from Ivanhoe Electric Inc.

CORRECTING AND REPLACING: Ivanhoe Electric Announces Completion of the Initial Assessment for the Santa Cruz Copper Project in Arizona

- The Initial Assessment Focuses on a Small Surface Footprint, 5.9 Million Tonnes per Year High Grade Underground Copper Mining Operation Supported Solely by the High-Grade Exotic, Oxide and Enriched Domains of the Santa Cruz and East Ridge Deposits

- Additional Resources at the Texaco Deposit and the Large, Primary Sulfide Resources at Santa Cruz Provide Potential for Future Growth

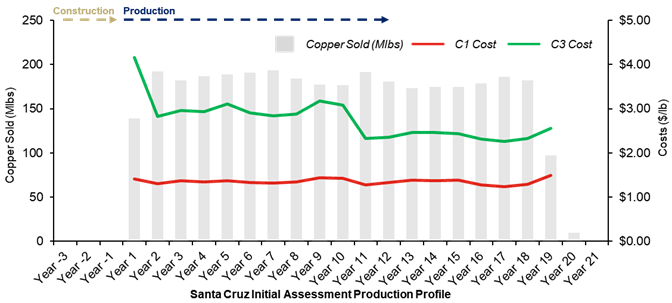

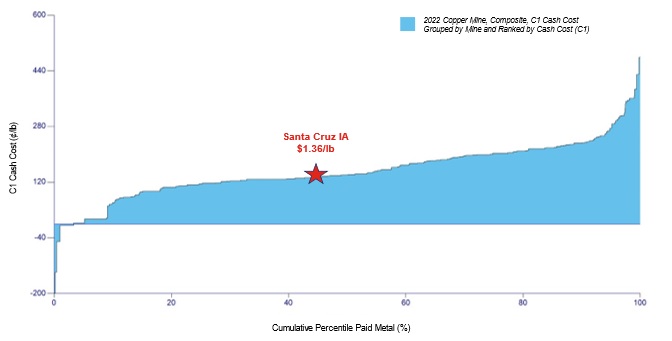

- Life of Mine ("LOM") Copper Production Estimated to be 1.6 Million Tonnes over a 20-Year Mine Life, with an Average Grade of 1.58% Total Copper and C1 Cash Costs[1] of $1.36 per Pound

- Estimated LOM Copper Production Includes 1.0 Million Tonnes of 99.99% Pure Copper Cathode and 0.6 Million Tonnes of Copper Contained in a Concentrate that is 48% Copper by Weight

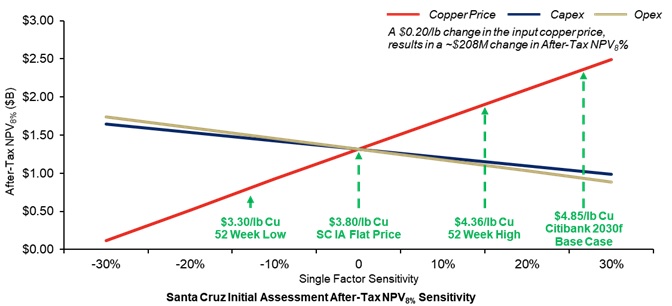

- Initial Capital Estimate of $1.15 Billion, After-tax NPV8% of $1.32 Billion and IRR of 23.0% Assuming LOM $3.80/lb Copper Price

