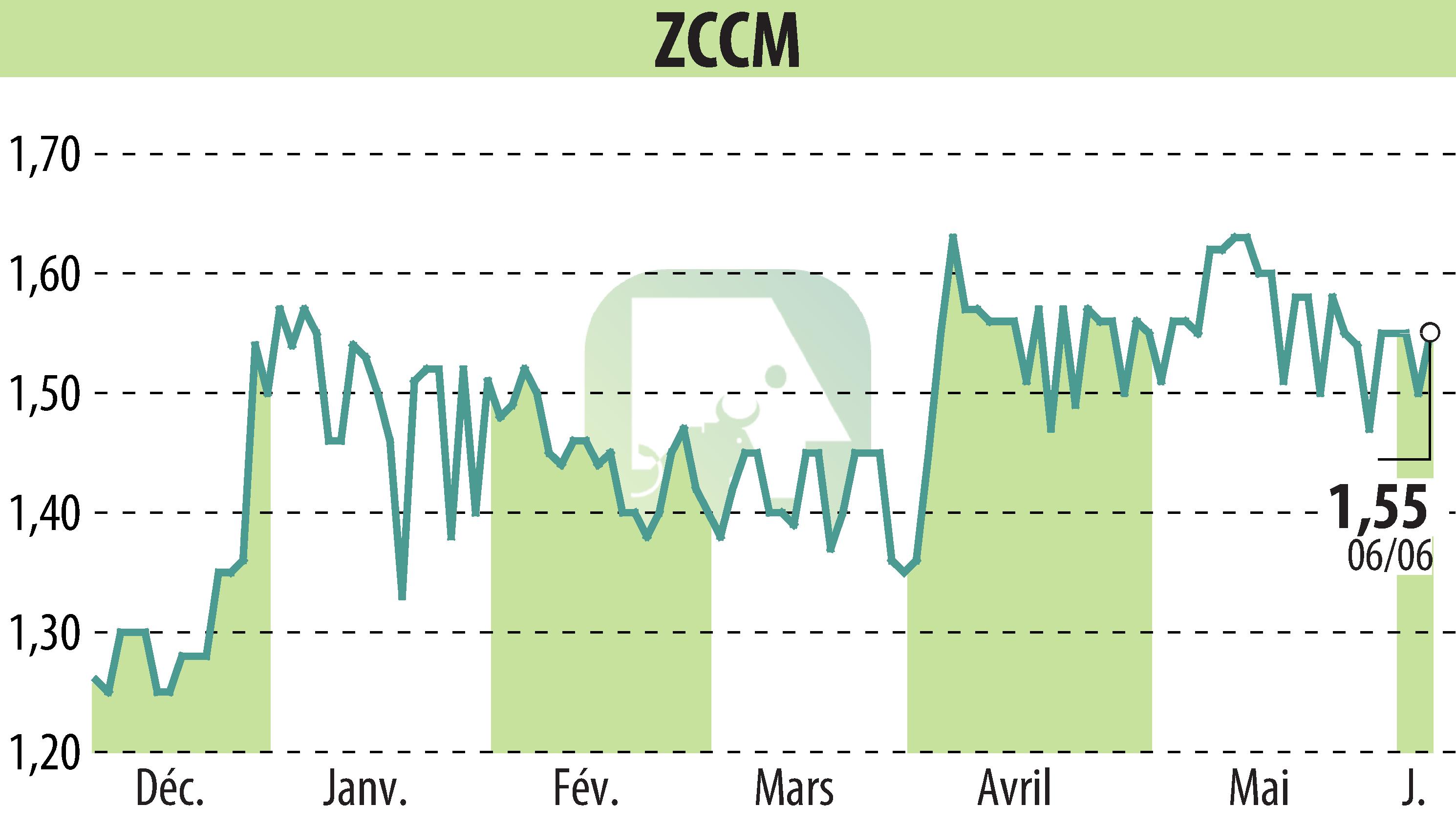

on ZCCM (EPA:MLZAM)

ZCCM-IH 2023 Financial Results Indicate Increased Losses Amidst Operational Challenges

ZCCM Investments Holdings Plc (ZCCM-IH) has released its audited financial results for the year ended 31 December 2023. The Group faced significant financial challenges, reporting a post-tax loss of ZMW 4,076 million, an increase from ZMW 3,786 million in 2022. This increase is largely attributed to the underperformance of Mopani Copper Mine Plc, which incurred a loss of ZMW 8.97 billion.

Despite these losses, the Group’s total assets grew from ZMW 48.92 billion in 2022 to ZMW 58.46 billion in 2023. Currency depreciation, however, led to a decrease in their value when converted to US Dollars. Liabilities rose significantly due to accrued interest on Mopani’s loan from Glencore and resulting foreign exchange losses.

The Company itself is showing resilience, with profits increasing to ZMW 4.84 billion in 2023, up from ZMW 4.25 billion in 2022. This improvement contrasts with the Group’s broader financial struggles.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ZCCM news