from Cerrado Gold Inc. (isin : CA1567881018)

Cerrado Gold Announces Positive Feasibility Study Results for Its Monte Do Carmo Gold Project, Brazil

Including an After-Tax NPV5% of Us$401.4 Million and an IRR of 34%

Highlights

- After-Tax NPV of US$401.4 million and IRR of 34%

- Average annual gold production of 94,797 ounces per annum over 9 year Life of Mine ("LOM")

- Average AISC of US$711 per ounce over LOM

- Initial Capex of US$186.6 million (including US$15.8 million contingency)

- Annual average free cash flow of $90 million over the LOM, with total cumulative after-tax free cash flow of $607 million over LOM

- Initial Proven and Probable Reserves of 895 koz of Gold (16.8 Mt at 1.66 g/t Au)

- Updated Measured and Indicated Resources of 1,012 koz of Gold (18.4 Mt at 1.72 g/t Au) and Inferred Resources of 66.1koz of Gold (1.1 Mt at 1.95 g/t Au)

(All numbers reported in US dollars, unless specifically stated otherwise)

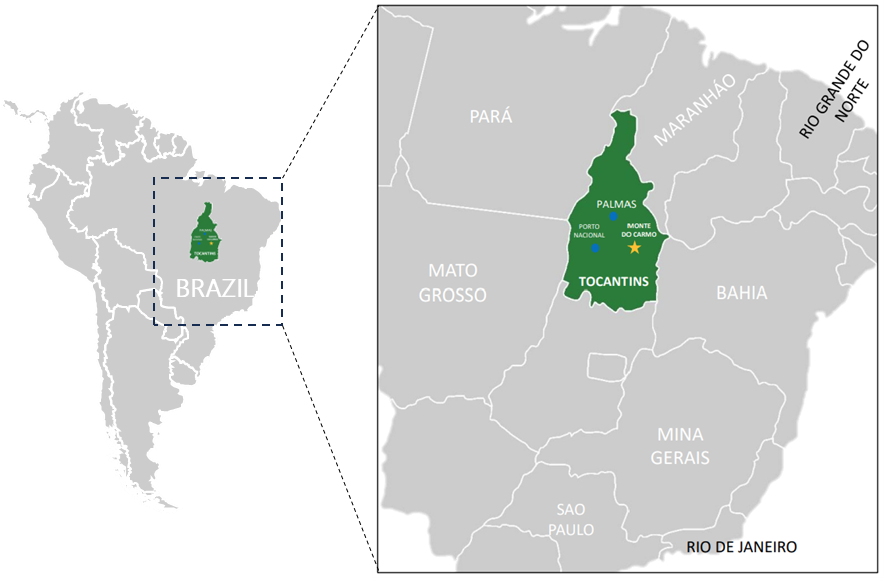

TORONTO, ON / ACCESSWIRE / November 2, 2023 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") is pleased to announce the very positive results of an independent Feasibility Study ("FS") prepared by DRA Global Limited ("DRA") in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") on its 100% owned Monte do Carmo gold project located in Tocantins State, Brazil. The results of the Feasibility Study supersede the 2021 Updated Preliminary Economic Assessment dated April 23, 2020 entitled "Independent Technical Report - Update Preliminary Economic Assessment for Serra Alta Deposit" filed on SEDAR by GE21 LTDA on October 7, 2021.

The FS outlines a robust project, with low capital costs and low operating costs generating significant Free Cash Flow over a 9 year mine life. The FS is focused on the principal Serra Alta deposit and the smaller satellite deposit of Gogo Do Onca and provides a scalable base of production for future potential exploration success.

Monte do Carmo is expected to commence production at a rate of 1.92Mtpa from the open pit for total production of 709,920 ounces. In Year 4, simultaneous underground development will be initiated contributing an additional 143,252 ounces over five years of operation.