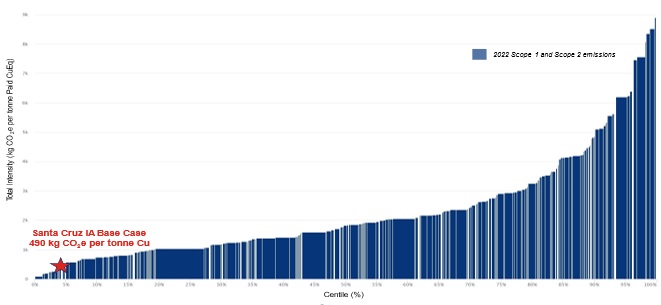

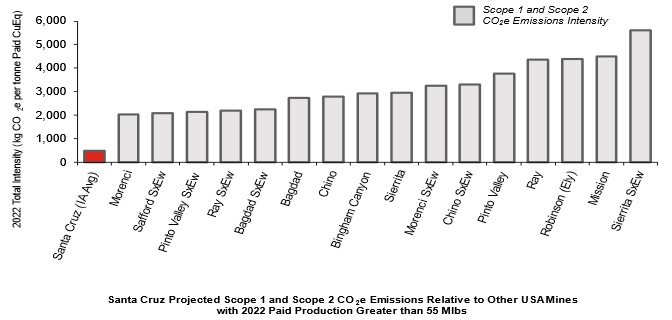

- Base Case Utilizes 70% Renewable Energy, Resulting in Low Scope 1 and 2 Carbon Dioxide Equivalent ("CO2e") Emissions of 0.49 Tonnes of CO2e per Tonne of Copper Produced, Compared to the Industry Average of 3.9 Tonnes of CO2e per Tonne of Copper[2]

- Ivanhoe Electric Controls the Private Surface Land and Patented Mineral Rights Encompassing the Entire Santa Cruz Copper Project

- Ivanhoe Electric to Host Conference Call to Review the Initial Assessment at 11:00 am ET on Wednesday, September 6, 2023

PHOENIX, AZ / ACCESSWIRE / September 6, 2023 / Ivanhoe Electric (NYSE American:IE)(TSX:IE) Executive Chairman, Robert Friedland and President and Chief Executive Officer, Taylor Melvin are pleased to provide the results from the Initial Assessment[3] ("IA") for its Santa Cruz Copper Project, located west of Casa Grande, Arizona. The IA is a preliminary technical and economic study for the Santa Cruz Copper Project and associated high-grade mineral resources included in the Santa Cruz and East Ridge deposits. The study analyzes the potential for a high-grade underground copper mining operation supported by modern technologies to reduce environmental impact and powered predominantly by renewable energy.

Mr. Friedland commented: "Completing the Initial Assessment for our Santa Cruz Copper Project is an important achievement for Ivanhoe Electric as we work to advance a new source of responsibly produced "green" copper in the United States. Our goal is to develop a modern copper mine that produces copper with among the lowest levels of carbon dioxide output in the industry; a product we think has the potential to attract a premium price in the future. Using primarily onsite renewable electricity generation, and with the potential to increase that to meet the Project's entire future needs, the Initial Assessment shows us that we are on the right track to achieving our goal at Santa Cruz and our larger goal of enhancing U.S. supply chain independence for critical metals. We are excited about the future for our Santa Cruz Project in Arizona."

Mr. Melvin commented: "The Initial Assessment for the Santa Cruz Copper Project is the result of a tremendous effort by our team and an important milestone for the Project. The study provides a first look at our plans for a technologically advanced, underground copper mine in Arizona with attractive economics at today's copper prices. We are designing the Project to minimize environmental impact through the use of modern technologies and renewable power. We believe the Santa Cruz Copper Project will become an industry-leading example of responsibly produced copper in the United States, and a source of high-quality jobs in Arizona during development and throughout its anticipated long mine life."

Highlights of the Initial Assessment

The Santa Cruz IA outlines a potential 5.9 million tonnes per year underground mining operation, supported by 105.2 million tonnes of modeled mill feed with an average grade of 1.58% copper from the Santa Cruz and East Ridge Deposits, resulting in an estimated 20-year mine life.

The IA focuses exclusively on the high-grade exotic, oxide and enriched domains of the Santa Cruz and East Ridge Deposits. The oxide and enriched domains of the Texaco Deposit are not included in the current study (2.7 million tonnes indicated grading 1.42% total copper and 27.3 million tonnes inferred grading 1.39% total copper, using a 0.80% cut-off grade). Future studies could evaluate the potential addition of the large primary sulfide domains at Santa Cruz (76.2 million tonnes indicated grading 0.88% total copper and 8.0 million tonnes inferred grading 0.92% total copper, using a 0.70% cut-off grade) and at the Texaco Deposit (0.9 million tonnes indicated grading 1.05% total copper and 35.0 million tonnes inferred grading 1.06% total copper, using a 0.80% cut-off grade), subject to market conditions.

