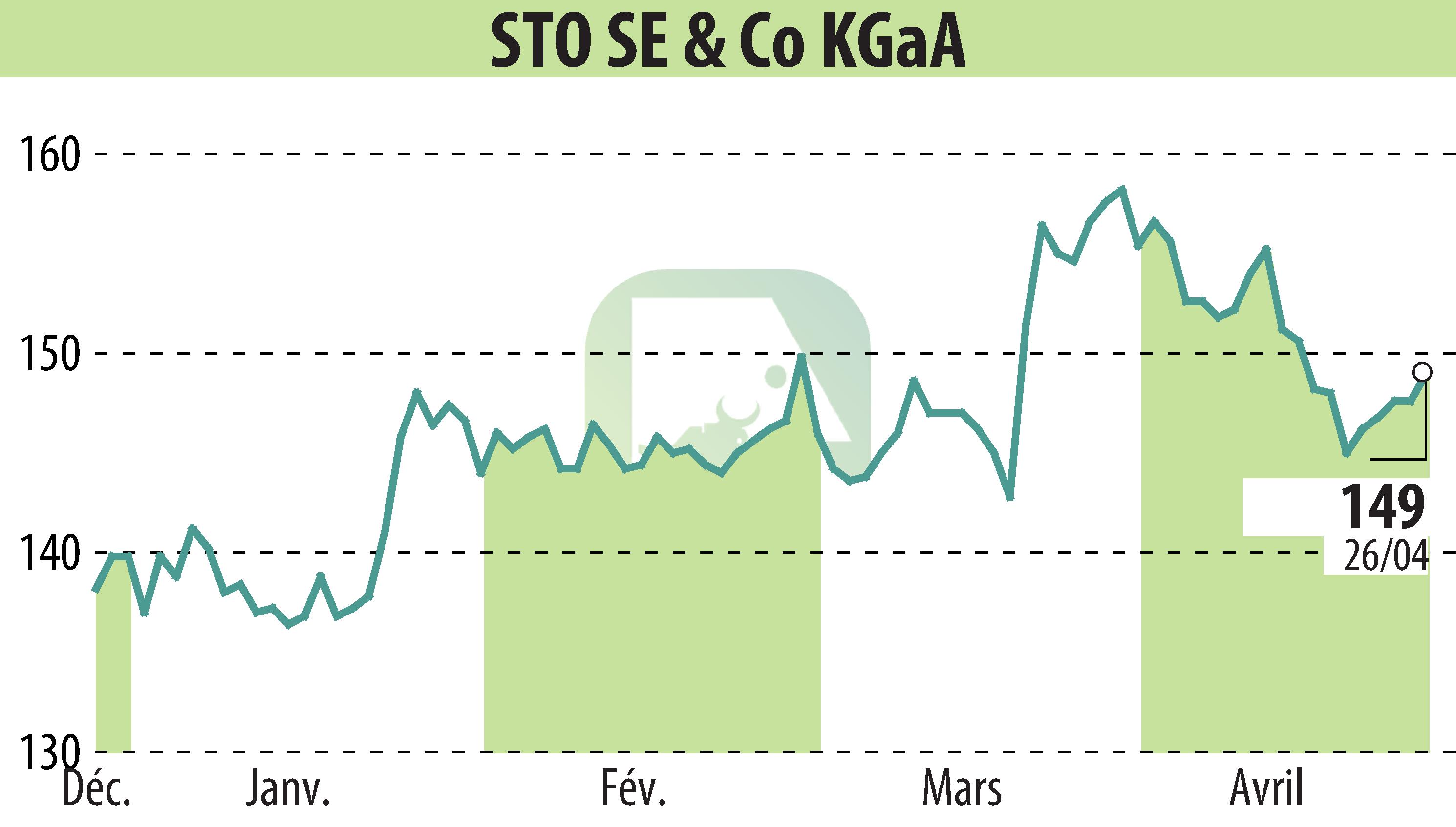

on Sto AG (isin : DE0007274136)

The Sto Group Navigates Market Challenges with Steady Financial Results in 2023

Sto SE & Co. KGaA reported a 3.9% decrease in annual turnover to EUR 1.72 billion in 2023 amidst difficult market conditions. Unfavorable weather and investor uncertainty, notably in the German market, were main factors impacting the business. The gross margin rate improved to 53.9%, reflecting strategic pricing adjustments and cost management efforts.

Despite a slight decline in consolidated earnings before interest and taxes (EBIT) by 2.5% to EUR 126.5 million, and earnings before taxes (EBT) by 0.7% to EUR 127.4 million, the company’s return on sales increased. Additionally, Sto maintained dividend distributions at the same level as the previous year, signaling confidence in its financial health.

Looking ahead to 2024, Sto anticipates a turnover of EUR 1.79 billion and projects EBIT and EBT to be between EUR 113 million and EUR 138 million. These expectations assume stable economic conditions and no significant geopolitical disruptions affecting its markets.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Sto AG news