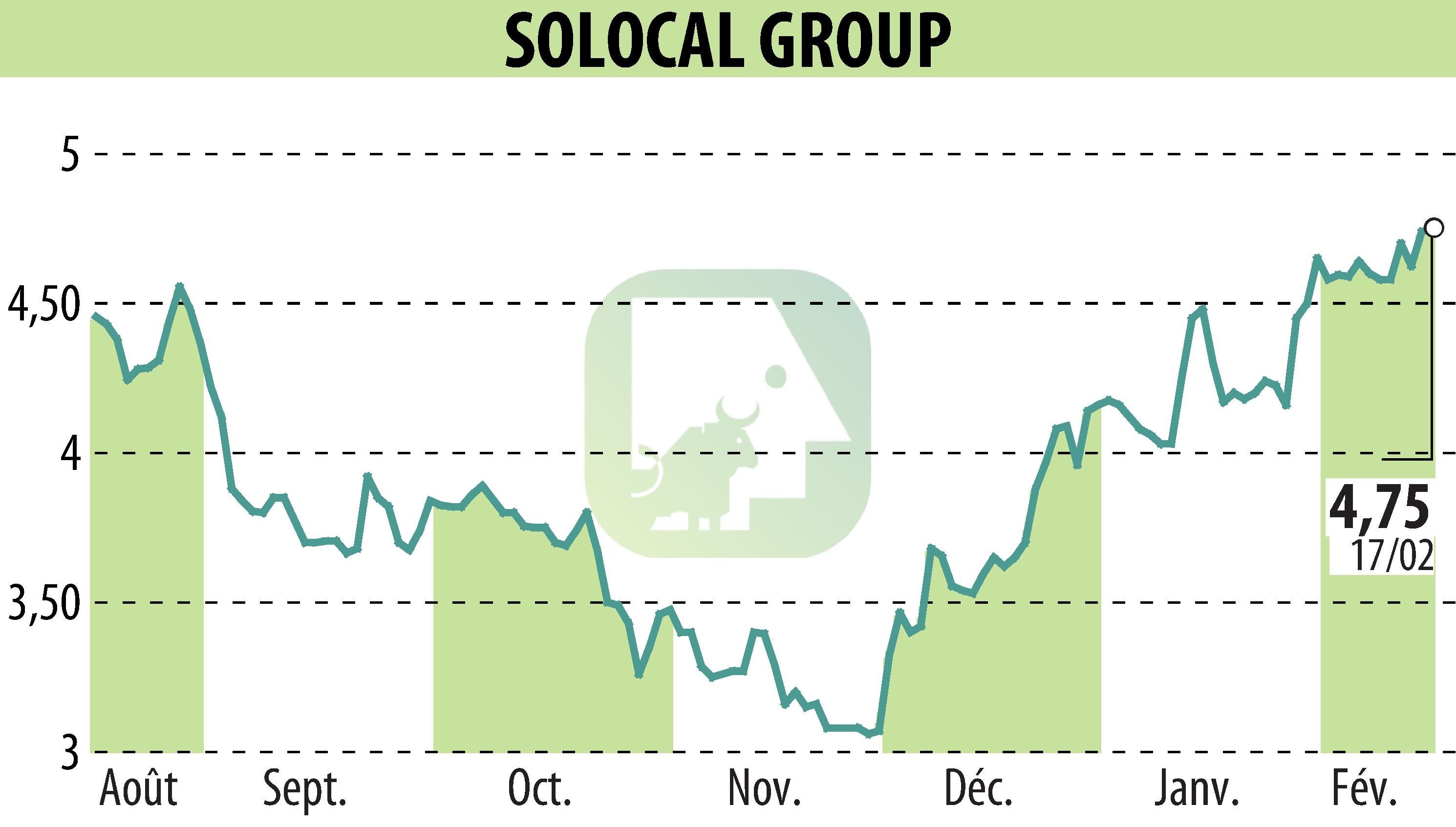

on SOLOCAL (EPA:LOCAL)

Solocal Achieves Financial Turnaround in 2025

In 2025, Solocal completed Phase 1 of its transformation, restoring financial fundamentals. The company announced a revenue of €324.5 million, declining by 3% from 2024. However, the EBITDA surged by 41% to €60 million, improving the margin from 12.8% to 18.5%. Operating income swung from a €15.6 million loss in 2024 to a gain of €28.4 million. Net cash position reached €51.8 million, up from €26.6 million.

The order backlog increased by 17.5% year-on-year, signifying a solid future revenue base. Solocal fully repaid its Revolving Credit Facility early, reducing debt. Despite a challenging market, Solocal aims for recovery in 2026. The company plans to return to growth by Q4 2026, projecting an EBITDA margin of around 20%.

The strategy involves further innovation and investment, focusing on digital solutions and AI. CEO Maurice Lévy emphasizes the company's commitment to becoming a leader in the French digital economy.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SOLOCAL news