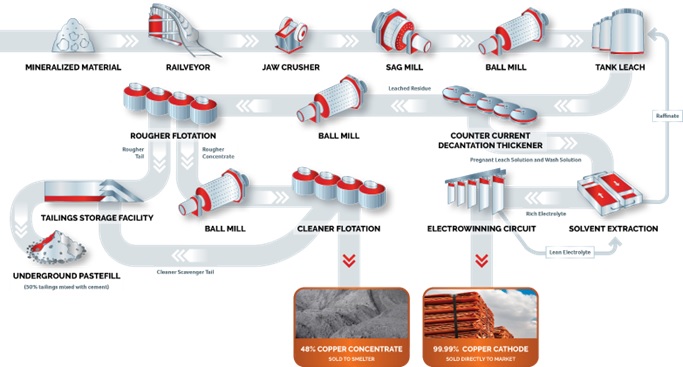

Copper recoveries of 95.4% are expected to be achieved through a combination of solvent extraction and electrowinning ("SX/EW") and conventional froth flotation.

The IA includes LOM production for the Project of 1.0 million tonnes of copper in the form of 99.99% pure copper cathode and 0.6 million tonnes of copper contained in a 48% copper concentrate with very low deleterious elements, such as arsenic or lead.

LOM average C1 cash costs are expected to be $1.36 per payable pound of copper, with C3 total costs[4] expected to average $2.84 per payable pound of copper.

The IA contemplates initial project capital expenditures of $1.15 billion, and LOM sustaining capital expenditures totaling $0.98 billion. A three-year construction period is envisioned to develop the underground workings and build the surface processing facilities.

The IA estimates that the Project has a pre-tax net present value ("NPV") of $1.6 billion at an 8% discount rate and a pre-tax internal rate of return ("IRR") of 25.1%, using a flat LOM copper price assumption of $3.80 per pound. After-tax NPV is estimated at $1.3 billion with an after-tax IRR of 23.0%, using the same discount rate and copper price assumptions.

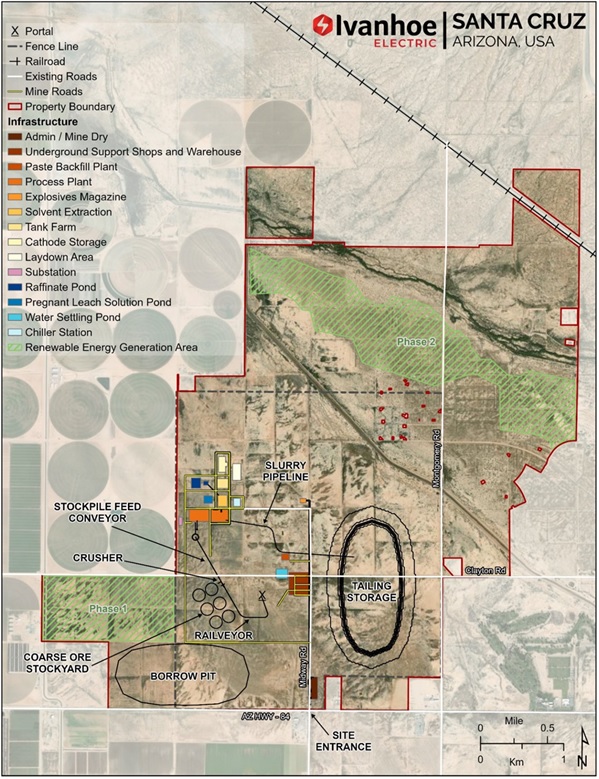

The IA is designed to minimize environmental impact and minimize surface land disruption. As a result of the small surface footprint required for underground copper mining activities included in the IA, the total land area expected to be required for the mine, plant, tailings storage facilities and potential on-site generation of renewable solar power covers approximately one-third of the total land package.

The IA base case assumes 70% of the total electric power requirements for the Project will be generated by onsite renewable infrastructure, enabling copper production with very low carbon dioxide equivalent ("CO2e") emissions of 0.49 tonnes of CO2e per tonne of copper for Scope 1 and 2 emissions. In comparison, the global mining industry average is approximately 3.9 tonnes of CO2e per tonne of copper equivalent[5]. The subsequent Preliminary Feasibility Study ("PFS") for the Project will evaluate the potential use of combined solar power, battery storage and a geothermal-driven microgrid as renewable power sources to provide up to 100% of the electricity requirements for the Project.

An all-electric underground heavy mining fleet is assumed in the IA, in combination with railveyor technology for material movement, which would significantly reduce carbon dioxide emissions and improve energy efficiency. The use of an all-electric underground heavy equipment fleet alone represents an estimated 70-80% reduction in Scope 1 emissions when compared to a traditional high-efficiency diesel-powered heavy equipment fleet.