Two open pit operating scenarios were analyzed for cost estimation purposes. The first scenario involved a traditional owner-operated model, while the second scenario explored a contractor-operated model. Over the 9-year life of the mine, it was found that the owner-operated option produced a higher NPV although with some reduction in IRR. Consequently, this study adopted the owner-operated option for both the Open Pit and Underground Operations.

Ore is processed at the plant using conventional concentration and cyanide leaching of gold concentrates. Tailings will be disposed of using a combination of best in practice dry stack, co-stacking and in-pit filling techniques.

The Company remains on track to receive the construction permit by the end of this year and is progressing Project Financing with an aim to make a fully financed construction decision in Q2 2024.

Mark Brennan, CEO and Chairman, stated: "We are extremely pleased that the results of this Feasibility Study demonstrate that Monte do Carmo is an extremely robust project that will generate significant returns on capital for a good period of time. Based on these results, we are confident that the project is positioned to be a high quality, low cost and low capital-intensive gold producer in the near term. We see the Serra Alta deposit as the cashflow engine to unlock future exploration and expansion potential of the greater Monte do Carmo Project."

Summary of Key Results and Overall Project Economics

| Production | Units | Value |

| Steady State Throughput | Mtpa | 1.92 |

| Average Annual Production | K oz per annum | 94,797 |

| Life of Mine | Years | 9.0 |

| Life on Mine Au Recovery | % | 95.23 |

| Total Ore Mined - Open Pit | Mt | 14.3 |

| LOM Average Stripping Ratio | x | 7.84 |

| Total Ore Mined - Underground | Mt | 2.5 |

| Total Recovered Gold (Payable) | Ounces | 853,172 |

| Operating Costs | Units | Value |

| Open Pit Mining | US$/tonne | 16.83 |

| Underground Mining | US$/tonne | 22.86 |

| Processing | US$/tonne | 9.32 |

| Water and Tailings Management | US$/tonne | 1.45 |

| G&A | US$/tonne | 2.43 |

| Total Cash Costs | US$/oz | 604.2 |

| AISC | US$/oz | 710.8 |

| Capital Expenditure | Units | Value |

| Initial Capital | US$ M | 170.8 |

| Contingency | US$ M | 15.8 |

| Total Upfront Capital | US$ M | 186.6 |

| Sustaining Capital | US$ M | 68.8 |

| Closure Costs | US$ M | 15 |

| Total Capital | US$ M | 270.4 |

| Financial Results | Units | Value |

| Pre-Tax NPV | US$ M | 474 |

| Pre-Tax IRR | % | 37 |

| Pre-Tax Payback Period | Years | 2.1 |

| After Tax NPV | US$ M | 401 |

| After Tax IRR | % | 34 |

| After Tax Payback Period | Years | 2.2 |

| Assumptions | Units | Value |

| Gold Price | US$/oz | 1,750 |

| Discount Rate | % | 5.0 |

A technical report summarizing the Feasibility Study will be completed in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects, and will be filed and available on SEDAR+ within 45 days of this Press Release.

Monte do Carmo Project Overview

The Monte do Carmo Gold Project is located in the state of Tocantins, Brazil; 2 km east of the town of Monte do Carmo, 40 km from Porto Nacional and 100 km from Palmas, the capital of Tocantins state. The Serra Alta deposit has been the main focus of exploration and development at the Monte do Carmo Project. Cerrado has conducted preliminary drilling on several analogue satellite deposits however the Company has been mostly focused on infill drilling at Serra Alta to support the Feasibility Study. The Project benefits from convenient access to essential infrastructure including paved roads, energy, 69 kV electrical power line, water supply, and an international airport, and is well supported by the local community.

Geology, Mineralization and Drilling

The regional geology of the Monte do Carmo area is characterized by multiple volcanic-sedimentary sequences with a number of intrusive suites spanning from the Lower to Upper Proterozoic eras, as well as younger Paleozoic sedimentary successions. The Serra Alta deposit itself is hosted by a cupola of the Monte do Carmo Granite (Paleoproterozoic Ipueiras Intrusive Suite) within the Neoproterozoic Araguaia Belt of Tocantins state, located within the broader Trans-Brazilian Lineament.

