on Volcon EPowersports, Inc. (NASDAQ:VLCN)

Volcon Announces Pricing of $12 Million Registered Direct Offering Priced At-The-Market

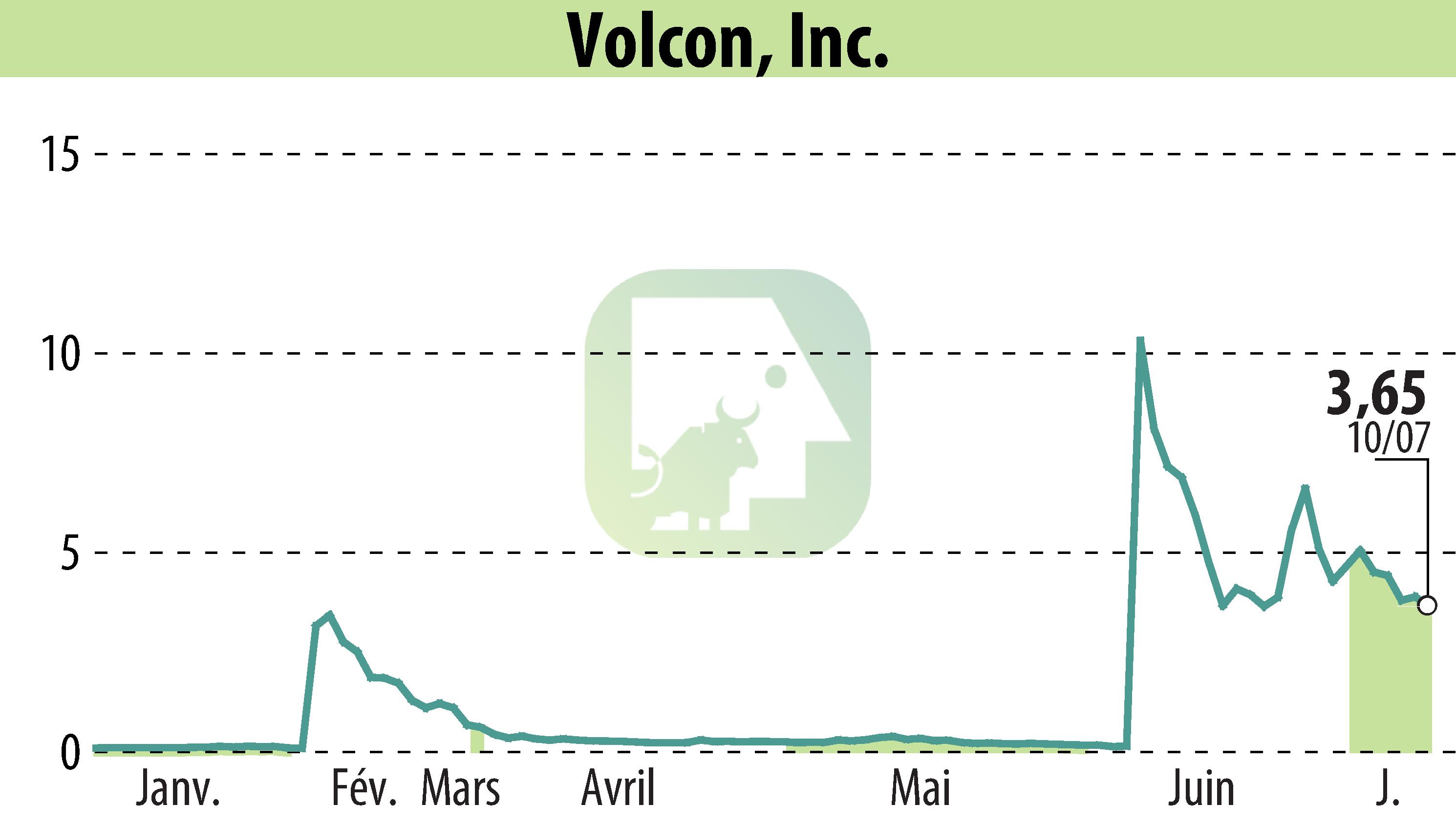

AUSTIN, TX / ACCESSWIRE / July 11, 2024 / Volcon Inc. (NASDAQ:VLCN), the first all-electric off-road powersports company, has announced securities purchase agreements with institutional investors. The deal involves the sale of 3,287,671 shares of common stock and/or pre-funded warrants at $3.65 per share or warrant, with an exercise price of $0.00001. The gross proceeds are estimated at $12 million.

The transaction is anticipated to close by July 12, 2024, pending customary conditions. Aegis Capital Corp. is the exclusive placement agent, with ArentFox Schiff LLP and Kaufman & Canoles, P.C. acting as counsels.

Volcon filed a registration statement on Form S-3 (File No. 333-269644), and the offering is made through a prospectus available on the SEC's website or via Aegis Capital Corp.

Proceeds will partially repay $2.94 million in principal on notes issued on May 22, 2024. As of July 10, 2024, all Series A convertible preferred stock converted to common stock, with approximately 2.63 million shares outstanding. Post-offering, Volcon will have no convertible debt or preferred stock and under $40,000 in debt.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Volcon EPowersports, Inc. news