The IA also contemplates placing 50% of the mine tailings back underground as cemented paste fill. The remaining 50% will be stored on the surface as thickened tailings at 65% solid content. Surface tailings will be contained within a ring dyke dam with a capacity to store 56.7 million tonnes. Water management associated with tailings storage is minimized as a result of thickened tailings and high evaporation rates in the Sonoran Desert.

Ivanhoe Electric controls the private surface land and patented mineral rights encompassing the entire Santa Cruz Project. The entirety of the facilities referenced in the IA, including mining, processing, tailings storage and onsite renewable power generation facilities, can be developed on private land under private mineral title. Ivanhoe Electric also controls water rights associated with its Santa Cruz land package.

Video of the Santa Cruz IA operation. Click on the image below for the high-resolution video.

Ivanhoe Electric to Host a Conference Call on the Santa Cruz Initial Assessment

On Wednesday, September 6, 2023, Ivanhoe Electric will host a conference call to discuss the results of the Santa Cruz IA.

The call will include remarks from Ivanhoe Electric's Executive Chairman Robert Friedland, President and Chief Executive Officer Taylor Melvin and other members of the Company's management team. It will also feature a question-and-answer session.

DATE: Wednesday, September 6, 2023.

TIME: 11:00 am Eastern / 8:00 am Pacific / 8:00 am Arizona.

DIAL IN: 1-888-664-6383 or 416-764-8650

LINK: https://app.webinar.net/oE8nX7LrV06

A replay of the call, together with supporting presentation slides, will be made available on Ivanhoe Electric's website at www.ivanhoeelectric.com.

Table 1. Summary of the Initial Assessment Estimated Operating and Economic Results

| Production Results | |

Mine Life | 20 years |

Total LOM Mill Feed | 105.2 Mt |

Nameplate Mill Throughput | 15,000 tpd |

Average Feed Grade (total copper) | 1.58% |

Average Feed Grade (soluble copper) | 1.01% |

Average Total Copper Recovery | 95.4% |

Total LOM Copper Production (in cathode and concentrate) | 1.59 Mt |

Average Copper Production in Cathode (first 10 years) | 57 ktpa |

Average Copper Production in Concentrate (first 10 years) | 29 ktpa |

| Operating Costs | |

Onsite Operating Costs (mining, processing, G&A) | $43.48/t |

Average C1 Cash Costs | $1.36/lb |

Average C3 Total Costs | $2.84/lb |

| Capital Costs | |

Initial Capital Expenditures | $1.15B |

Sustaining Capital Expenditures | $0.98B |

Total LOM Capital Expenditures | $2.12B |

| Economic Analysis | |

Copper Price | $3.80/lb |

Pre-Tax Undiscounted Free Cash Flow | $5.22B |

Pre-Tax NPV 8% | $1.64B |

Pre-Tax IRR | 25.1% |

After-Tax Undiscounted Free Cash Flow | $4.23B |

After-Tax NPV 8% | $1.32B |

After-Tax IRR | 23.0% |

Robust IA Economics for the USA's "Next Generation" Copper Mine

The IA outlines LOM copper production totaling 1.6 million over a 20-year mine life - underpinned by 105.2 million tonnes of modeled mill feed grading 1.58% total copper. Copper C1 cash costs are expected to average $1.36 per pound.

Figure 1. Santa Cruz IA copper sales and cost profile.

Total operating costs (mining, processing, G&A and other) are expected to average $43.48 per tonne processed, including mining costs of $27.33 per tonne, processing costs of $12.84 per tonne and G&A and other costs of $3.31 per tonne.

The initial capital expenditures total $1.15 billion, which includes pre-production development of the twin declines and underground infrastructure, purchase of mining equipment, construction of the processing plant and infrastructure facilities and construction of the tailings storage facility.

LOM sustaining capital expenditures total $0.98 billion, which includes the capital required to extend the twin declines to the lower portion of the Santa Cruz Deposit, as well as the maintenance of all equipment and supporting infrastructure. It also includes expansion and closure costs of the tailing facility.

The IA estimates LOM revenue of $12.9 billion using a flat copper price assumption of $3.80 per pound. Pre-tax undiscounted free cash flow totals $5.22 billion and pre-tax NPV8% totals $1.64 billion with an IRR of 25.1%.

On an after-tax basis, the IA Project is estimated to generate $4.23 billion of undiscounted free cash flow, an NPV8% of $1.32 billion with an IRR of 23.0%.