At the deposit scale, the Monte do Carmo Granite, along with other later felsic and mafic-ultramafic layered intrusions, intrudes felsic volcanic rocks of the Santa Rosa Suite with an overlying (faulted contact) discontinuous quartzite remnant, possibly of the Upper Proterozoic Monte do Carmo Formation. The entire package is in turn unconformably overlain by flat-lying Paleozoic (Meso-Neo Devonian) ferruginous sediments of the Pimenteiras Formation, subject to relatively intense subaerial weathering (i.e., laterite and saprolite development).

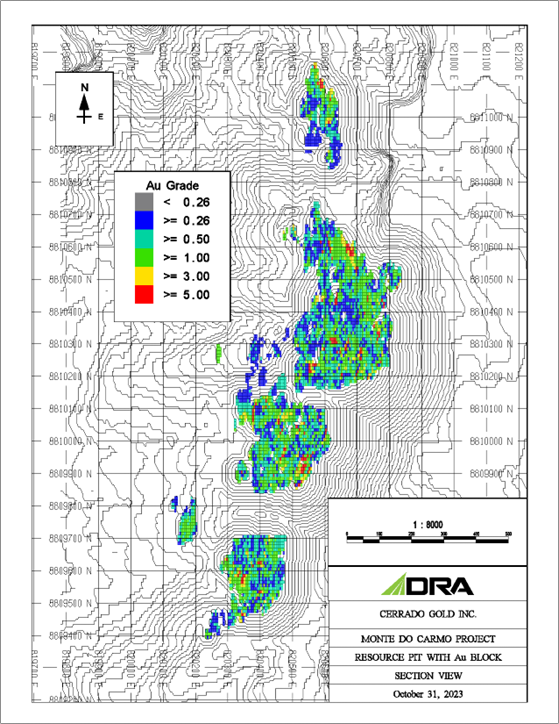

The Serra Alta deposit is interpreted as an intrusion-related gold system, with mineralization associated with hydrothermally altered and locally veined granitic rocks. Abundant mineralized shoots are clearly controlled by varying densities of vein and veinlet swarms that are weakly enriched in sulphides (pyrite, galena, sphalerite and chalcopyrite). The deposit currently comprises 8 main zones that span approximately 2 km of strike length (oriented 190-195o) with an overall width of ~600 m, and dip moderately to steeply (55-75o) to the west-northwest with a vertical extent on the order of 200 m. In general, individual mineralized lenses (i.e., shoots) range from approximately 5 m to greater than 30 m in width.

Sheeted vein sets mostly follow the overall deposit trend; however, the presence of multiple mineralized vein orientations indicates a more complex system that evolved over several mineralization and deformation events, as evidenced by the structural history of the area. There are two main northeast-trending (~N30oE) faults that flank the mineralization at Serra Alta, with a series of smaller east-west (± 30o) faults that delimit the deposit into discrete structural blocks; as such, each zone was modelled and estimated individually to respect these constraining features. The lateral extent of the sheeted vein swarms is wider towards the intrusive contact between the main granitic host rocks and overlying felsic volcanics; this intrusive contact acts as a cap throughout much of the deposit.

Modern exploration at the Monte do Carmo Project began in 1985 by Verena Mineração Ltda (VML). A total of 8,629 m of historical drilling in 75 holes has since been completed by several companies, including VML (eventually Monte Sinai Mineração), Paranapanema and Kinross; Rio Tinto also drilled an additional 3,894 m in 53 reverse circulation holes. This work focused on a variety of regional targets in addition to Serra Alta. Recent exploration drilling by Cerrado includes a total of 108,987 m completed in 439 holes up to the database cut-off date of December 31, 2022. The current Mineral Resource Estimate (MRE) includes a total of 12,690 composite sample intervals in 338 holes that intersect the interpreted mineralized domains used for estimation. Historical drilling has been vetted for quality and consistency purposes; only holes that meet a stringent multi-criteria standard were maintained in the database for use in the MRE.

