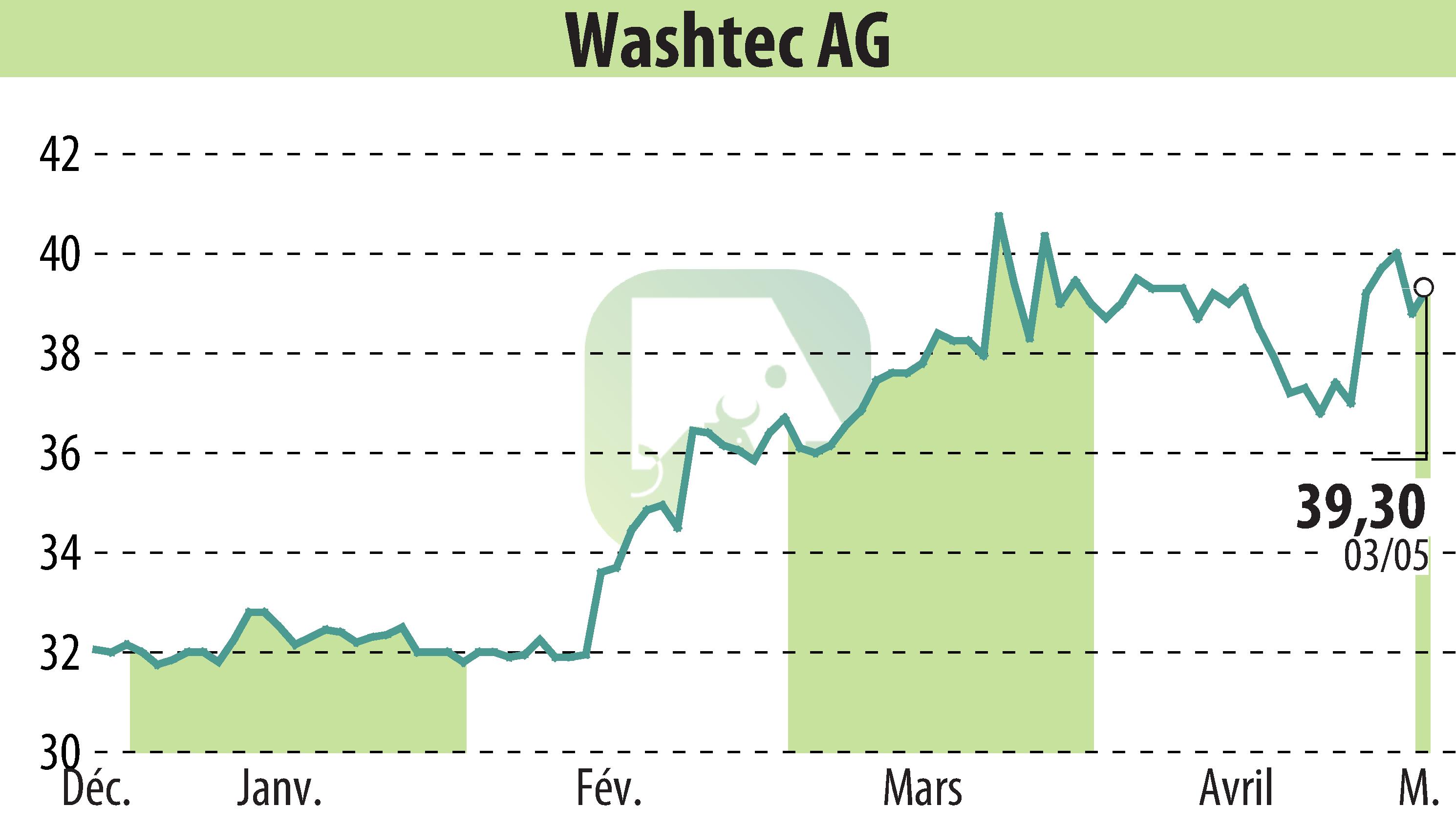

on WashTec AG (isin : DE0007507501)

WashTec AG Maintains EBIT Margin in Q1 Despite Revenue Drop

WashTec AG reported a stable EBIT margin for the first quarter of 2024, holding at 5.1%, despite a decrease in revenue. The company posted a revenue of €100.8 million, a decline of 7.7% from the previous year’s €109.2 million, influenced by reduced equipment sales in North America.

The EBIT for the first quarter was marginally lower at €5.1 million compared to €5.5 million in the same period last year. However, a slight increase in the EBIT margin from 5.0% in the previous year reflects efficiency improvements, even after accounting for one-off expenses.

Significantly, WashTec showcased a substantial improvement in free cash flow, which surged to €9.3 million from last year's €1.9 million, thanks to reduced capital expenditures and a tax refund. Despite this, the company experienced a decline in orders and a reduced order backlog compared to last year, reflecting a broader market slowdown.

WashTec reiterated its financial guidance for 2024, projecting similar revenue levels to the previous year and a mid single-digit percentage increase in EBIT. New CEO Michael Drolshagen expressed confidence in the company’s established market position and focus on profitability.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WashTec AG news