Figure 2. IA economics are sensitive to the input copper price and capital and operating cost assumptions.

Note: Copper price points calculated by Ivanhoe Electric and inserted into IA sensitivity model.

The IA is preliminary in nature and includes an economic analysis that is based, in part, on inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable the inferred mineral resources to be categorized as mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Accordingly, there is no certainty that the results of the IA will be realized.

The IA contains economic analyses which include and exclude inferred mineral resources. This press release focuses on the economic analysis, including inferred mineral resources. For more information regarding the economic analysis without inferred mineral resources, see the Initial Assessment, which is included as an exhibit to the Form 8-K filed with the SEC in connection with this announcement.

The IA is based on Ivanhoe Electric's December 31, 2022 Mineral Resource Estimate, which includes the Santa Cruz, East Ridge and Texaco Deposits, using a 0.70% copper cut-off at Santa Cruz, 0.90% at East Ridge and 0.80% at Texaco (the "2022 Mineral Resource Estimate", see February 14th, 2023 news release). The economic analysis described in this release and in the IA does not include any mineral resources from the Texaco Deposit.

Phased Approach to Underground Mining Optimizes Initial Capital Expenditures and Maximizes Return on Investment

In the IA, twin declines, each measuring 4.3 kilometers, would be developed to access the upper parts of the Santa Cruz and East Ridge deposits. One decline is required for air intake and access, while the other will be required for air exhaust and material movement. To develop the declines, the IA assumes that construction of the portal box cut would begin in 2026, decline development in 2027 and continues through 2028 to access the top portion of the mine. Under these assumptions, stoping activities would begin in 2029 with a 1-year ramp up to the full 15,000 tonnes per day capacity.

Mining of the upper portion would proceed for the first eight years before additional capital expenditures are required to extend the declines by 1.9 kilometers. Additional surface infrastructure would be required once mining of the lower portion commences. This would include the second phase construction of a refrigeration plant, ventilation, water handling, and material handling.

Mine sequencing would employ typical transverse longhole stopes for the Santa Cruz deposit on a primary-secondary sequence with paste backfill for support. Mining of the Santa Cruz exotic mineralization has been evaluated using a drift and fill technique with access from the Santa Cruz longhole stoping levels. The East Ridge deposit will apply a drift and fill mining technique with access directly from the twin declines.

Over the total LOM, 105.2 million tonnes of mineralized material is expected to be mined. This includes 88.6 million tonnes from the Santa Cruz deposit, 1.9 million tonnes from the Santa Cruz exotic mineralization, 9.8 million tonnes from the East Ridge deposit and 4.9 million tonnes of low-grade material required to access the Deposits.

Figure 3. Santa Cruz IA site layout, requiring approximately one-third of the total land package for the mine, plant, process, tailings storage facilities and on-site generation of solar power.

Figure 4. Completed IA mine design plan identifying the Santa Cruz deposit, Santa Cruz zone of exotic mineralization and East Ridge deposit. Key mining infrastructure is also depicted, such as the portal box cut, twin declines, lateral developments and ventilation raises.

Significant Technical Work Completed to Date Increased Knowledge of the Regional Aquifer and Groundwater Flows

Ivanhoe Electric has conducted a detailed analysis of historical hydrogeological information and completed additional drill holes focused on obtaining additional hydrogeological information. Using this information, a hydrogeological conceptual site model was developed to determine which rock types have influence on the storage or movement of groundwater. A groundwater flow model was then developed to evaluate mine dewatering requirements and inform mine planning. The underground mine access and mine plan were analyzed against the groundwater flow model and showed that most of the mineralization is located within rock relatively low in water inflow.

Ivanhoe Electric has been proactive in its approach to geotechnical data collection. Upon acquisition of the Project, early collection of geotechnical information began to facilitate the completion of a comprehensive geotechnical model in the early stage of design work, which also informed the groundwater flow model. As of August 2023, Ivanhoe Electric has completed 71,620 meters of geotechnical drilling.

Copper Recoveries Averaging 95.4% Expected to be Achieved by Using SX/EW for Copper Cathode Production and Froth Flotation Copper Concentrate Production

The IA envisions the production of copper through a process that utilizes a conventional design for treating high-grade mixed copper oxide and copper sulfide mineralization. In the IA, total copper recovery averages 95.4% over the LOM.

