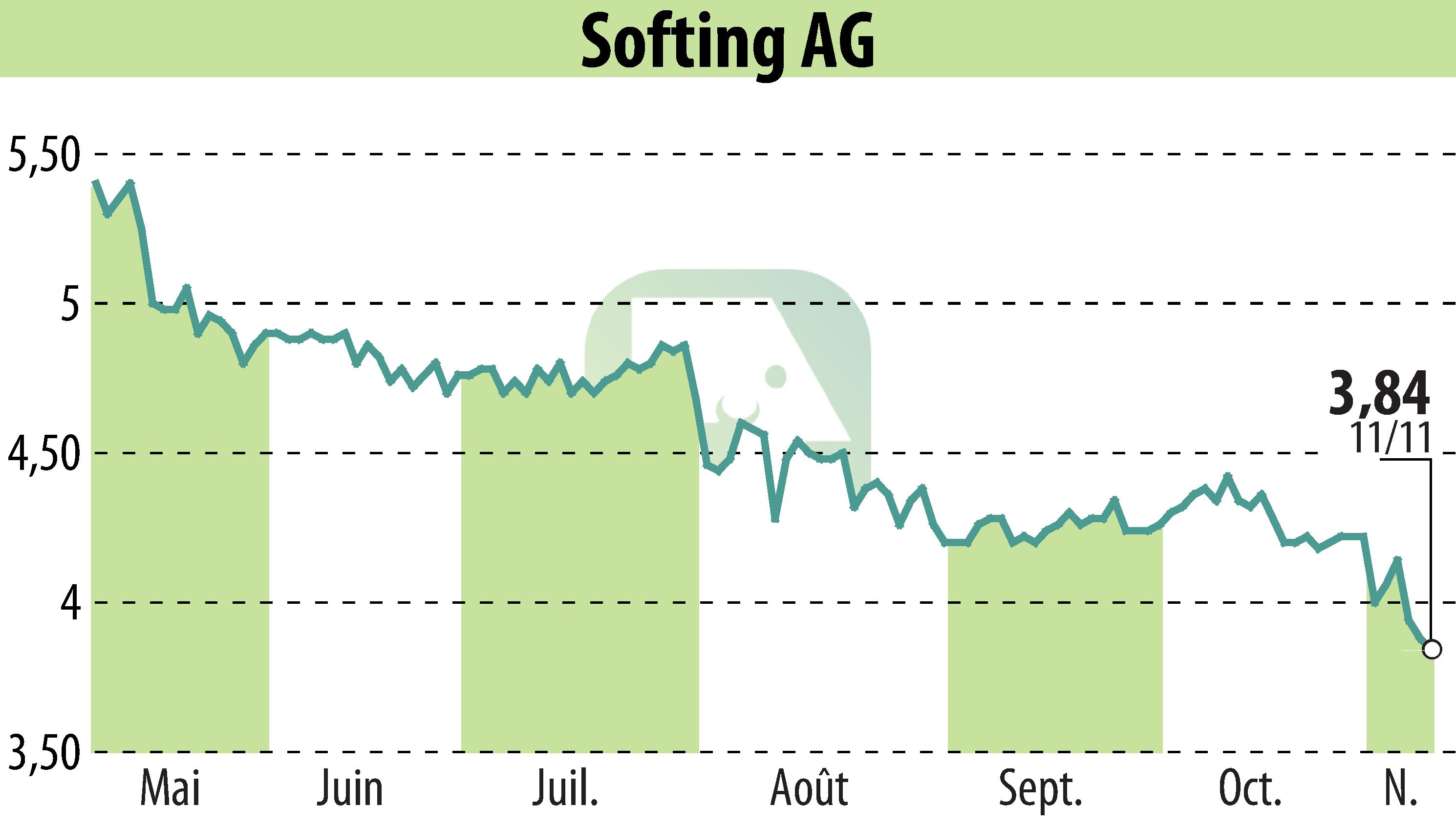

on Softing AG (isin : DE0005178008)

Softing AG Reports Decline in Revenue Amidst Economic Challenges

Softing AG has released its interim statement for the third quarter and the first nine months of 2024, highlighting a challenging economic environment. The company's revenue decreased by approximately 20% year-on-year, totaling EUR 69.8 million. This decline reflects broader industry trends, with both mechanical engineering and process manufacturing sectors experiencing downturns.

The North American market, which had previously boosted revenue by over 50% in 2023, showed signs of overbuying and investment restraint. Consequently, revenue in the Industrial segment fell sharply by around 25%. However, the Automotive segment demonstrated positive growth, with revenue increasing by 16%, although operating losses increased due to start-up costs.

Despite a flat performance in the IT Networks segment, Softing maintains guidance for 2024 with expectations of EUR 105 million in revenue and EUR 4-5 million in operating EBIT. The company's financial position remains steady, but challenges persist due to geopolitical uncertainties and industrial recession scenarios.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Softing AG news