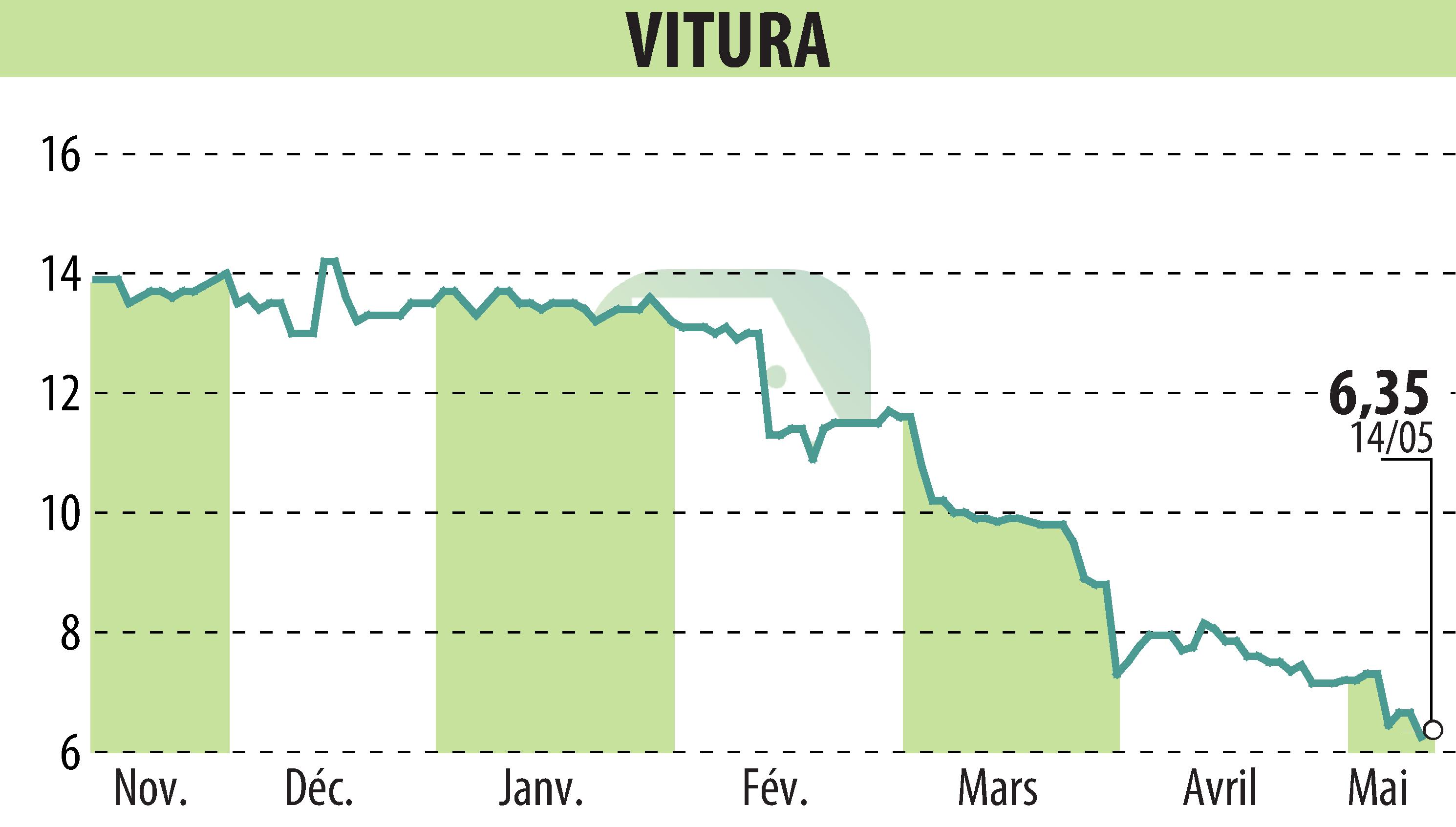

on VITURA (EPA:VTR)

Vitura first quarter 2024 results: changing rental performance

Vitura revealed its results for the first quarter of 2024, recording rental income of 10.9 million euros compared to 12.7 million euros for the same period in 2023. The company notes a drop in income due mainly due to the departure of tenants in 2023, notably the Passy Kennedy and Office Kennedy assets, preparing a project to merge the two properties.

The occupancy rate for buildings in operation reached 82% as of March 31, 2024, included in this calculation, the recent Rives de Bercy campus shows an initial rate of 69%. Rives de Bercy welcomed a major French industrialist as its first tenant for a 5,600 m² space. This new campus illustrates Vitura's space repositioning strategy, aiming to offer modern facilities and high environmental standards.

In addition, Vitura is preparing to bring together the Passy Kennedy and Office Kennedy buildings in an ambitious project that will include various quality services and meet the strictest ecological standards. The company also extended the maturity of the debt concerned to facilitate the financing of this project.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all VITURA news