The IA includes potential LOM production of 1,587,000 tonnes of copper contained in 99.99% pure cathode and 48% copper concentrate with very low deleterious elements, such as arsenic or lead. LOM copper recovered to cathode totals 1,032,000 tonnes and LOM copper recovered to concentrate totals 555,000 tonnes (65% copper in cathode, 35% copper in concentrate).

Figure 5. Santa Cruz IA summary processing flowsheet showing the production of both copper cathode from copper oxide mineralization and copper concentrate from copper sulfide mineralization.

Ivanhoe Electric is Committed to Utilizing Industry-Leading Mining Technologies and Renewable Power Sources

The IA applies modern mining technologies, including the use of railveyor technology for the efficient movement of mined mineralization from underground to surface. Railveyor is a safe and autonomously operated alternative to traditional belt conveyors or diesel haul trucks. It is also able to recover energy through regenerative braking during the return phase.

Figure 6. Sandvik roadheader used for decline development shown on the left (Source: Sandvik) and railveyor unloading turn shown on the right (Source: Railveyor)

Additionally, the IA base case envisions that 70% of the Project's power requirements will be generated from onsite renewable power sources. The subsequent PFS will investigate the potential of onsite generation of power from combined solar panels, battery storage and a geothermal-driven microgrid to provide 100% of the electricity needs for the Project. Even at 70%, the application in the IA of onsite renewable power for the direct production of copper would lead to one of the lowest CO2e emissions intensities per pound of copper produced in the industry[6].

Average carbon intensities in the global mining industry stand at approximately 3.9 tonnes of CO2e per tonne of copper equivalent, encompassing both scope 1 and 2 emissions[7]. The IA base case anticipates that the average CO2e intensity for Santa Cruz copper (development and mining stages) is 0.49 tonnes of CO2e per tonne of copper for scope 1 and 2 emissions.

CO2e intensity is affected by a variety of factors, including the type and efficiency of the mining equipment used, the grade of the ore, the depth of the mine, and the method of generating electricity.

Figure 7. At the IA base case, Santa Cruz is projected to be one of the lowest CO2e emissions operations per tonne of copper on the global emissions "cost" curve.

Source: Wood Mackenzie, 2023 (single year 2022 data shown, the Santa Cruz 2023 IA has not been reviewed by Wood Mackenzie).

Figure 8. Santa Cruz is projected to produce less CO2e per Tonne of Copper than other USA copper mines currently in production.

Source: Wood Mackenzie, 2023 (single year 2022 data shown, the Santa Cruz 2023 IA has not been reviewed by Wood Mackenzie).

Figure 9. Santa Cruz LOM C1 copper cash costs of $1.36/lb in the IA are projected to be below industry average.

Source: Wood Mackenzie, 2023 (single year 2022 data shown, the Santa Cruz 2023 IA has not been reviewed by Wood Mackenzie).

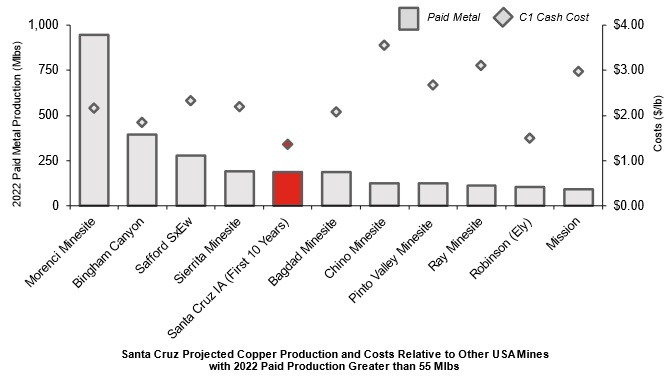

Figure 10. Santa Cruz has the potential to be a significant copper producer in the US with attractive operating costs.

Source: Wood Mackenzie, 2023 (single year 2022 data shown, the Santa Cruz 2023 IA has not been reviewed by Wood Mackenzie).

Ivanhoe Electric is Committed to the Responsible Development of the Santa Cruz Project through Diligent Permitting, Planning, Environmental Monitoring, Water Management and Stakeholder Engagement

Data collection for permitting purposes is ongoing using a phased approach - Phase A involves acquiring the information required for the twin decline development permits, and Phase B focuses on obtaining mine development permits. The data included in the IA will form the basis for the permitting process.

