on VERBIO Vereinigte BioEnergie AG (ETR:VBK)

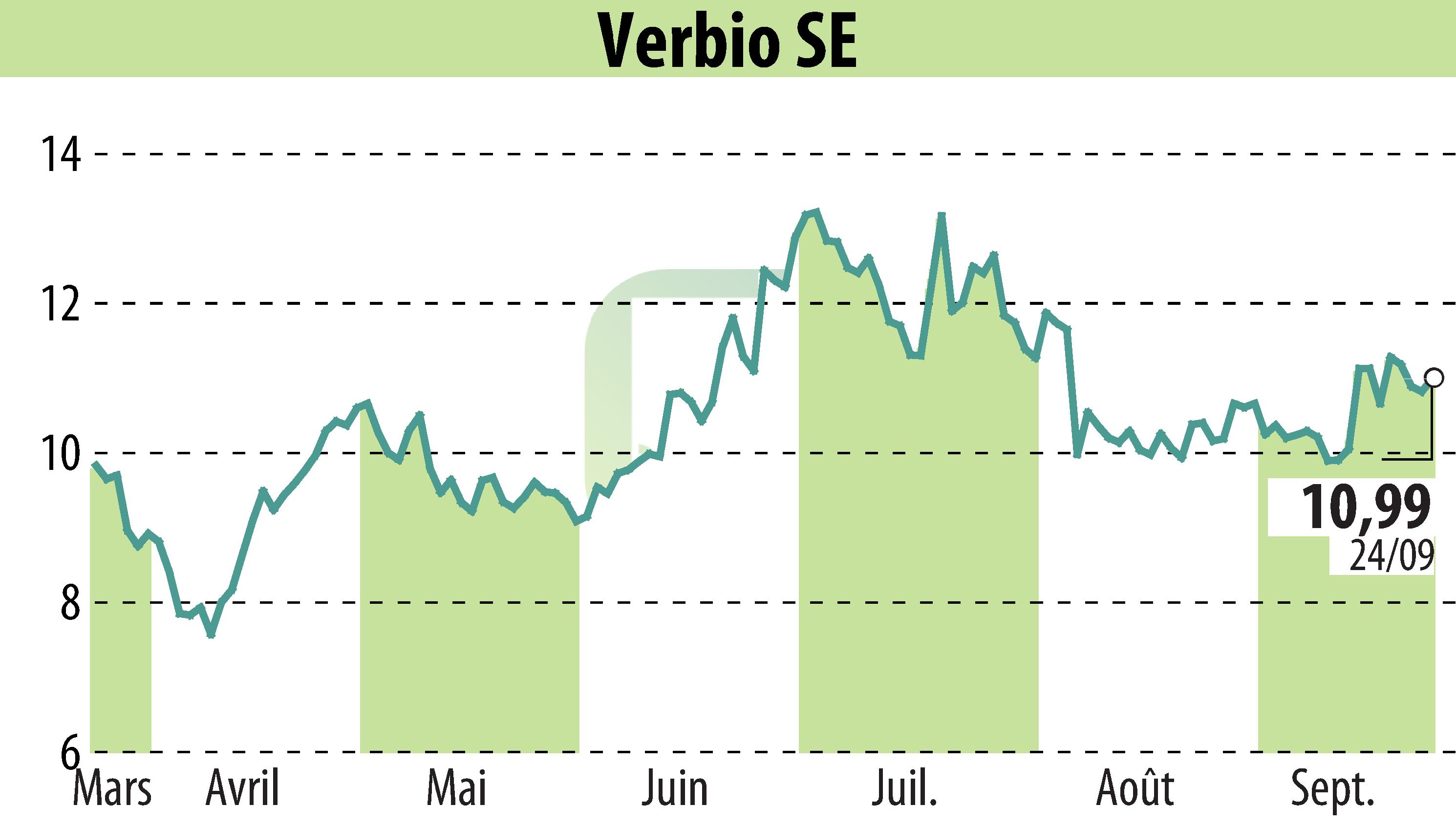

Verbio SE Anticipates Significant EBITDA Recovery in FY 2025/26

Verbio SE has confirmed its preliminary EBITDA result of EUR 14.2 million for the fiscal year 2024/25, highlighting a challenging year with lower profit margins and write-downs impacting the financial outcomes. The company's net financial debt stands at EUR 164 million, in line with its liquidity strategy despite a sharp decline in earnings. Verbio anticipates a significant recovery in EBITDA for FY 2025/26, supported by improvements in the biofuels market in Europe and the expanded operations in North America.

Production achievements marked the year, with 1.2 million tonnes of biodiesel and bioethanol and a record 1.190 GWh of biomethane. Nonetheless, revenue fell slightly to EUR 1,579.8 million, attributed to unfavorable market conditions and lower GHG premiums. The Nevada plant's operational performance, boosted by higher biomass utilization rates, is seen as a pivotal component of Verbio's international strategy.

The proposal to suspend dividends reflects political decisions affecting liquidity and underscores a conservative approach amidst volatile market conditions. Verbio's investments focused on expanding capacities and infrastructure, with a vision to stabilize and enhance competitiveness in the renewable energy market.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all VERBIO Vereinigte BioEnergie AG news