In terms of expansion potential, while the Serra Alta deposit has generally been well-tested, prospective areas of interest to extend mineralization remain both to the east and north, as well as to depth. Additionally, the Monte do Carmo region in general remains highly prospective for exploration potential with multiple high-priority targets already identified within the Cerrado land package.

Data Verification

DRA performed data verification and validation procedures on the drilling database prior to modelling and estimation. DRA reviewed the geological, drilling and analytical data, including the implemented Quality Assurance / Quality Control ("QA/QC") measures, used to support Mineral Resources. Additionally, the QP of Geology and Resources completed a visit to the Project site in order to review overall site geology, drill core, core shack facilities, sample storage and security, as well as to conduct interviews with key site personnel. It is the opinion of the QP that the provided geological database is of sufficient quality for use in the estimation and classification of Mineral Resources, according to CIM guidelines and industry best practices.

Mineral Resource Estimate

The MRE was established using data from boreholes drilled and sampled up to December 31, 2022. The in-pit resource estimate for the Serra Alta deposit includes Measured and Indicated Resources of 15,304 kt @ 1.65 g/t Au for 812 koz, and Inferred Resources of 345 kt @ 1.36 g/t Au for 15 koz; the underground portion includes Measured and Indicated Resources of 3,054 kt @ 2.03 g/t Au for 199 koz, and Inferred Resources of 708 kt @ 2.24 g/t Au for 51 koz. The resource estimate has been prepared using a marginal cut-off grade of 0.26 g/t Au for the in-pit resources; underground resources include low-grade blocks falling within underground reporting shapes to reflect realistic mining logistics. Both the open-pit and underground resources are reported using a gold price of US$1,850. Additional details on mining and processing modifying factors are provided in the footnotes for the table below.

| Serra Alta Deposit (Brazil) - Mineral Resources Summary, DRA Global Limited, October 31, 2023 | ||||

| Category | Tonnage (kt) | Average Grade (g/t Au) | In-Situ Ounces (koz Au) | |

| Open-Pit3,4,5 | ||||

| Measured | 2,014 | 1.73 | 112 | |

| Indicated | 13,290 | 1.64 | 700 | |

| Measured + Indicated | 15,304 | 1.65 | 812 | |

| Inferred | 345 | 1.36 | 15 | |

| Underground6,7,8 | ||||

| Measured | 42 | 1.66 | 2 | |

| Indicated | 3,012 | 2.04 | 197 | |

| Measured + Indicated | 3,054 | 2.03 | 199 | |

| Inferred | 708 | 2.24 | 51 | |

| Total | ||||

| Measured | 2,056 | 1.73 | 115 | |

| Indicated | 16,302 | 1.71 | 897 | |

| Measured + Indicated | 18,358 | 1.72 | 1,012 | |

| Inferred | 1,053 | 1.95 | 66 | |

Notes:

| ||||

A plan map of the immediate Serra Alta deposit area (shown below) depicts the grade distribution at surface of the estimated Mineral Resources with respect to the optimized pit shell.

A representative east-west vertical cross-section (looking north) through the core of the deposit (Section 8810420N) is also provided below, highlighting the proximity of estimated blocks outside the pit shell to the east, which represent the underground portion of the reported Mineral Resources. Blocks shown are estimated above a marginal cut-off grade of 0.26 g/t Au.

Mineral Reserve Estimate

The Mineral Reserve Estimate was established using the Mineral Resource Estimate with the effective date of October 31, 2023. The total mineral reserve estimate of the Serra Alta deposit includes Proven Reserves of 2 Mt @ 1.68 g/t Au for 109,000 oz (in-situ) and Probable Reserves of 14.8 Mt @ 1.66 g/t Au for 787,000 oz (in-situ). The reserve estimate has been prepared using a cut-off grade of 0.28 g/t Au for the in-pit reserves, and 0.8 g/t Au for the underground reserves. Both the open-pit and underground reserves are reported using an assumed gold sales price of US$1,700. Additional details on mining and processing factors are provided in the footnotes for the tables below.

