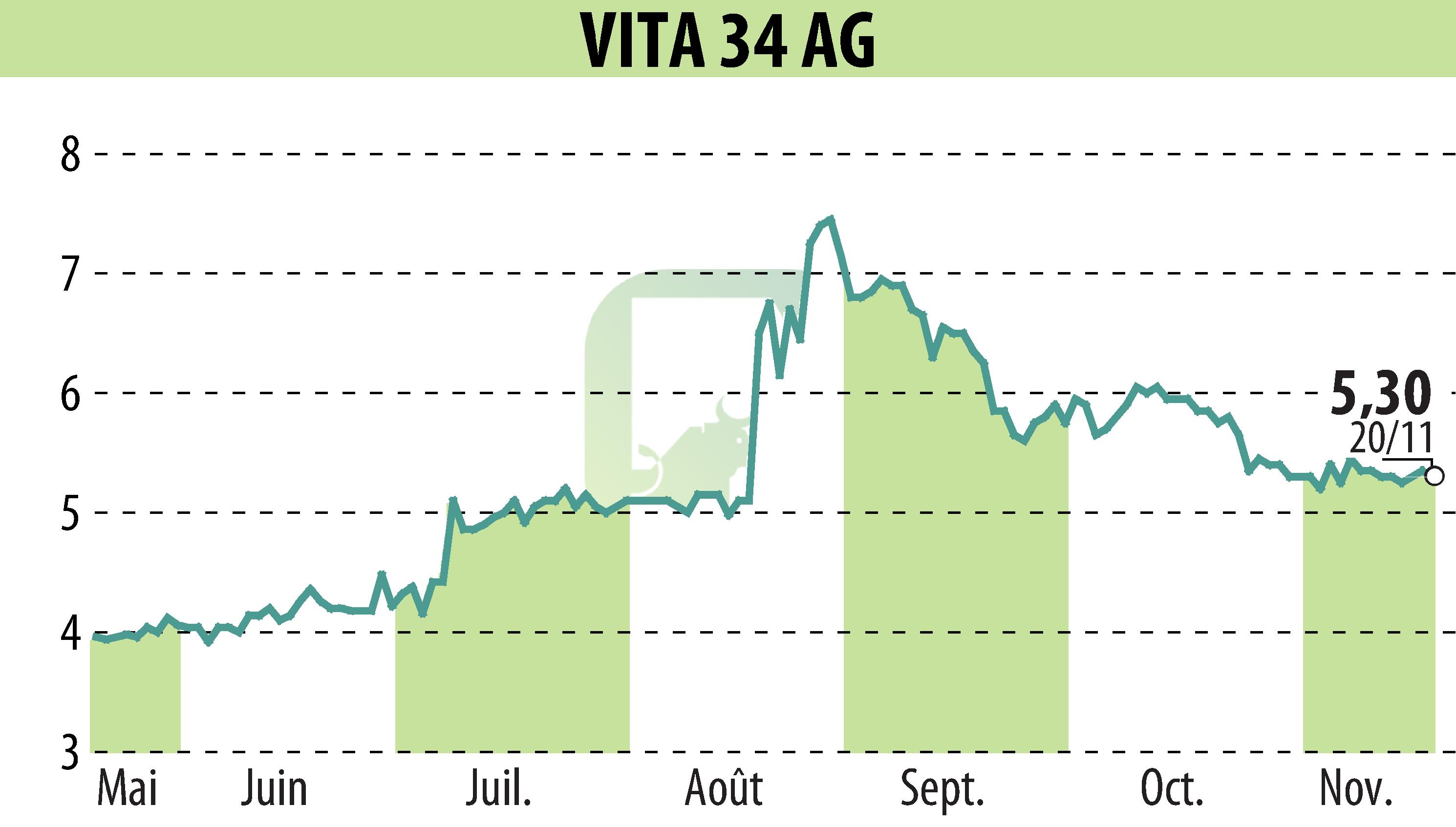

on Vita 34 AG (ETR:V3V)

FamiCord AG Enhances Growth and Revenue Quality in Q3 2025

FamiCord AG reported a 2.5% increase in revenues to EUR 22.8 million for Q3 2025, accumulating a 10% rise to EUR 66.4 million over nine months. The firm bolstered profitability amidst economic uncertainties and low birth rates in Europe. The subscription-based model gained traction, boosting revenue predictability.

EBITDA from ongoing operations held steady at EUR 3.8 million for Q3, matching the previous year, while rising to EUR 8.7 million over nine months. This reflects effective sales strategies and cost management. Recurring revenues showed significant growth, enhancing the stability of FamiCord’s income.

The strategic pivot towards subscription models impacted cash flow, now standing at EUR 3.4 million, down from last year's EUR 7.8 million, due to the dominance of prepaid contracts previously. The company maintains strong liquidity and is expanding operations in Eastern Europe.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Vita 34 AG news