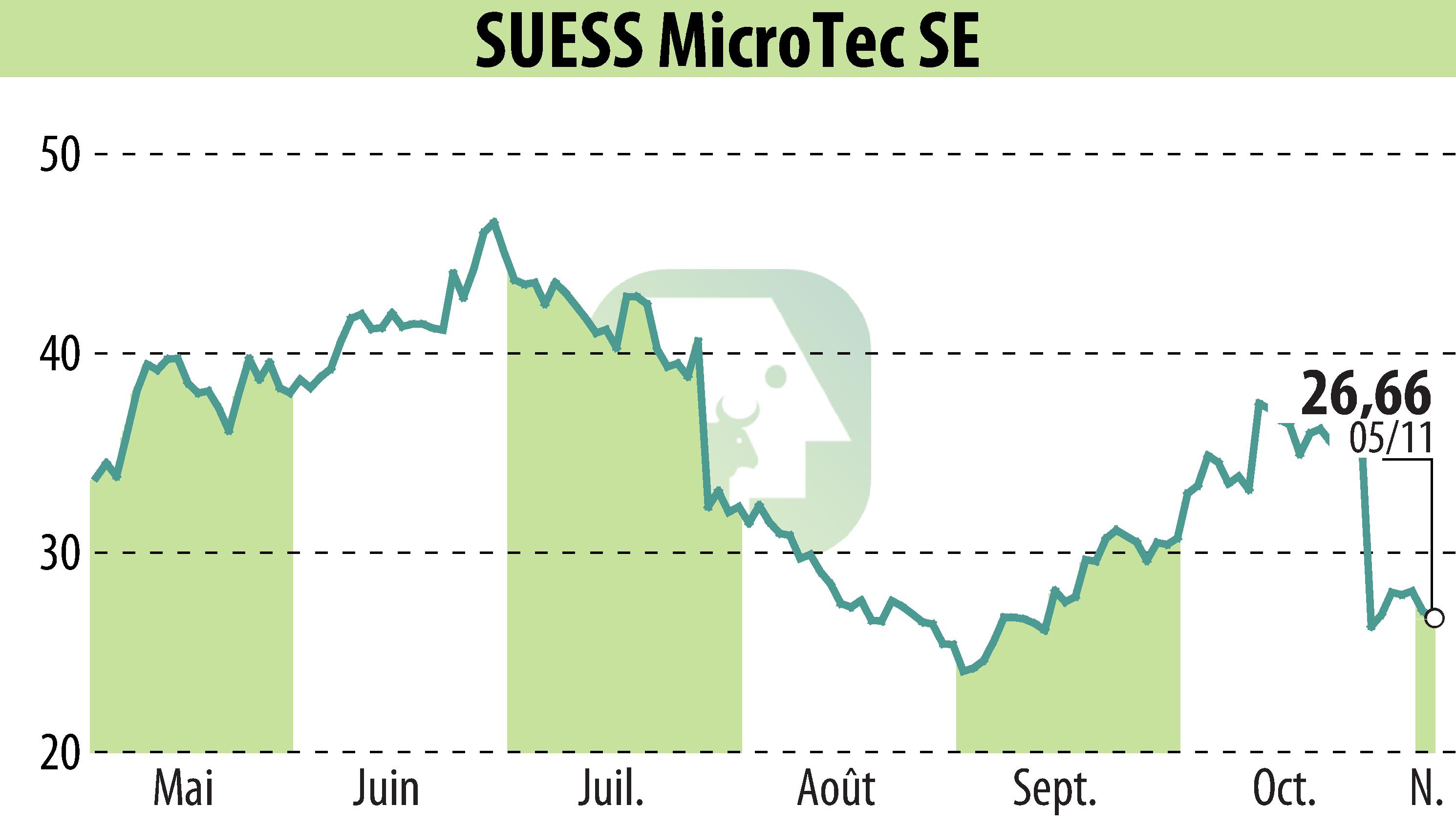

on SÜSS MicroTec AG (ETR:SMHN)

SUSS MicroTec Anticipates Stronger Orders in Q4

SUSS MicroTec announced a 15.1% sales increase to €118 million in Q3, with a 30.2% rise to €384.4 million over nine months. The company expects a significant rise in orders in Q4, following a muted Q3 order intake of €70 million, down from €84 million the previous year.

The Advanced Backend Solutions segment contributed significantly, with orders reaching €62.4 million. Despite the growth, gross profit margins declined from 39.6% to 35.9%, attributed to increased rework expenses and an unfavorable product mix.

The EBIT margin dropped to 10.5% in Q3. Cost management reduced R&D and administrative expenses, but further measures are being considered. SUSS aims for 2025 sales between €470 million and €510 million. The financial burden of a new site and deferred high-margin projects will impact Q4 results.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SÜSS MicroTec AG news