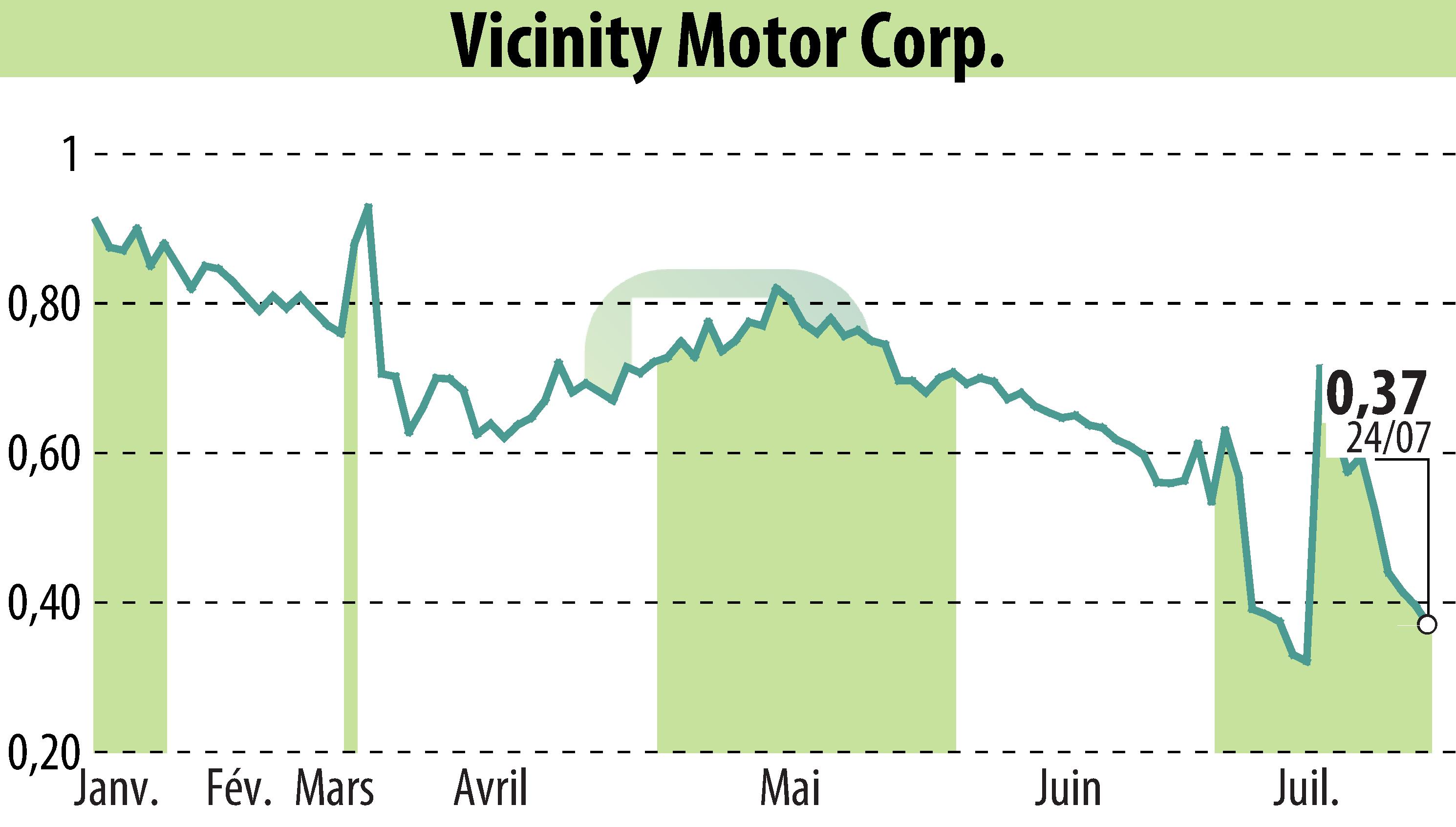

on Vicinity Motor Corp. (NASDAQ:VEV)

Vicinity Motor Corp. Customers Eligible for U.S. IRS Commercial Clean Vehicle Tax Credit of Up to $40,000 per Vehicle

Vancouver, BC / ACCESSWIRE / July 25, 2024/ Vicinity Motor Corp. (NASDAQ:VEV)(TSXV:VMC), a North American supplier of commercial electric vehicles, announced that its customers can now receive up to $7,500 in tax credit for the VMC 1200 Class 3 Electric Truck and up to $40,000 for the Vicinity Lightning electric transit bus.

This opportunity follows approval from the United States Internal Revenue Service (IRS) as a "qualified manufacturer" for the Commercial Clean Vehicle Credit. The credit, defined in §30D(d)(3) of the Internal Revenue Code, allows businesses and tax-exempt organizations to claim credits for qualifying vehicles as part of the Inflation Reduction Act of 2022. There is no limit on the number of credits a business can claim. Vicinity will be listed on the IRS Qualified Manufactured index.

"The Commercial Clean Vehicle Credit targets vehicles like our VMC 1200 and Vicinity Lightning, encouraging organizations to electrify their fleets," said Brent Phillips, President of Vicinity Motor Corp. "This lowers costs for new buyers in the U.S. considering the transition to EVs."

Ronnie Garcia, Grant & Government Relations Manager, added: "The 45W tax credit from the Inflation Reduction Act of 2022 provides substantial financial incentives, reducing the total cost of ownership for businesses and transit agencies."

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Vicinity Motor Corp. news