on TAG Tegernsee Immobilien U. Beteiligungs AG (ETR:TEG)

TAG Immobilien AG Reports Strong Performance in Q1 2024

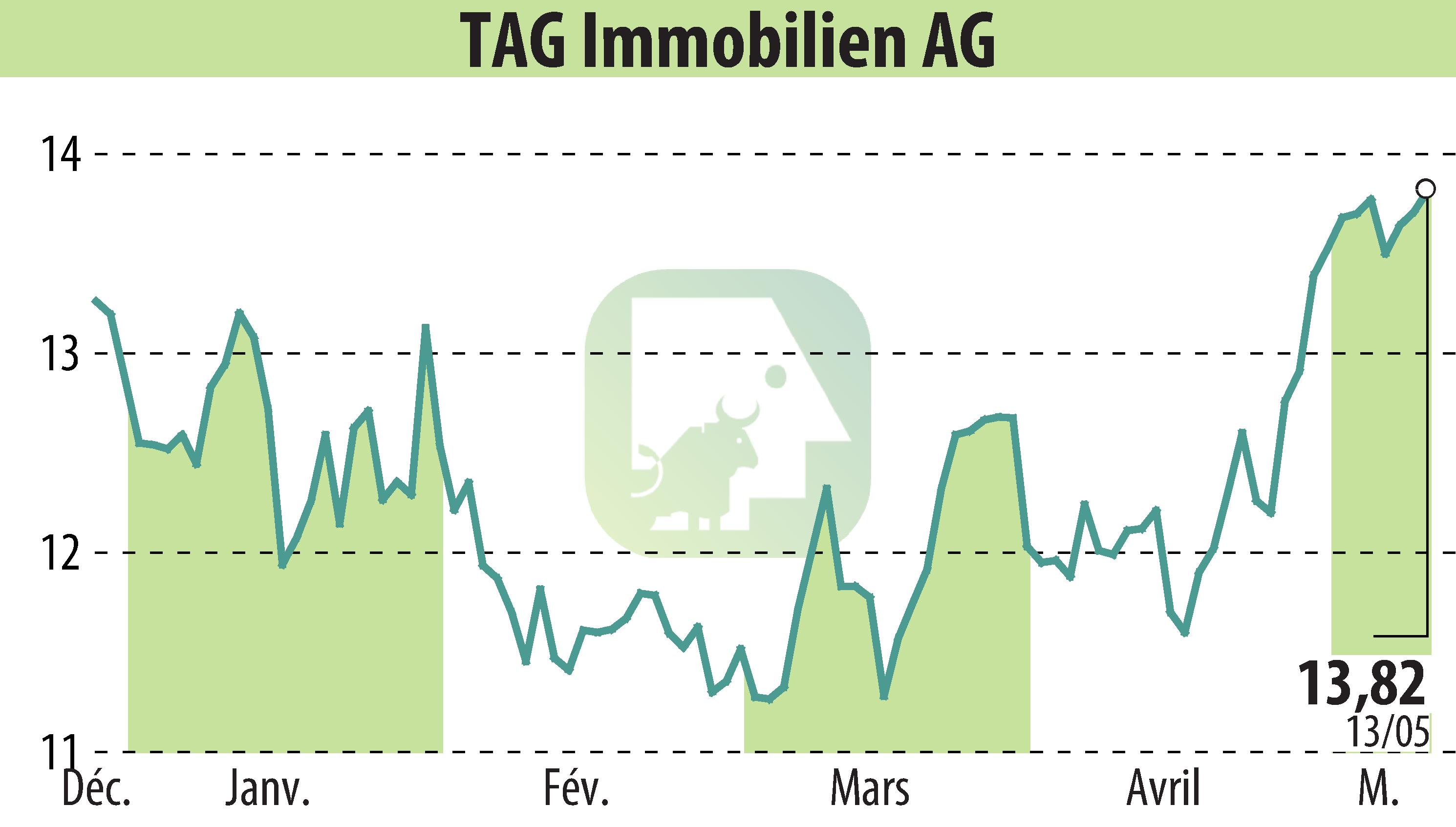

TAG Immobilien AG announced a robust start to 2024 with rising rental and sales results and a lowered loan-to-value (LTV) ratio. The firm's result from rental operations increased to EUR 44.6 million, up 5% from Q1 2023.

In the Polish market, sales results significantly improved, with net income from adjusted sales rising to EUR 19.8 million, a considerable jump from EUR 8.8 million in the same quarter of the previous year. This was primarily due to an increase in the units handed over, despite a decrease in the number of residential units sold year-on-year.

The consolidated net income for the company surged 60% to EUR 52.9 million, bolstered by strong operational performance. Additionally, TAG reiterated its guidance for the 2024 financial year without any adaptations.

The LTV ratio improved to 45.6%, a decrease from 47.0% at the end of 2023, mainly attributed to income from sales in Poland. The company also reported strong other financial ratios, maintaining stable average interest rates.

TAG continues its commitment to enhancing its climate efficiency and social responsibilities within its operational frameworks, aligning with long-term sustainability goals including a significant move towards a carbon-neutral portfolio by 2045.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TAG Tegernsee Immobilien U. Beteiligungs AG news