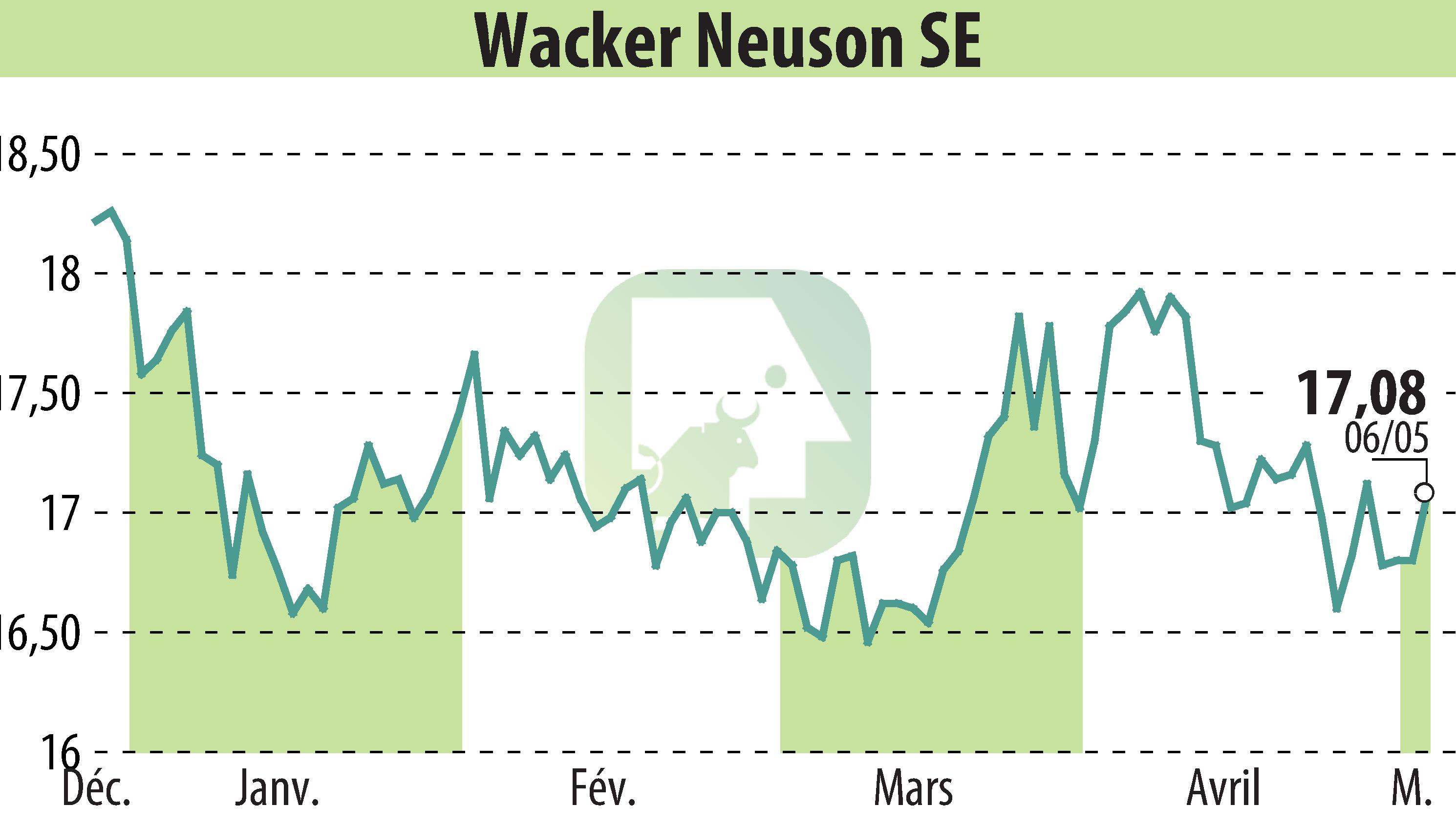

on Wacker Neuson SE (isin : DE000WACK012)

Wacker Neuson Reports Decrease in Q1 2024 Revenue, Optimistic for Annual Goals

Wacker Neuson Group announced a decrease in revenue for the first quarter of 2024, recording EUR 593.1 million, down by 11.1% compared to Q1 2023. Despite a lower revenue figure, the Group confirmed its full-year guidance for revenue and EBIT, anticipating improvements in market demand. The EBIT for Q1 2024 stood at EUR 36.9 million, with an EBIT margin of 6.2%, which is an improvement from the last quarter of 2023.

The company attributes the diminished performance primarily to ongoing economic challenges in the construction and agricultural sectors and high dealer inventory levels. These factors contributed to a decrease in order intake and challenges in reducing net working capital. However, the Group has implemented cost-cutting measures and expects these actions will gradually balance out the setbacks of the reduced production output.

In a statement, Dr. Karl Tragl, Chairman of the Executive Board and CEO, expressed confidence in achieving higher revenue and profitability as the year progresses. He emphasized the importance of their long-term Strategy 2030 in sustaining growth and meeting future financial targets. The Group expects to maintain its strategies focused on reducing dealer inventory and improving overall market conditions throughout the year.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Wacker Neuson SE news