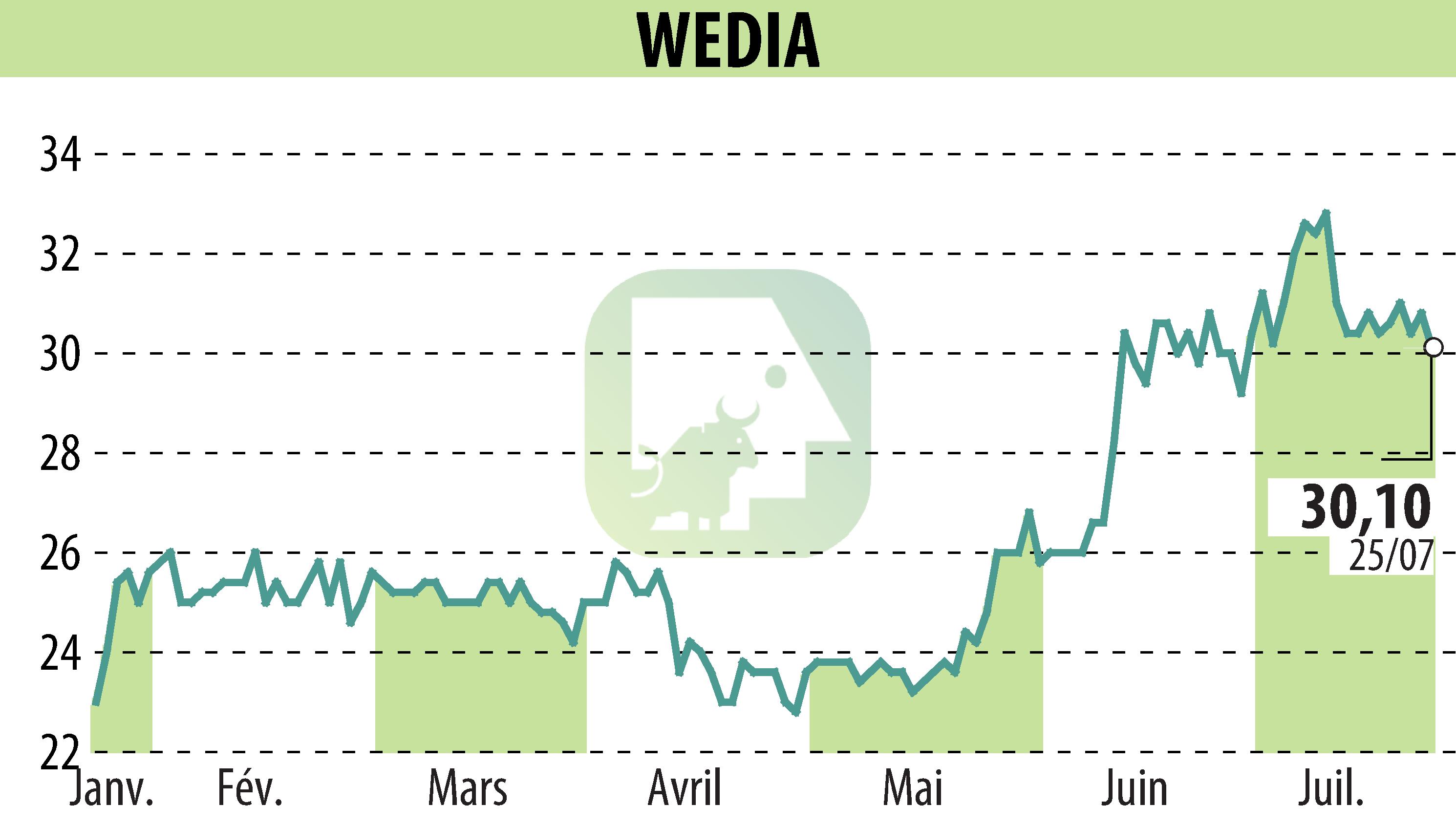

on WEDIA (EPA:ALWED)

Wedia's 2024 half-year turnover down slightly to EUR 6.9 million

The Wedia group recorded a consolidated turnover of €6.9 million in the first half of 2024, down 2% compared to the restated first half of 2023. SaaS revenues, stable at €5.5 million, now represent 81% of total turnover and half are generated internationally.

The Services activity experienced an 8% drop in number of days billed despite an increase in the Average Day Rate of 4%. Commercial momentum was slowed by prolonged decision times in projects subject to calls for tender.

Wedia has signed contracts with several renowned companies, including Havas, Roche Bobois and the French Football Federation. The group, present in more than 120 countries, has more than 4,000 customers.

The group has also strengthened its position on the market by integrating artificial intelligence solutions into its offers. In the medium term, Wedia aims to offer innovative solutions combining Digital Asset Management and Social Media Management to meet the needs of businesses in terms of visual content and social networks.

Wedia also announced that it was in exclusive negotiations with Cathay Capital for the acquisition of a controlling interest, which could lead to a simplified takeover offer during September 2024.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WEDIA news