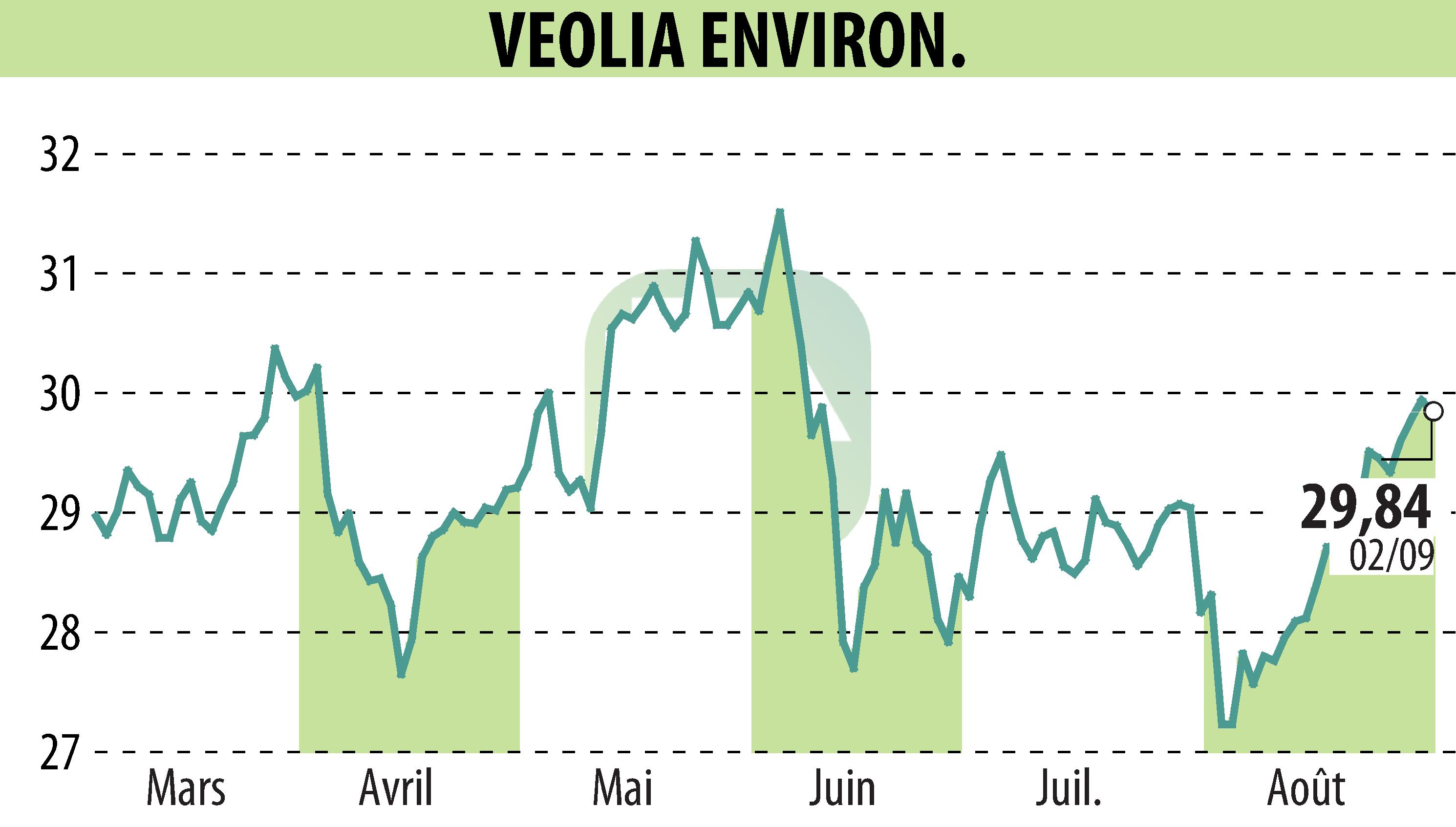

on VEOLIA (EPA:VIE)

Veolia Successfully Returns to Senior Bond Market

Aubervilliers, September 2, 2024. Veolia took advantage of a constructive market window to issue EUR 500 million in bonds maturing in September 2034. These bonds bear a coupon of 4.571% and were issued at par.

This transaction marked Veolia's return to the senior bond market, which the Group last tapped more than 3 years ago. Despite a busy market, the high quality of the order book and a high oversubscription rate allowed Veolia to achieve the transaction with no new issue concession, demonstrating the Group's strong credit quality and financial strength.

"This transaction follows the repurchase of our convertible bond in early August and is a testament to the confidence of the finance community in Veolia’s performance and potential," stated Estelle Brachlianoff, CEO of Veolia Environnement. She added that the strong interest in Veolia aligns with the Group's strategic positioning in ecological transformation, optimizing its debt and benefiting shareholders and investors.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all VEOLIA news