The open pit design includes 14,344 kt of Proven and Probable Mineral Reserves at a grade of 1.62 g/t Au. To access these reserves, 112.5 Mt of waste rock must be mined resulting in a stripping ratio of 7.8 to 1.

The underground design includes 2,451 kt of Proven and Probable Mineral Reserves at a grade of 1.90 g/t Au. To access these reserves, 800 m twin ramps will be developed from a mine portal located in the Central Pit. A total of 19,400 m of lateral development in ore and waste will be required during the underground operation. The mining method selected for Monte do Carmo is long hole transverse open stoping with cemented rockfill with minimum stope width of 3 m and maximum height of 20 m. The table below presents the mineral reserves for the underground mine.

| Serra Alta Deposit (Brazil) - Mineral Reserve Estimate, DRA Global Limited. October 31, 2023 | ||||

| Category | Tonnage (kt) | Average Grade (g/t Au) | In-Situ Ounces (koz Au) | |

| Open Pit 5, 6, 12 | ||||

| Proven | 1,976 | 1.68 | 107 | |

| Probable | 12,368 | 1.61 | 639 | |

| Total Proven and Probable | 14,344 | 1.62 | 746 | |

| Underground 7, 8, 13 | ||||

| Proven | 39 | 1.81 | 2 | |

| Probable | 2,412 | 1.91 | 148 | |

| Total Proven and Probable | 2,451 | 1.90 | 150 | |

| Total | ||||

| Proven | 2,015 | 1.68 | 109 | |

| Probable | 14,780 | 1.66 | 787 | |

| Total Proven and Probable | 16,795 | 1.66 | 895 | |

Notes:

| ||||

Mining Methods

The open pit portion of the Project will be a conventional open pit, truck and shovel operation. The underground portion will be mined using a longitudinal longhole and transverse longhole mining methods.

Two operating scenarios were evaluated to estimate costs. The first scenario was based on traditional owner-operated model, while the second scenario explored a contractor-operated model. Following a comparison of the discounted capital and operating costs over the 9-year life of the mine, it was determined that the owner-operated option provided better economic advantages. For this FS, the owner-operated option was selected.

