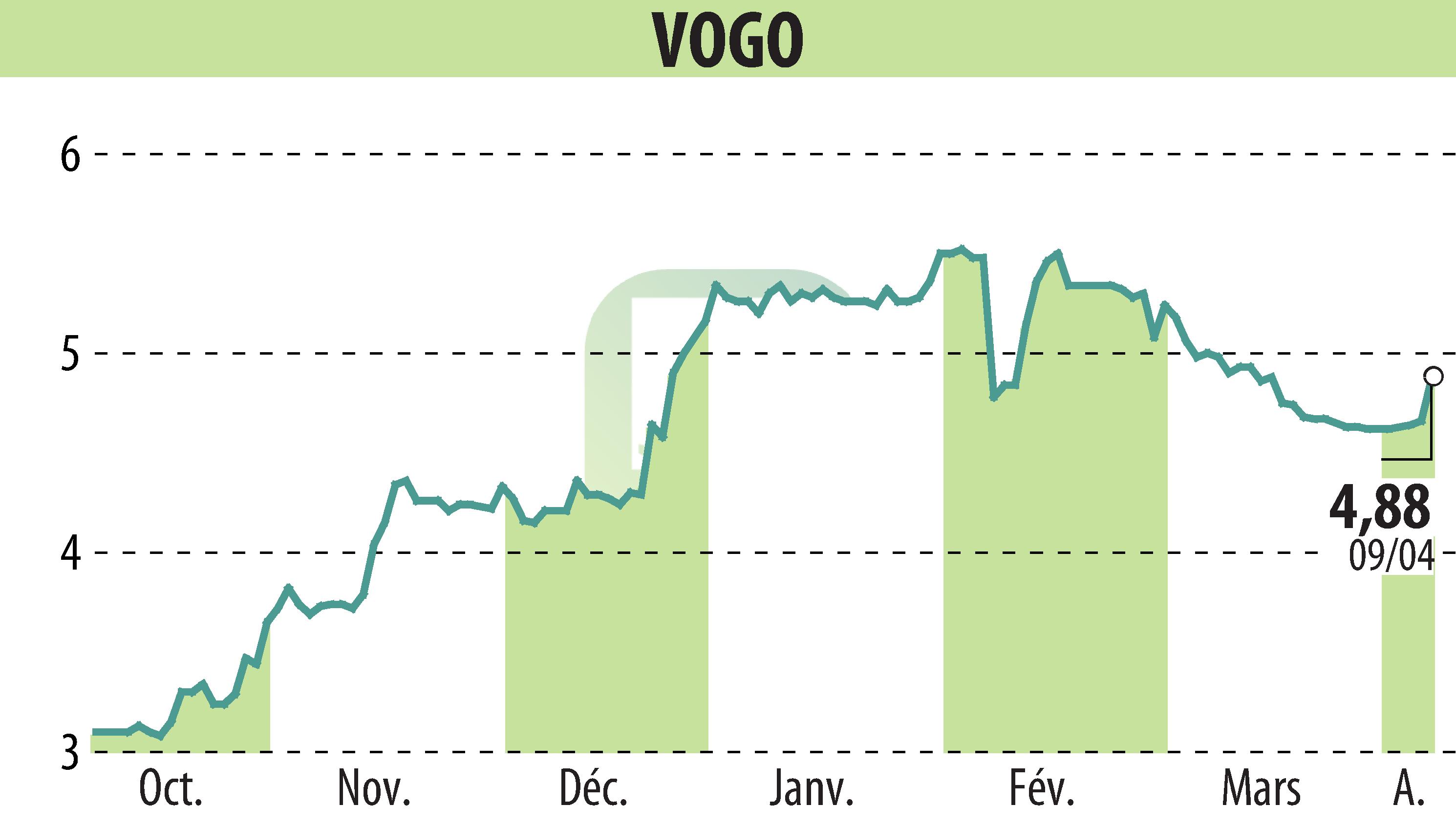

on VOGO (EPA:ALVGO)

VOGO Reports a Significant Turnaround in 2023 Reflecting Business Model Transformation

VOGO (ISIN: FR0011532225 - ALVGO) announced its 2023 financial outcomes highlighting a transformative year with substantial progress in the latter half. Despite a revenue dip to €9.6 million in 2023 from €12 million in 2022, the second half of 2023 saw a revenue increase by approximately 14%, showcasing the initial success of its transition to a Technology as a Service (TaaS) model. This shift not only attracted new customers but also demonstrated notable benefits such as growth in recurring revenues and enhanced customer loyalty.

The company observed a controlled operating expense, with external expenses reducing by 28% and a moderate 3% increase in personnel expenses, aiding the sales momentum. Despite these efforts, VOGO reported a €2.2 million operating loss due to significant R&D investments aimed at strengthening its technological edge. However, an EBITDA turnaround in H2 2023 to €310k signals a positive trajectory.

At the end of December 2023, VOGO's financial position was solid with €9.2 million in equity and a manageable net debt of €5.2 million. The firm expressed strong growth expectations for 2024, backed by a 28% increase in 2023 order intake and strategic developments like the FIFA certification for VAR video applications. The acquisition of a 51% stake in the VOGOSCOPE joint venture from ABEO is also expected to consolidate its market offering.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all VOGO news