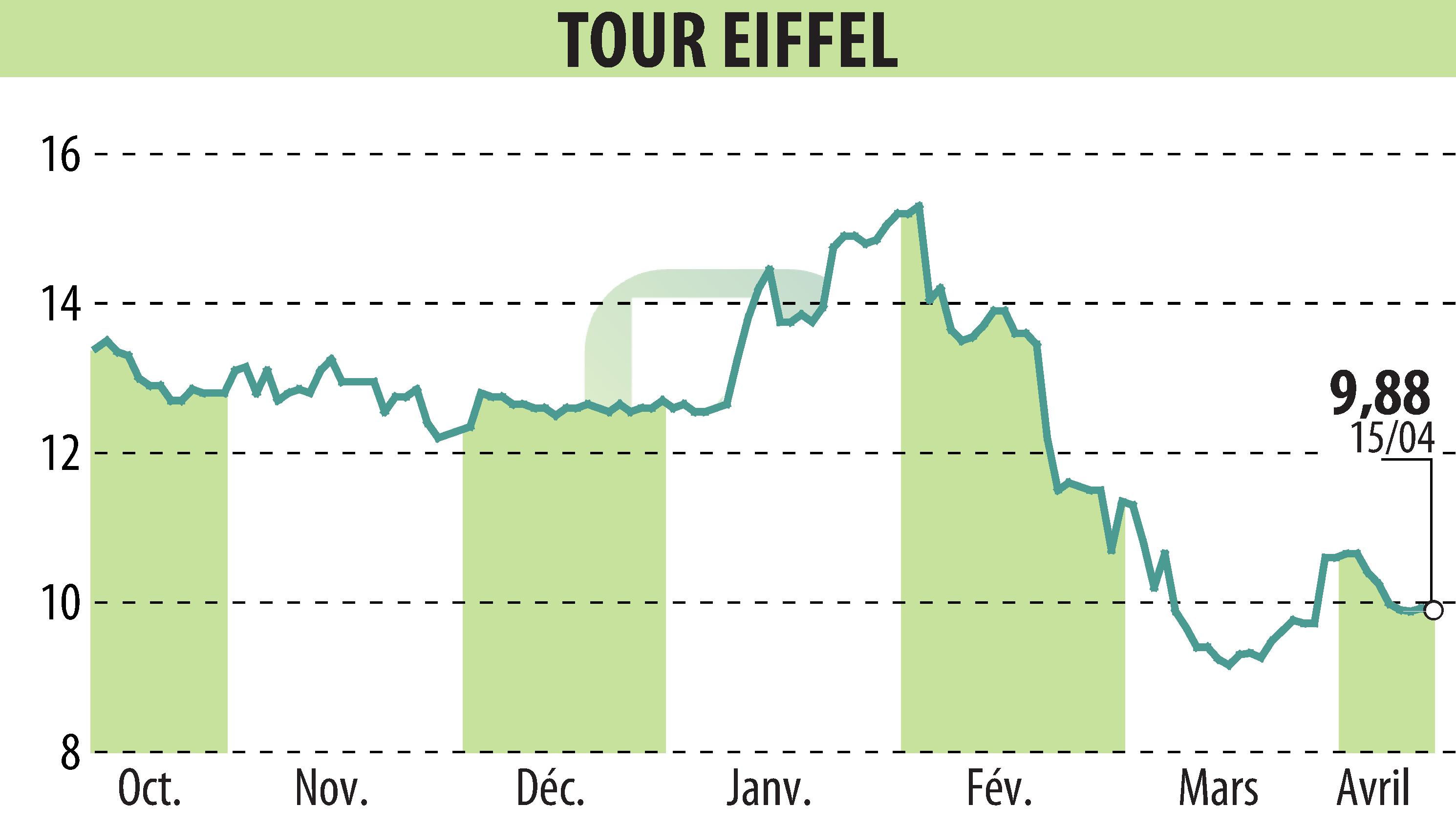

on TOUR EIFFEL (EPA:EIFF)

The Société de la Tour Eiffel launches sustainable financing of €90 million linked to ESG objectives

The Société de la Tour Eiffel announces the conclusion of a new credit line of 90 million euros over seven years, potentially extendable by two years, with financial conditions indexed to ESG (environmental, social and governance) criteria. This financing is granted by the Caisse Régionale de Crédit Agricole Mutuel de Paris et d’Ile-de-France.

The credit replaces a previous facility and aims to improve the maturity of the debt while maintaining liquidity. It is directly linked to the achievement of specific objectives, such as reducing energy consumption, certifying developments and training employees on ESG issues. This approach is part of the company's ongoing commitment to ESG criteria.

This operation, which took place in a difficult sectoral context, also underlines the solidity of the links between the Société de la Tour Eiffel and its financial partners. Management sees this financing as a realization of the alignment between its financial policy and its environmental and social commitments.

R. H.Copyright © 2024 FinanzWire, all reproduction and representation rights reserved. Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TOUR EIFFEL news