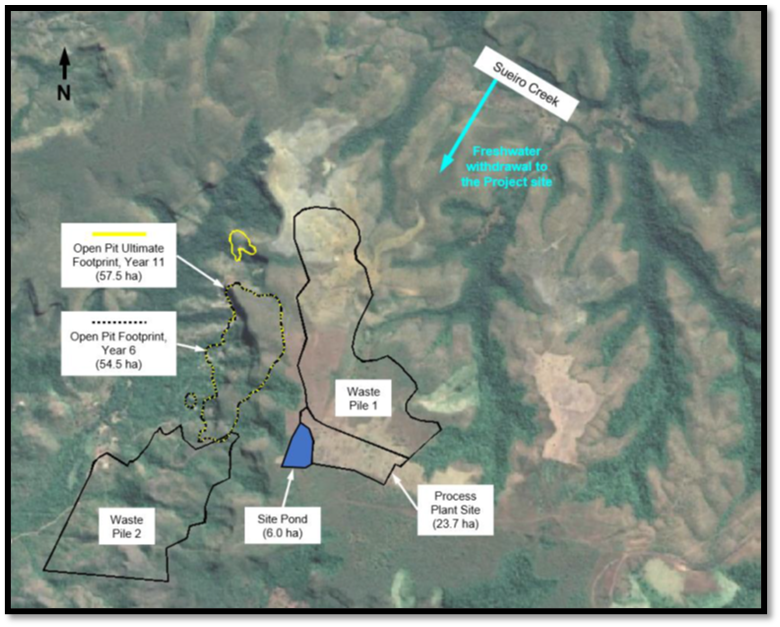

Open Pit

Three open pits (South, Central and North Pits) will be mined over the 9-year operating mine life, with an additional one year of pre-production mining to be undertaken where waste material is being mined for construction and ore stockpiling ahead of process plant commissioning. The mining equipment fleet will be owner-operated and will include outsourcing of certain support activities such as explosives manufacturing and blasting. Production drilling and mining operations will take place on 5 m and 10 m bench heights. The primary loading equipment will consist of 95 tonne hydraulic excavators (6.0 m3 bucket size) and front-end wheel loaders (6.1 m3 bucket size). The loading fleet is matched with a fleet of 50 tonne haulage trucks. A fleet of 48 tonne excavators will be used to excavate the narrow-thickness ore zones to mitigate additional dilution.

Peak open pit mining production will be 23 Mtpa of combined ore and waste (63,000 t/d). Total material moved over the LOM is expected to be 127 Mt of which 14.3 Mt is ore.

The open pit operation includes two waste rock dumps, one immediately to the east and one to the south of the open pits.

Underground

DRA has proposed an underground mine design to complement the open pit production, targeting a daily output of 1,500 t and suitable for the deposit geometry. The design combines longitudinal longhole and transverse longhole mining methods, utilizing cemented rock fill (CRF). Key features include a twin ramp access, six levels spaced 25 m apart, and 30-t trucks for ore handling. CRF will be placed with 14-t Load-Haul-Dump (LHD) with cement milk mixing which will occur in a mobile mixer. Waste rock will be sourced from mining development or surface hauling. The ventilation will be managed by the main fan installed in a bypass near the portal. The twin ramp will be the main intake and exhaust of the mine.

Metallurgy and Processing

Cerrado has undertaken numerous metallurgical testing programs, encompassing test work on domain composites and variability point samples to delineate the metallurgical response throughout the mine's operational life. The test work has shown that the ore exhibits favourable responses to both direct carbon-in-leach (CIL) and flotation / CIL processes, with low reagent consumption at a particle size of 80% passing 106 µm. Comminution test work has indicated that the ore falls within the category of soft to moderate hardness. Additionally, external test work and gravity recovery modeling have unveiled Cerrado's ore high amenability to gravity recovery. It is characterized by substantial Gravity Recoverable Gold (GRG) content and is notably coarse, with the potential for GRG recovery well exceeding 60%.

Despite test work indicating that the direct CIL process flowsheet could result in improved overall gold recoveries, the Feasibility Study was based on flotation and cyanide leaching of flotation concentrates. This choice was made due to the potential agricultural utilization of tailings from the flotation circuit, which contain an average of 4.5% K2O, providing promising prospects for the development of an agricultural product. This is currently under further investigation.

The process facility, with a capacity of 1.92 Mtpa, comprises comminution, gravity concentration, gold flotation, cyanide leaching, carbon elution and gold recovery circuits. The final tailings are subjected to thickening, filtration, and dry stacking in a tailings storage facility. Given the significant GRG component, an overall gold recovery of 95.3% is anticipated over the LOM.

Site Infrastructure

The Monte do Carmo Project is in the central region of Brazil, in the State of Tocantins, 62 km southeast of the state capital Palmas.

Palmas has an international airport with several daily flights to Brasilia, Goiânia and São Paulo with onward international connections. Monte do Carmo is accessed via a paved road (highway TO-255) east from Porto Nacional, where a field office is established at the project site.

Entrance to the town of Monte do Carmo

Monte do Carmo, situated 39 km to the east of Porto Nacional, is a town in the Tocantins state of Brazil. Porto Nacional, located 50 km south of the state capital, Palmas (or 60 km by road), and 760 km north of Brasilia, the federal capital, serves as a pivotal hub in the region.

The primary industry in this area of Tocantins is agriculture, with expansive fields of soybeans and corn to the west of Monte do Carmo, along with cattle farming. Monte do Carmo itself is flanked by cuestas, mesa-like formations, where agricultural activity is relatively limited.

