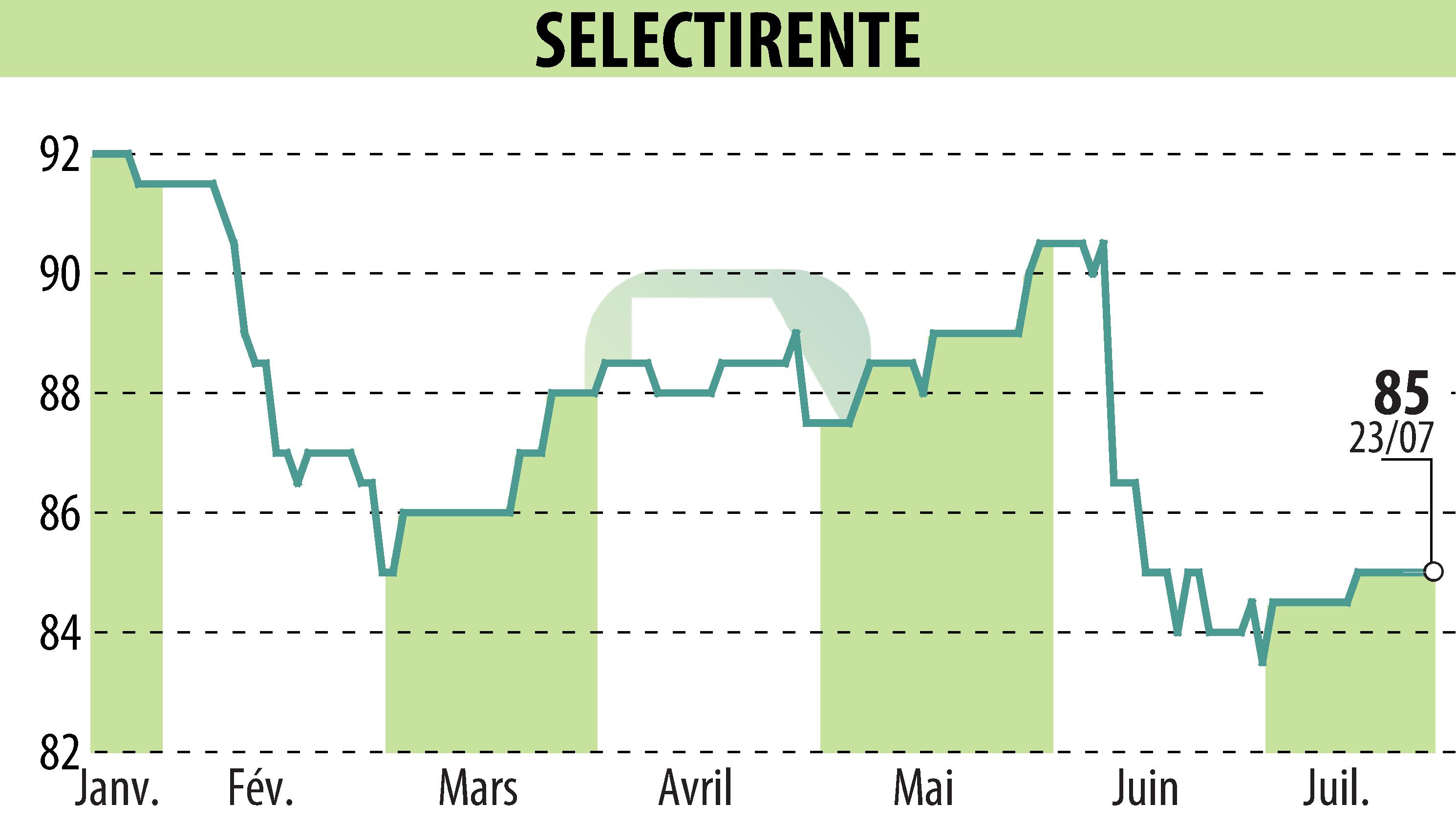

on SELECTIRENTE (EPA:SELER)

Solid performance for SELECTIRENTE in the first half of 2024

SELECTIRENTE posts a strong increase in its IFRS net profit to €13.2 million, or €3.17/share, compared to €1.2/share in H1 2023. Net current cash flow remains stable at €10.9 million .

The company made investments of €2.9 million and disposals of €8.1 million with a capital gain of €3.8 million. Rents increased by 3.5% on a like-for-like basis, supporting an average financial occupancy rate of 94.6% over the 12 months.

The assets are valued at €575 million, with a slight increase of 0.1% at constant scope. The NAV NDV according to EPRA standards stands at €89.46/share after payment of the dividend of €4/share.

The financial structure remains healthy with an EPRA LTV debt ratio of 37.5% and cash flow of €2.7 million. A refinancing of €80 million was carried out, providing flexibility to seize new opportunities.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SELECTIRENTE news