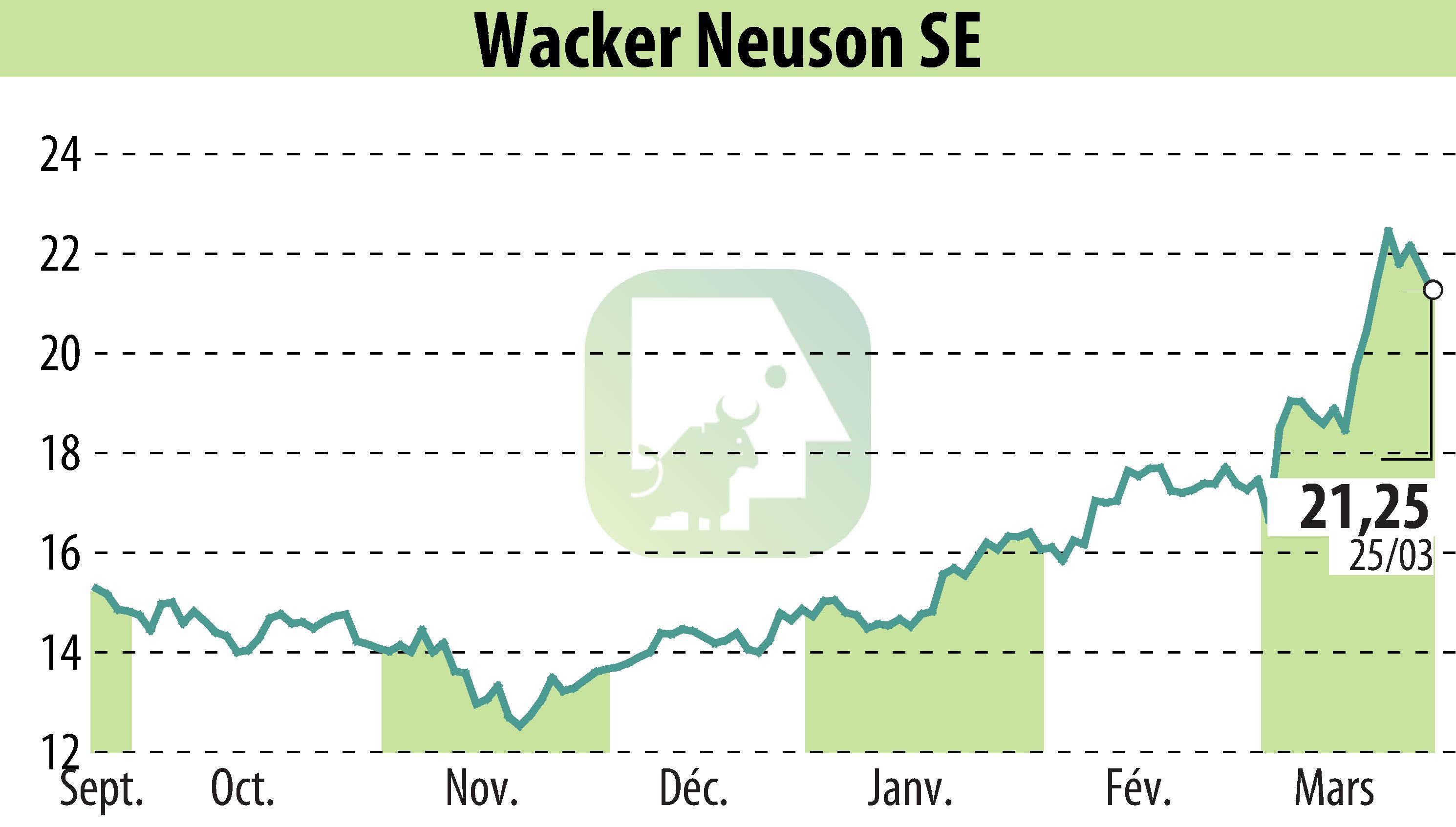

on Wacker Neuson SE (isin : DE000WACK012)

Wacker Neuson Group Reports 2024 Results, Projects Profitability Increase in 2025

Wacker Neuson Group, a noted manufacturer of light and compact equipment, released its 2024 financial results, revealing a 15.8% decline in group revenue to EUR 2,234.9 million and a 55.2% drop in EBIT to EUR 122.5 million. The EBIT margin fell to 5.5% from 10.3% in 2023. Despite these results, the company's free cash flow improved significantly, reaching EUR 184.6 million by year's end.

The Group attributed the disappointing 2024 performance to a weak market environment and full dealer stocks, which led to lower orders and revenue. Nonetheless, they anticipate an improved financial outlook in 2025, following early strategic interventions in sales strengthening, cost reduction, and inventory optimization.

The company plans to propose a dividend of EUR 0.60 per share, aligning with its strategy to involve shareholders in profits. For 2025, Wacker Neuson forecasts revenue between EUR 2,100 million and EUR 2,300 million, with an EBIT margin of 6.5% to 7.5%.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Wacker Neuson SE news