Porto Nacional plays a vital role in supporting the local agricultural sector. It offers a wide range of services and fulfills essential needs for the region. The city is thriving, boasting a robust job market and a diverse array of services. Porto Nacional boasts a solid infrastructure, including a paved runway capable of accommodating large aircraft. Further north, the Tocantins River is dammed to supply the Lajeado Hydroelectric Power Plant, leading to a broad and flooded river as it flows south from that point.

Water

Based on water balance simulations, it is expected that the Project facilities and catchment areas within the Project footprint will provide sufficient water supply to meet the mill's make-up water demand and the underground mine's water demand for equipment operation in all simulated scenarios.

The proposed water management system for the Project includes several components: the Site Pond, an Open Pit sump, a sump located at the filtered tailings stack, water transfer pumps, and pipelines. These components are designed to facilitate the transfer of water between various Project infrastructure points and to secure a fresh water supply from Sueiro Creek. In case there is a backup water supply requirement, freshwater will be pumped from Sueiro Creek through a pipeline extending approximately 4.5 km to the north of the Project site.

The following main Project facilities and infrastructure for water management will be utilized:

- Process Plant Site

- Site Pond

- Open Pit

- Underground Mine

- Waste Pile 1 (filtered tailings and waste rock disposal)

- Waste Pile 2 (waste rock disposal)

Site Layout

Power

To the east of Monte do Carmo, near the municipality of Ponte Alta, high voltage power is available from the Izamu Ikeda hydropower plant (30 MVA) located on the Balsas River, a tributary of the Tocantins River. A high-tension power line (69 kV) from this plant crosses the concession containing Serra Alta, about 500 m south of the main Serra Alta project.

For the Monte do Carmo project, a new 36 km long 138 kV line will need to be installed to sufficiently meet the project demands and those of the nearby settlements. Monte do Carmo's power requirement will be about 12 MW (24/7) - the utility provider has confirmed this is readily available. The new line will follow the existing 69 kV line to the Izamu Ikeda hydropower plant.

68 kV line, south of the location for the process plant

Telecommunication mast in Monte do Carmo town. There is cellular reception in the immediate area, including the camp.

Capital and Operating Costs

Outlined below is a summarized capital cost estimate (Capex) for the Monte do Carmo project, which includes the development of the mine, ore processing facilities, and required infrastructure. The estimate was calculated using standard costing methods for achieving a Feasibility Study, which provides an accuracy of ±15%, and follows AACE Class 3 Guidelines. The operating cost (Opex) encompasses mining, processing, tailings and water management, general and administrative fees, as well as gold bullion transport and refinery.

The table below provides details of the Capex required for the construction of the mine, processing plant, and all associated infrastructure, with an estimated total initial cost of US$186.6 million and US$ 68.8 million in sustaining costs.

Serra Alta Deposit - Initial and Sustaining Capital Costs

| Description | Initial Capex | Sustaining Capex |

| (millions of US$) | (millions of US$) | |

| Direct Costs | 152.5 | 68.8 |

| Infrastructure - Site Infrastructure | 8.9 | |

| Infrastructure - Water Collection System | 1.6 | |

| Infrastructure - Dam | 0.6 | |

| Infrastructure - Substation | 3.6 | |

| Infrastructure - Transmission Lines | 7.6 | |

| Infrastructure - Temporary Facilities | 3.2 | |

| Processing Plant - Concrete | 7.3 | |

| Processing Plant - Metallic Structure | 5.0 | |

| Processing Plant - Architecture | 1.4 | |

| Processing Plant - Boiler | 3.0 | |

| Processing Plant - Mechanical Equipment | 38.3 | |

| Processing Plant - Mobile Equipment | 0.6 | |

| Processing Plant - Piping | 3.2 | |

| Processing Plant - Electrical Equipment | 10.5 | |

| Processing Plant - Automation, Instrumentation, and Telecommunications | 1.5 | |

| Processing Plant - Gold Laboratory | 1.0 | |

| Mining - Open Pit Pre-stripping | 21.4 | |

| Mining - Open Pit Equipment | 33.8 | 22.0 |

| Mining - Underground Equipment & Infrastructure |