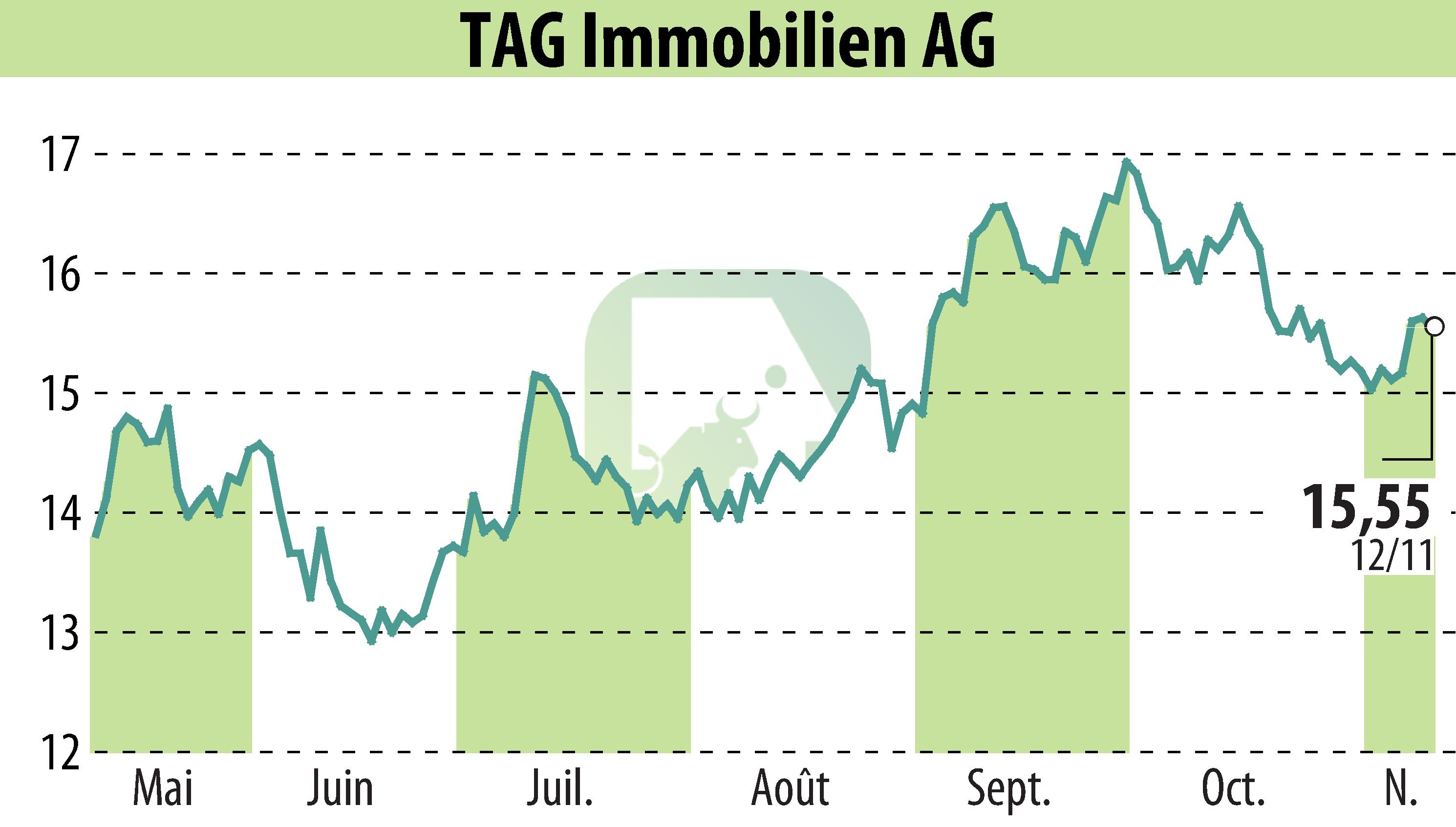

on TAG Tegernsee Immobilien U. Beteiligungs AG (isin : DE0008303504)

TAG Immobilien AG Reports Strong Performance Amidst Dynamic Market Conditions

TAG Immobilien AG has demonstrated robust operating performance as of 30 September 2024. Despite a slight dip in FFO I by 2% to EUR 130.5m, adjusted net income from sales in Poland surged by 39% to EUR 38.8m. This contributed to a 2% rise in FFO II to EUR 167.5m. Like-for-like rental growth in Germany increased to 2.8%, with vacancy rates dropping below 4%. In Poland, rental growth hit 3.7%, with over 3,000 units completed and plans for 10,000 by late 2028.

TAG's liquidity is strengthened by a EUR 500m bond issued in August 2024, allowing for further investment in the Polish rental market. The portfolio's EPRA NTA per share rose by 2% to EUR 18.61, while LTV reduced to 46.1%. The company anticipates continued growth in 2025, targeting FFO I of EUR 172-176m and an 8% boost in FFO II due to increased sales in Poland. A EUR 0.40 per share dividend is proposed for 2024, after a two-year hiatus.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TAG Tegernsee Immobilien U. Beteiligungs AG news