To support the permitting process, there are several baseline environmental monitoring programs already in place. These programs include quarterly surface water sampling in major drainages, as well as the installation of piezometers in selected drill holes to collect sub-surface hydrologic data. Water elevation from existing agricultural wells is measured and a baseline groundwater sampling and monitoring program is being developed. To further assess the impact on local waterways, Ivanhoe Electric has assessed and classified all waterways within the Project area through the completion of an ordinary high water mark analysis.

Updated biological, archaeological, and cultural studies have been completed, which assist Ivanhoe Electric in taking the precautionary steps to preserve the ecosystem and cultural heritage. Ivanhoe Electric has, for example, implemented beneficial practices and procedures aimed at protecting migratory bird species.

Additionally, meteorological data is monitored to gather site-specific climate and evaporation information. This data, along with the development of an emissions inventory, will help determine the air permitting pathway.

Ivanhoe Electric has commenced engagement with key stakeholders, including surrounding communities, government agencies and municipalities and local water groups.

Qualified Persons

The Initial Assessment is entitled "S-K 1300 Initial Assessment & Technical Report Summary, Santa Cruz Project, Arizona", is dated September 6, 2023, and was prepared in accordance with Subpart 1300 and Item 601 of Regulation S-K. The Initial Assessment was prepared by the following firms: SRK Consulting (U.S.), Inc. (SRK), Nordmin Engineering, Ltd. (Nordmin), M3 Engineering and Technology Corp. (M3), Met Engineering, LLC(Met Engineering), Call & Nicholas, Inc. (CNI), INTERA Incorporated (INTERA), KCB Consultants Ltd. (KCB), Tetra Tech, Inc. (Tetra Tech), Life Cycle Geo, LLC (LCG), and Haley & Aldrich, Inc. (H&A).

The Initial Assessment will be available on the SEC's EDGAR website as an exhibit to a Form 8-K filed by the Company in connection with this announcement.

Other disclosures of a scientific or technical nature included in this news release with regard to the Santa Cruz Project have been reviewed, verified, and approved by Glen Kuntz, P.Geo, a Qualified Person as defined by Regulation S-K, Subpart 1300 promulgated by the U.S. Securities and Exchange Commission and by Canadian National Instrument 43-101. Mr. Kuntz is an employee of Ivanhoe Electric.

Ivanhoe Electric will have prepared and filed an independent technical report prepared under Canadian National Instrument 43-101 within 45 days of this news release. This report will be available on the company's website and on the company's SEDAR profile.

For the purposes of Canadian National Instrument 43-101, the independent Qualified Persons responsible for preparing the scientific and technical information disclosed in this news release are Anton Chan (SRK); Matt Sullivan (SRK); Joanna Poeck (SRK); Christian Ballard (Nordmin); Laurie Tahija (M3); John Woodson (M3); Jim Moore (Met Engineering); Rob Cook (CNI); Jim Casey (KCB); Annelia Tinklenberg (INTERA); Daryl Longwell (Tetra Tech); Tom Meuzelaar (LCG); and Eric Mears (H&A). Each Qualified Person has reviewed and approved the information in this news release relevant to the portion of the scientific and technical information for which they are responsible.

The technical report summary and technical report include relevant information regarding the assumptions, parameters and methods of the mineral resource estimates on the Santa Cruz Project, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release.

About Ivanhoe Electric

We are a U.S. company that combines advanced mineral exploration technologies with electric metals exploration projects predominantly located in the United States. We use our accurate and powerful Typhoon™ geophysical surveying system, together with advanced data analytics provided by our subsidiary, Computational Geosciences Inc., to accelerate and de-risk the mineral exploration process as we seek to discover new deposits of critical metals that may otherwise be undetectable by traditional exploration technologies. We believe the United States is significantly underexplored and has the potential to yield major new discoveries of critical metals. Our mineral exploration efforts focus on copper as well as other metals, including nickel, vanadium, cobalt, platinum group elements, gold, and silver. Through the advancement of our portfolio of electric metals exploration projects, headlined by the Santa Cruz Copper Project in Arizona and the Tintic Copper-Gold Project in Utah, as well as other exploration projects in the United States, we intend to support United States supply chain independence by finding and delivering the critical metals necessary for the electrification of the economy. We also operate a 50/50 joint venture with Saudi Arabian Mining Company Ma'aden to explore for minerals on ~48,500 km2 of underexplored Arabian Shield in the Kingdom of Saudi Arabia. Website: www.ivanhoeelectric.com.

