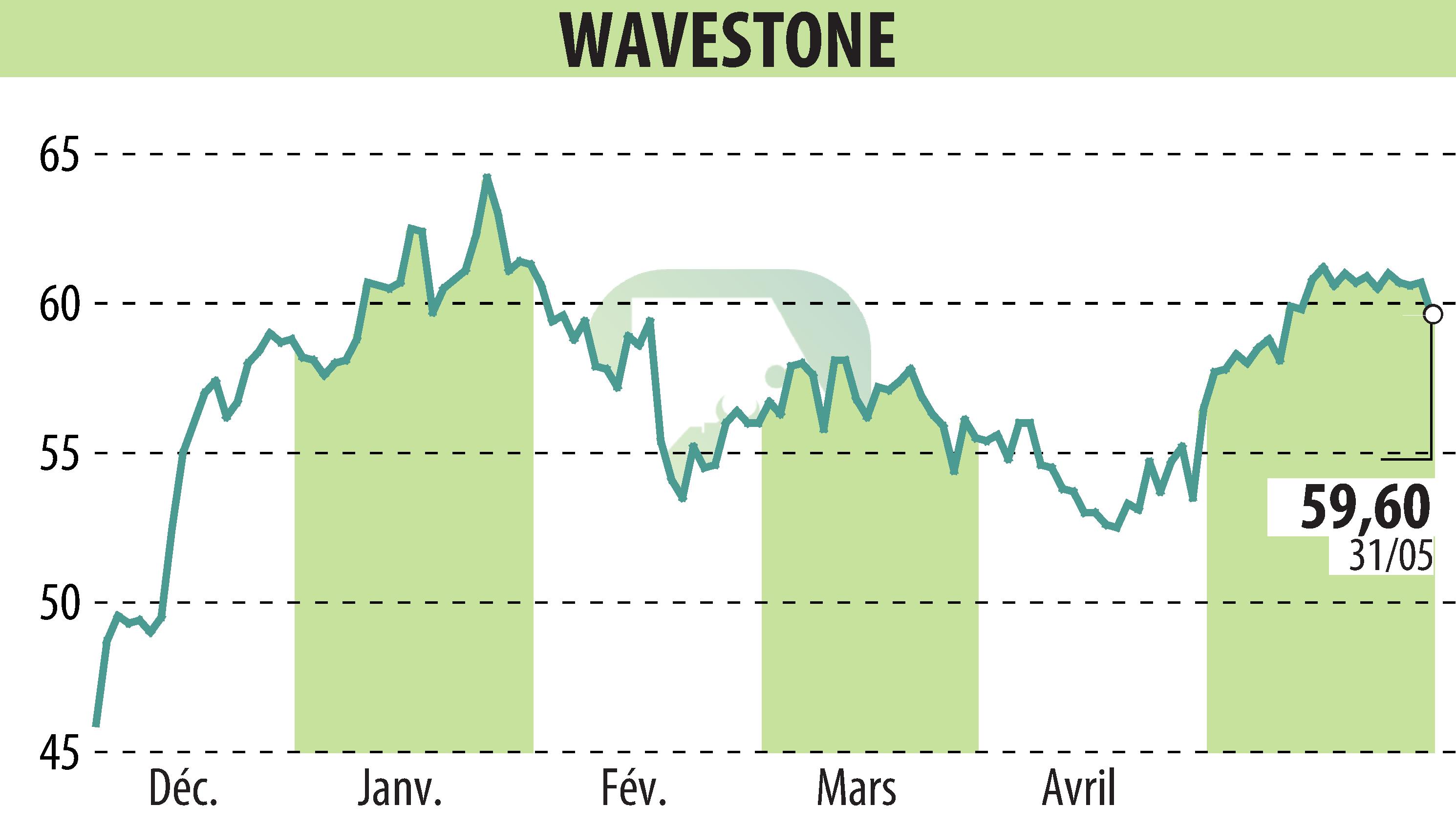

on WAVESTONE (EPA:WAVE)

Wavestone exceeds its profitability targets in 2023/24

The Wavestone Board of Directors has approved the consolidated annual accounts for the financial year 2023/24. Closed on March 31, 2024, turnover reached €701.1 million, an increase of 32%. Recurring operating profit (ROR) amounts to €101.3 million, with an operating margin of 14.5%.

The acquisitions of Q_PERIOR and Aspirant Consulting contributed significantly to Wavestone's performance, with pro forma revenue of €943.8 million and ROR of €123.9 million, representing a margin of 13.1 %.

Excluding acquisitions, Wavestone generated revenue of €586.9 million, exceeding the target of €580 million with a margin of 15.4%, above the target of 15%. Furthermore, the average daily rate increased by 1% to reach €898.

Despite a difficult economic environment, Wavestone was able to maintain solid profitability, with net income of €58.6 million, up 17%, and net cash of €19.3 million.

For 2024/25, Wavestone targets growth of 3% to 5% and a recurring operating margin above 13% while continuing to integrate Q_PERIOR.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WAVESTONE news