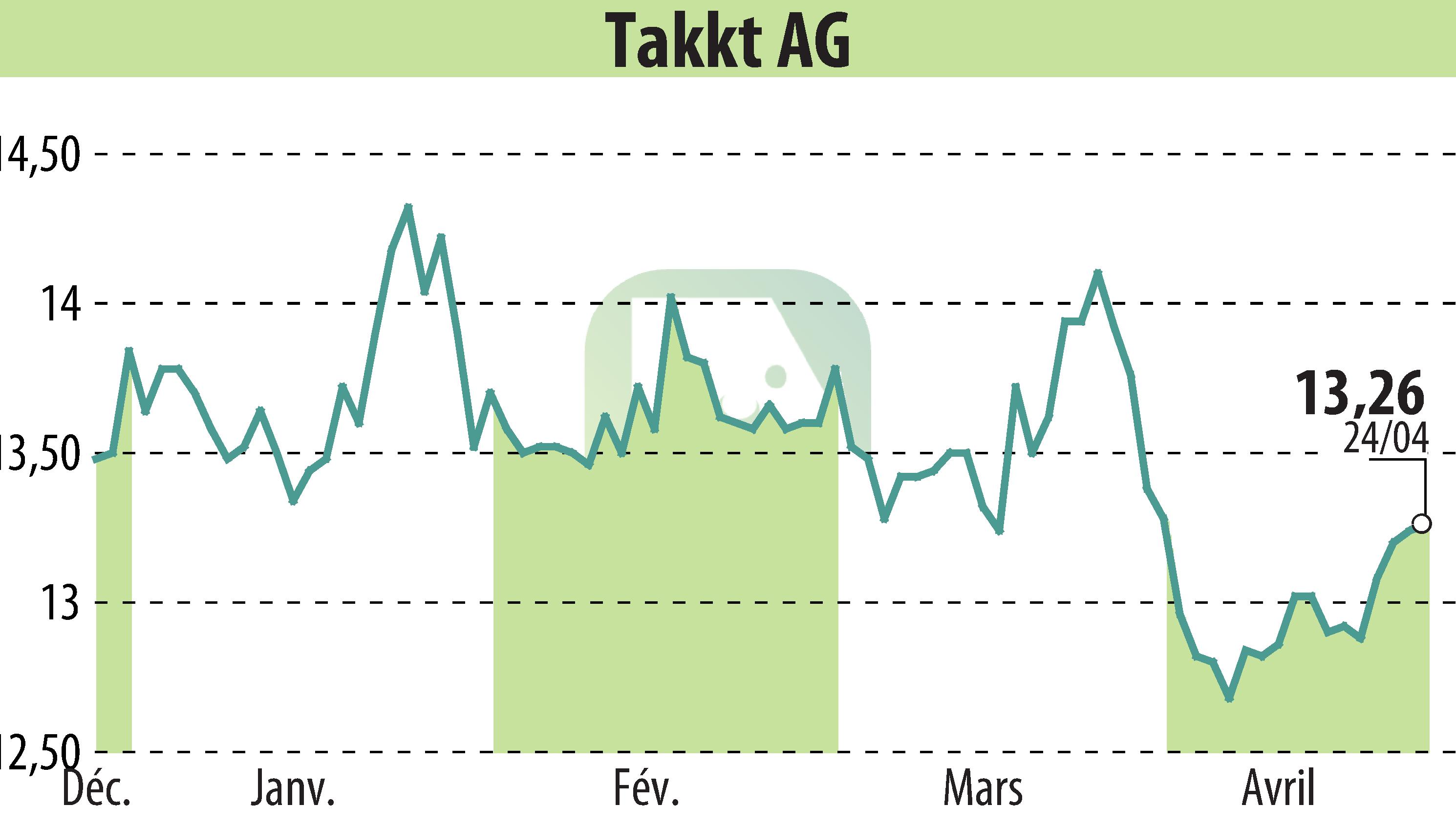

on TAKKT AG (isin : DE0007446007)

TAKKT AG Reports First Quarter Performance Amid Market Challenges

TAKKT AG, the B2B omnichannel distributor, has reported its financial performance for the first quarter of 2024. Announced on April 25, 2024, the company faced a challenging market environment which resulted in a 16.5% drop in organic sales; nevertheless, TAKKT saw significant improvements in other financial metrics. The company’s CEO, Maria Zesch, acknowledged the tough market conditions but confirmed efforts to adapt and improve were ongoing.

Despite decreased sales, which fell from EUR 321.8 million the previous year to EUR 269.0 million, the gross profit margin improved to 41.2 percent from 40.0 percent. This improvement was attributed to reduced costs for inward freight and better purchasing conditions. Adjusted EBITDA margin also reported at 7.4 percent, with one-time expenses impacting earnings. Furthermore, the company saw an increase in free cash flow to EUR 21.3 million, supported by effective inventory management.

Looking ahead, TAKKT anticipates a slow recovery in demand as market conditions are expected to improve in the latter half of 2024. Complementing these expectations are strategic operational adjustments including the integration of IT systems across divisions and restructuring initiatives aimed at reducing the cost base. CFO Lars Bolscho confirmed ongoing financial strategies are expected to gradually improve profitability through the year.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TAKKT AG news