Contact Information

Investors: Valerie Kimball, Director, Investor Relations 720-933-1150

Follow us on Twitter

Ivanhoe Electric's Executive Chairman Robert Friedland: @robert_ivanhoe

Ivanhoe Electric: @ivanhoeelectric

Ivanhoe Electric's investor relations website located at www.ivanhoeelectric.com should be considered Ivanhoe Electric's recognized distribution channel for purposes of the Securities and Exchange Commission's Regulation FD.

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable US and Canadian securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the company's current expectations regarding future events, performance and results and speak only as of the date of this news release.

Such statements in this news release include, without limitation: the projections, assumptions and estimates contained in the Initial Assessment, including, without limitation, those relating to exploration, development, capital and operating costs, production, grade, recoveries, metal prices, life of mine, mine sequencing, NPV, IRR, payback, processes, equipment, staffing, emissions, use of land, water, power and other inputs, tailings storage, groundwater flow and estimates of mineral resources; costs and emissions relative to other mines; use of renewable energy; the preparation of a PFS; the functioning of our technology; our ability to accelerate and de-risk the mineral exploration process; potential new discoveries and planned or potential developments in the businesses of Ivanhoe Electric.

Forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Such statements are subject to significant risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including we have no mineral reserves, other than at the San Matias project; we have inferred resources that may never be upgraded to a higher category of resource or reserve; we have a limited operating history on which to base an evaluation of our business and prospects; we depend on our material projects for our future operations; our mineral resource calculations at the Santa Cruz Project are only estimates; actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated; the title to some of the mineral properties may be uncertain or defective; our business is subject to changes in the prices of copper, gold, silver, nickel, cobalt, vanadium and platinum group metals; we have claims and legal proceedings against one of our subsidiaries; our business is subject to significant risk and hazards associated with exploration activities, mine development, construction and future mining operations; we may fail to identify attractive acquisition candidates or joint ventures with strategic partners or be unable to successfully integrate acquired mineral properties or successfully manage joint ventures; our success is dependent in part on our joint venture partners and their compliance with our agreements with them; our business is extensively regulated by the United States and foreign governments as well as local governments; the requirements that we obtain, maintain and renew environmental, construction and mining permits are often a costly and time-consuming process; our non-U.S. operations are subject to additional political, economic and other uncertainties not generally associated with domestic operations; and our operations may be impacted by the COVID-19 pandemic, including impacts to the availability of our workforce, government orders that may require temporary suspension of operations, and the global economy. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risk factors described in Ivanhoe Electric's Annual Report on Form 10-K and other documents filed with the U.S. Securities and Exchange Commission.

No assurance can be given that such future results will be achieved. Forward-looking statements speak only as of the date of this news release. Ivanhoe Electric cautions you not to place undue reliance on these forward-looking statements. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release, and Ivanhoe Electric expressly disclaims any requirement to do so.

[1] C1 cash costs calculated per Wood Mackenzie's definition which include mining, processing and G&A costs. C1 cash cost is not a measure recognized by GAAP but is a standard measure used in mining as a reference point to denote the basic cash costs of running a mining operation to allow a comparison across the industry.

[2] Source: Tipple Consulting; Santa Cruz Initial Assessment, 2023 (based on public company disclosures from 2021-2022)

[3] The Initial Assessment is the equivalent of a Preliminary Economic Assessment ("PEA") under Canadian National Instrument 43-101.

[4] C3 total costs quoted per Wood Mackenzie's definition of C3 total costs which include mining, processing, G&A, depreciation, depletion and royalties costs. C3 total cost is not a measure recognized by GAAP but is a standard measure used in mining as a reference point to denote the total costs of running a mining operation to allow a comparison across the industry.

[5] Source: Tipple Consulting; Santa Cruz Initial Assessment, 2023 (based on public company disclosures from 2021-2022)

[6] Source: Wood Mackenzie, 2023 (based on public disclosure, the Santa Cruz 2023 IA has not been reviewed by Wood Mackenzie).

[7] Source: Tipple Consulting; Santa Cruz Initial Assessment, 2023 (based on public company disclosures from 2021-2022)

SOURCE: Ivanhoe Electric Inc.

View source version on accesswire.com:

https://www.accesswire.com/781210/correcting-and-replacing-ivanhoe-electric-announces-completion-of-the-initial-assessment-for-the-santa-cruz-copper-project-in-arizona