on ICADE (EPA:ICAD)

Standard & Poor’s Downgrades Icade's Credit Rating to BBB

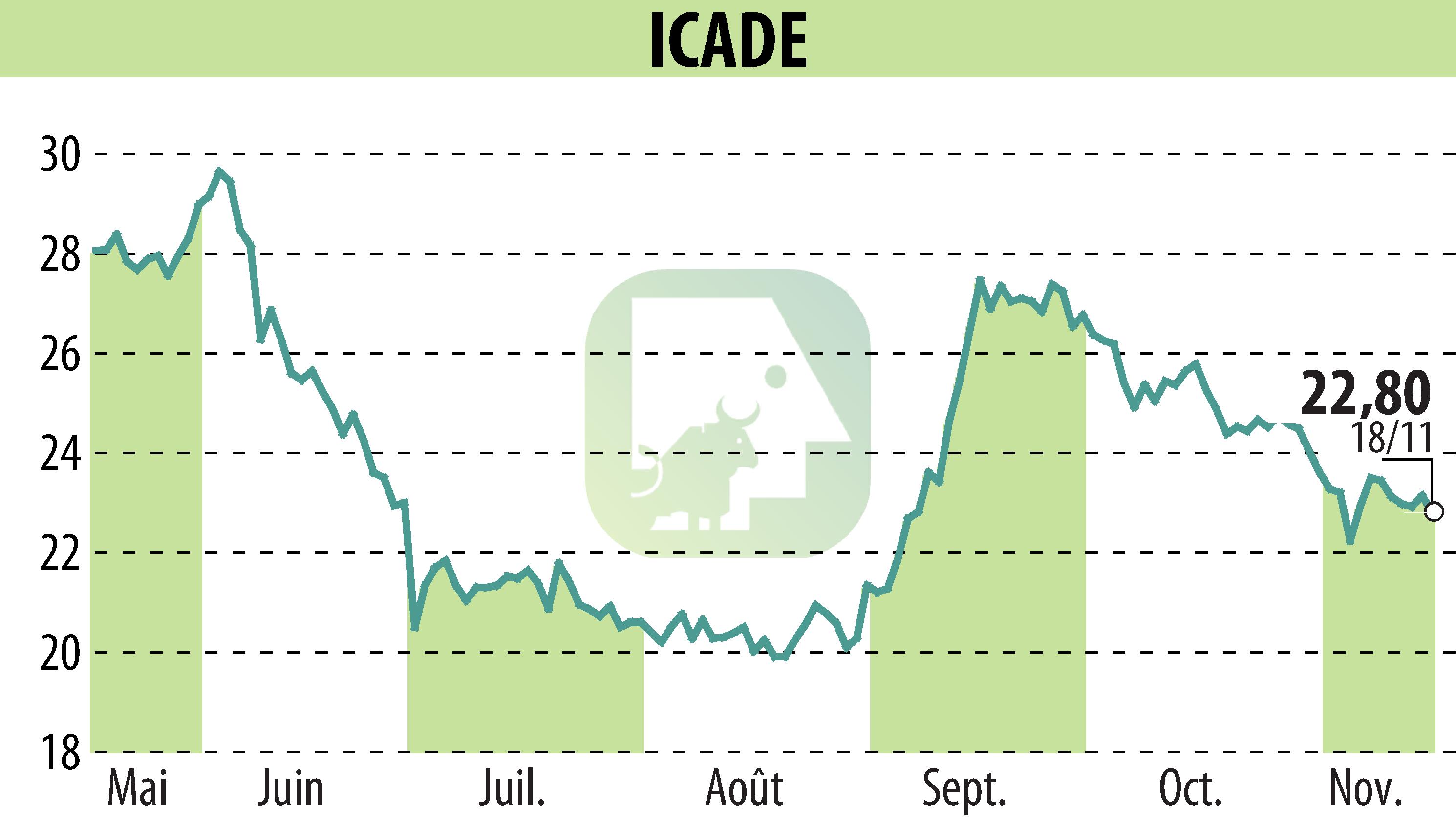

On November 18, 2024, S&P Global announced the lowering of Icade’s long-term credit rating from BBB+ with a negative outlook to BBB with a stable outlook. This adjustment reflects challenges within the Group's activities and a revised timeline for the sale of its Healthcare business. Despite this change, Icade's short-term rating remains A-2.

In line with the new rating, S&P Global has adapted Icade’s financial ratio thresholds. The net debt-to-capital ratio target is now set toward 50%, up from below 40%. The net debt-to-EBITDA ratio target increased from below 8.5x to below 11x, and the interest coverage ratio (ICR) goal adjusted to 2.4x from above 3.8x.

Icade acknowledges S&P’s decision and confirms its commitment to a stringent financial policy, a key component of its ReShapE 2024–2028 Strategic Plan. By mid-2024, the Group's liquidity stood at €2.4 billion, excluding NEU Commercial Paper, sufficient to cover debts until 2028.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ICADE news